Options Education Center

Explore strategies

Learn more

Download workspace

Download

Upgrade options level

Learn more

Straddle opportunities for earnings

A straddle is a multi-leg options strategy enabling investors to potentially profit from significant price fluctuations in a stock, typically associated with events like earnings announcements. This position can also benefit from heightened volatility realizing profits upon closing if the options are sold for a price higher than their initial purchase cost.

Five reasons straddles might be right for you

Things to watch for when trading straddles

Additional premiums

Substantial price movement necessary

Efficient markets

Trade management required

| Quick reference guide: Long straddle | |

|---|---|

| Market outlook | Anticipating a sharp price move in either direction and/or increased volatility |

| Position net debit or credit | Debit (premium paid) |

| Number of legs | Two – one long call and one long put with identical strikes and expirations |

| Maximum profit | Unlimited upward, or from the strike price to zero downward |

| Profits from | Underlying price moving significantly in either direction rapidly |

| Maximum loss | Premium paid to enter the position, occurs if both options expire worthless |

| Breakeven | There are two, the strike minus the premium paid and the strike plus the premium paid |

| Risk from | Underlying price not moving sufficiently to cover the cost of the position and/or a decline in volatility |

| Options level required | Level 3 – Click here for additional information |

What is a straddle?

A straddle is a multi-leg debit spread that involves two key actions.

Buy a call option

Buy a put option

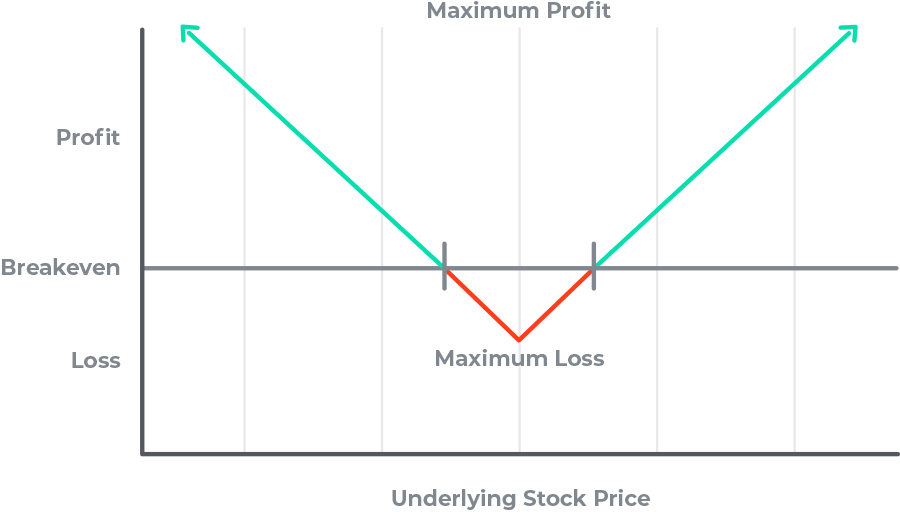

The straddle risk/reward profile

Long Straddle

Reward

Realized when both options are sold. Profit equals the sale price of both options minus the premium paid at purchase. This can happen if the underlying price moves significantly or if implied volatility rises.

Breakeven

There are two breakeven points – the strike plus the premium paid, and the strike minus the premium paid.

Risk

The amount paid for both options. The loss would be realized if both options expire with the underlying trading at the strike price.

Situations suited for a straddle

Common situations where a straddle may be used include:

Traders might opt for a straddle when anticipating a substantial, rapid price movement in the underlying, or, when the current implied volatility is low and expected to increase rapidly.

Three to four weeks before an earnings announcement

Approximately one month before an earnings announcement, implied volatility is often low compared to the week of the report. Options can be inexpensive during this period of low-volatility. As the earnings date approaches, the uncertainty of the number increases volatility. The positive Vega of long options also causes the options’ value to rise. Avoid entering the straddle in the days before the earnings report is released, as purchasing the straddle during such periods of elevated volatility would lead to overpayment. After earnings are released, volatility typically decreases, and the Vega of the straddle will drop the value of the options. This decline might even surpass the profit gained from Delta and price movement.

Limited risk

Expecting a significant price move but uncertain about the direction.

A drastic increase in volatility

If the current implied volatility is very low but it is expected to increase soon. Typically, volatility is low or dropping while the price of an underlying is gradually rising. If the price turns down at a resistance level or the trend becomes bearish, the volatility will usually rise.

How to place a straddle trade

Select a stock

Check implied volatility (IV)

Choose strike prices and expiration

Risk management

- Upward breakeven. The strike plus premium paid.

- Downward breakeven. The strike minus premium paid.

Analysis

- Vega is the premium movement for every 1 percent change in volatility.

- Imagine an option premium is $16, the Vega is 0.31, and IV is 47.69%. If the IV moves up to 48.69% then the new premium would be $16.31 assuming nothing else changes.

Exiting the straddle

Still unsure?

Sharpen your straddle skills with simulated trading

Access the TradeStation platform in Simulated Trading mode to familiarize yourself with the strategy and order execution. Practice placing the spread in a risk-free environment until you feel confident.

Conclusion

A straddle, which involves the purchase of a call and a put with the same strike and expiration, is a valuable strategy for traders seeking to profit from significant price movements during events like earnings releases. This approach can capitalize on both substantial price shifts and an increase in implied volatility, boosting the value of the purchased options.

ID3296067D0124