Market Insights

Opportunity knocks for those with trading in their DNA.

Curiosity creates opportunity. Insights create strategy. Born traders create their destiny.

Stocks

Options

Futures

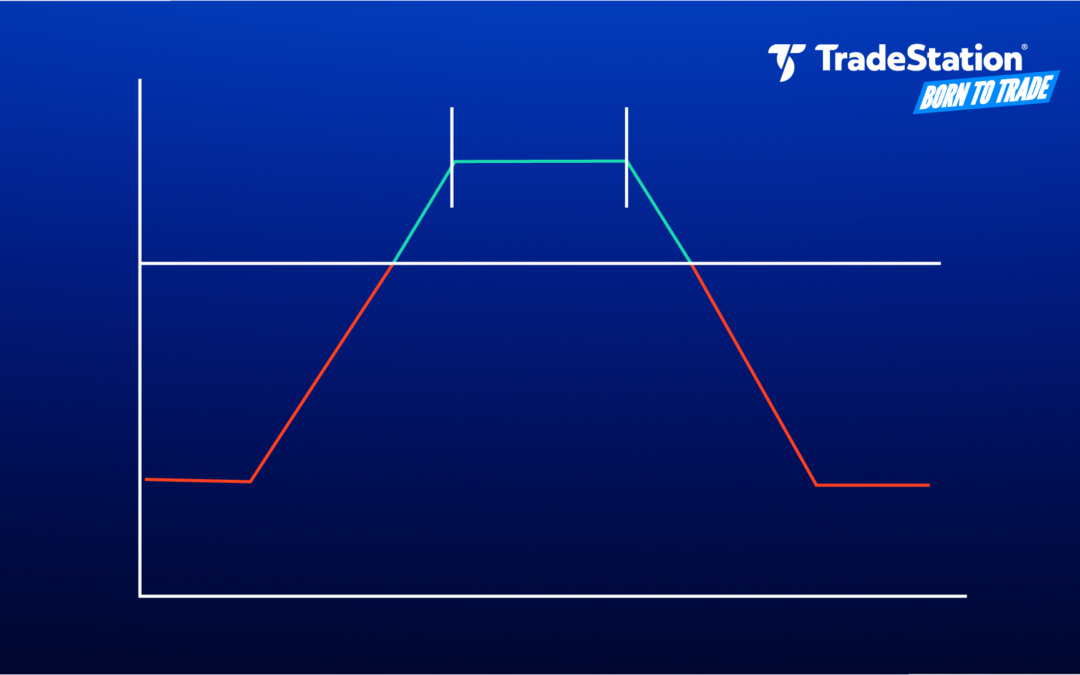

The Iron Condor Strategy: A Guide to Options Trading Neutral Markets

by TradeStation | Oct 28, 2025

The iron condor is a commonly used strategy among experienced traders who wish to navigate neutral markets and tightly manage risk.

Chart of the Day: Will Goldman Sachs Get Going?

by David Russell | Feb 16, 2024

Goldman Sachs has gone nowhere for two months, but some traders may look for that to change. The first pattern on today’s chart is the $374 level. It was a weekly closing price from January 2023 that GS remained below through late December. The stock rallied above it...

S&P 500 Holds Channel, Reclaims 5,000: Market Trends This Week

by David Russell | Feb 15, 2024

Downloads are available here. TradeStation’s ideas on TradingView are available here. Register for Market Trends here. Sizing Up the S&P 500 Index holds recent channel, weekly low from 2/5 Wilder's RSI remains near overbought Prices hold rising...

Stocks Cross Historic Level on Strong Earnings, Economic Data

by David Russell | Feb 12, 2024

Stocks continue their advance into record territory as earnings beat estimates and recession fears melt away. The S&P 500 rose 1.4 percent between Friday, February 2, and Friday, February 9. It was the 14th gain in the last 15 weeks, and the fifth consecutive...

S&P 500 in Tight Channel Near 5,000: Market Trends This Week

by David Russell | Feb 8, 2024

Downloads are available here. TradeStation’s ideas on TradingView are available here. Register for Market Trends here. Sizing Up the S&P 500 Index forming potential ascending channel since mid-January. Making higher lows above previous peak from...

Microsoft and Toyota Break Out as Apple and Tesla Stall

by David Russell | Feb 7, 2024

Apple and Tesla have been two of the best performing large stocks for years. But now they may be falling behind two major rivals: Microsoft and Toyota Motor. The charts below demonstrate how AAPL and TSLA remain trapped under recent highs, while MSFT and TM have...

Quadruple Witching Dates for 2024: How Can They Impact Stock and Futures Trading?

by David Russell | Feb 7, 2024

What Is Quad Witching? Quadruple witching is an event in financial markets when four different sets of futures and options expire on the same day. Futures and options are derivatives, linked to underlying stock prices. When derivatives expire, traders must close...

Top Stocks for Options Trading

Technology & Communication

Nvidia Calls Get Active as AI Goes Mainstream

by David Russell | Jan 7, 2025

Options traders flocked to Nvidia yesterday ahead of a potentially key week for the AI giant. Volume surged in short-dated weekly calls expiring this Friday, which suggests investors are looking for a quick move. Here were some of the busiest contracts: More than...

This Mini Version of the Nasdaq Is Leaving QQQ in the Dust

by David Russell | Dec 3, 2020

Big cap technology stocks have struggled for months. But that's not true for their smaller cousins. The below compares the performance of the Invesco Nasdaq Next Gen ETF (QQQJ) with the Invesco QQQ (QQQ). QQQ tracks the Nasdaq-100 index, so it holds the 100 largest...

Nio, Tesla Made November ‘Electric Car Month’ at TradeStation

by David Russell | Dec 1, 2020

November was "electric car month" at TradeStation as investors piled into stocks like Nio, Tesla and Xpeng. The surge of activity on our platform followed a rising trend of "ESG" strategies, focused on "environmental, social and governance" priorities. So far, they've...

What Are Value Stocks? How Do I Find Them?

by David Russell | Nov 24, 2020

Value stocks have gained popularity this month as investors look for vaccines to end the coronavirus pandemic. This article will consider key things to know: What are value stocks?Why are they going up?How do I find value stocks?Are value stocks good investments? What...

How Do I Find IPOs and SPACs? Video Tutorial on Finding and Assessing New Companies

by David Russell | Nov 23, 2020

There's been a resurgence of initial public offerings (IPOs) and special purpose acquisition companies (SPACs) this year. Many of these stocks are members of innovative and fast-growing industries like software, electric...