Options Education Center

Explore the world of complex options strategies and discover how you can implement new ideas into your own trading

Welcome to TradeStation’s Options Education Center, where your journey toward trading mastery begins. Explore the power of options through our educational resources and empower your trading with the knowledge and skills to help navigate dynamic market conditions, potentially turning challenges into opportunities.

Browse the education materials below to:

Build trading confidence

Uncover portfolio risk management benefits

Employ advanced strategic options tactics

Master TradeStation options analysis and trading tools

Explore options strategies

Understanding Covered Calls: Potential Income for Stock Investors

Understanding Protective Puts: Your Portfolio’s Insurance Policy

Building a Safety Net Around Your Stocks: The Collar Options Strategy

The Jade Lizard Strategy: Trading Sideways and Rising Markets

Navigating Market Chaos: Options Strategies for Volatility Spikes

The Hidden Threat in Your Portfolio: How Beta Shows Actual Market Risk

Protect Your Portfolio from Market Volatility: Options Strategies Explained

The art of Options Conversions: Trading options market inefficiencies

Synthetic Strategies: Alternative Approaches to Directional Trading

Trading Big Market Moves with Ratio Back Spreads

Understanding Diagonal Spreads: A versatile Options Strategy

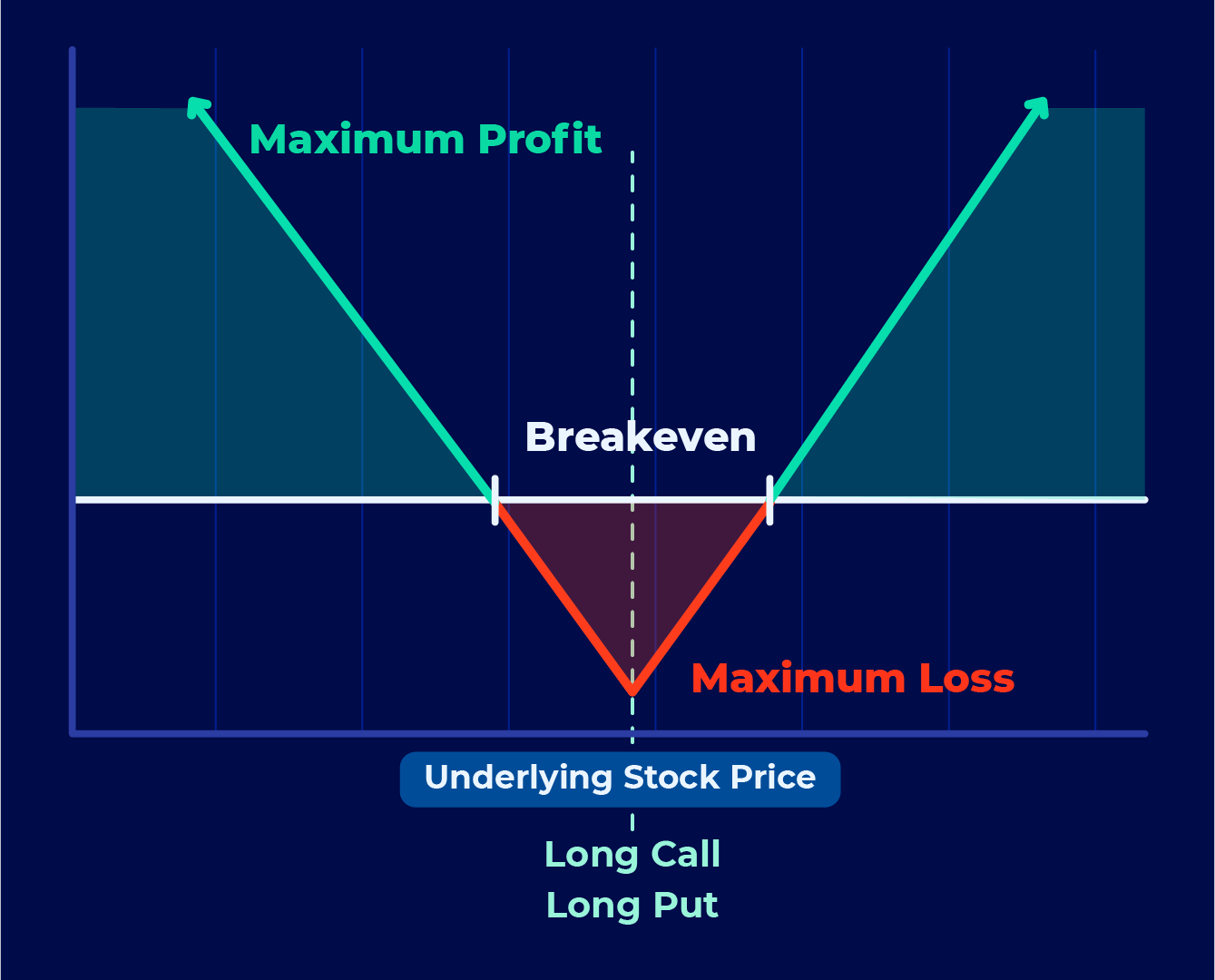

Strangle Options: Your Tool for Unpredictable Markets

Calendar Spreads: Understanding a Time-Based Options Strategy

Multi-legged Option Spreads: Condors and Butterflies Explained

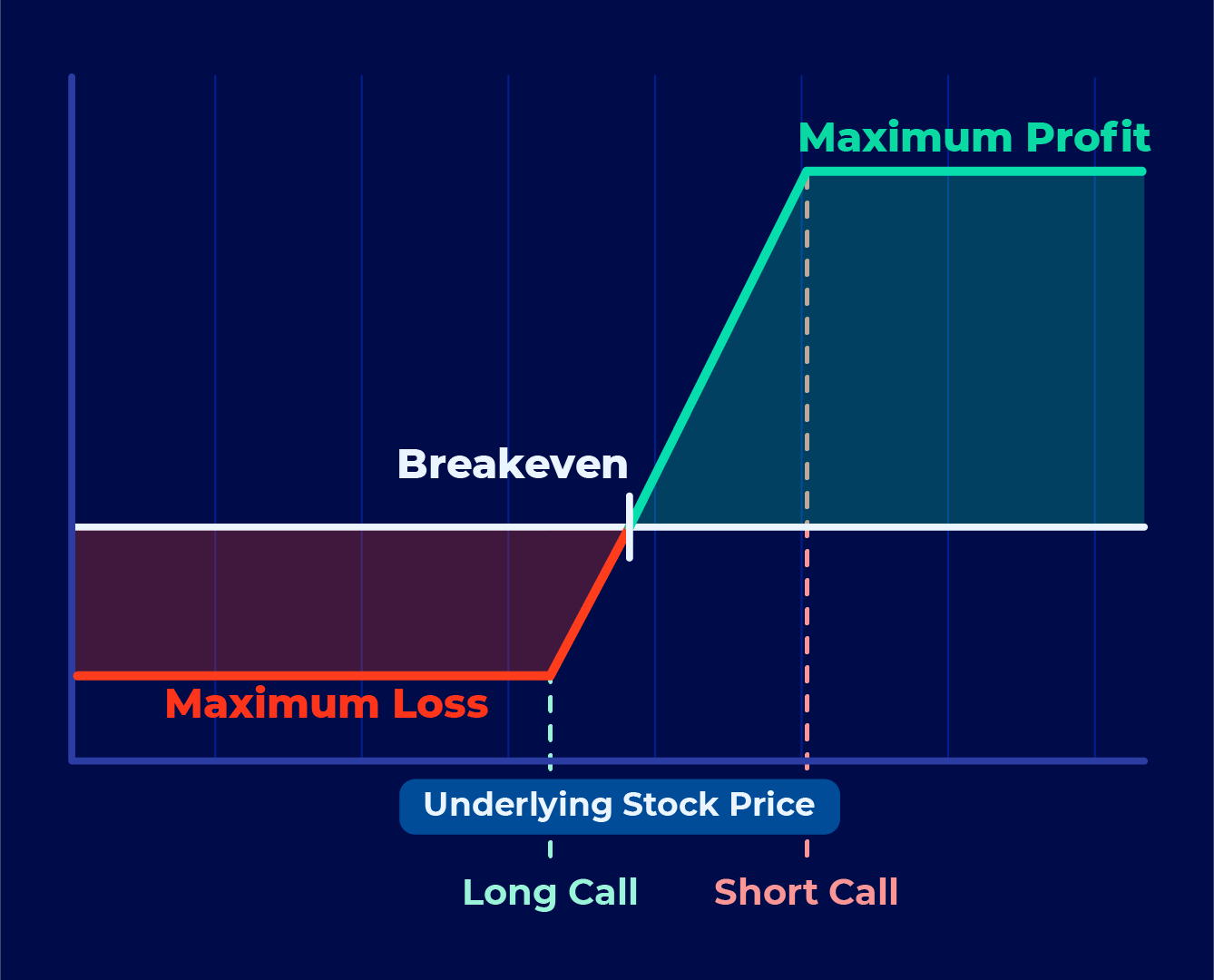

Improving probabilities and confidence with bull call spreads

Understanding Index Options: A Guide for Options Traders

Unlocking Futures Options: A guide to pricing and trading

Utilize Iron Condors and Iron Butterflies: trade sideways markets, time and volatility decay

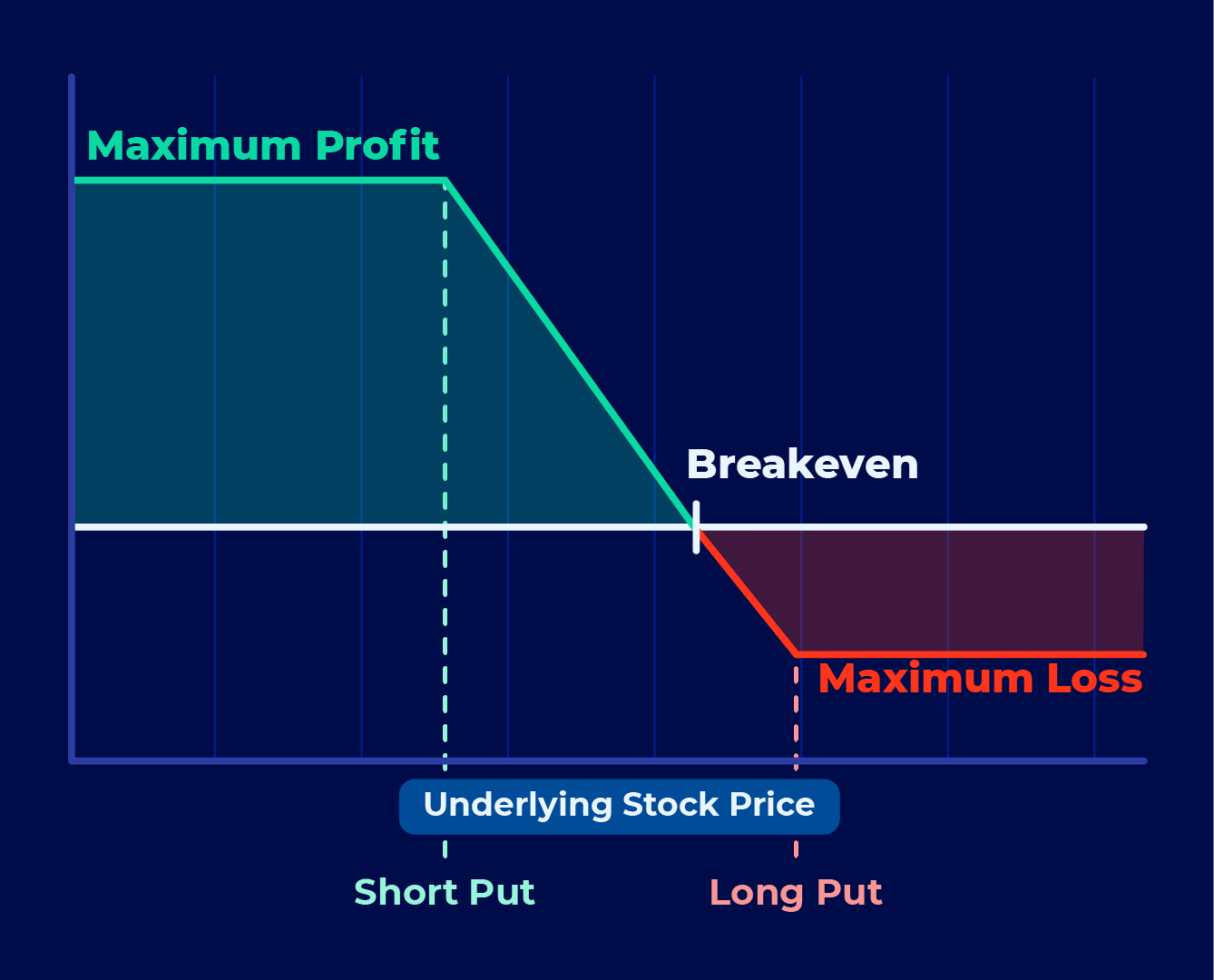

Bull put spreads: understanding credit spreads for bullish moves

Placing activation rules on options orders

Bear call spreads: trading time and volatility

Trading downtrends effectively with bear put spreads

Trading zero days to expiration (0DTE) options

Straddle opportunities for earnings

Featured options webinars

The Jade Lizard: Options Premium in Sideways & Mildly Bullish Markets

Navigating Market Chaos: Options Strategies for Volatility Spikes

Improved Options Management on TradeStation Mobile

Protect Your Portfolio: Beta Hedging with Index Options

Protecting Your Portfolio: Defensive Options Strategies for Market Volatility

Plan the Trade, Trade the Plan: Strategic Options Execution

Options tactics for Q1 earnings: targeting opportunity

Tips for Options Traders: Preparing 2024 Tax Returns

Vertical Options Spreads: A Guide to Credit and Debit Strategies

Synthetic Strategies: Alternative Approaches to Directional Trading

Options Conversions: Trading Market Inefficiencies

Diagonal Spreads: Analyzing Long-Term Income Potential

Navigating Markets and Mitigating Risk with Index Options

Ratio Back Spreads: Trading explosive price swings with options

Balancing risk and reward with calendar spreads

Analyzing and graphing options spreads risk/reward

Navigating Neutral markets: condors and butterflies

Channeling the potential of 0DTE strategies

Strangles: Taking advantage of price swings and volatility

Bull call spread: Balancing opportunity and risk

Futures options explained: Insights from CME

Unlocking the power of iron condors and iron butterflies in your options trading strategy

Understanding the bull put spread: balancing risk and reward in options trading

Understanding bear call spreads: A Limited-Risk Options Strategy to Harness Time, Volatility, and Bearish Trends

Using activation rules for strategic order execution in multi-leg options

Strategize options trading with OptionStation Pro®

0DTE options – understanding risks with debit verticals

Optimize profit potential with bull call spreads

Crafting strategic straddles: turn earnings into opportunities

Learn more about options

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

ID4970854 D1125