Market Insights

Opportunity knocks for those with trading in their DNA.

Curiosity creates opportunity. Insights create strategy. Born traders create their destiny.

Stocks

Options

Futures

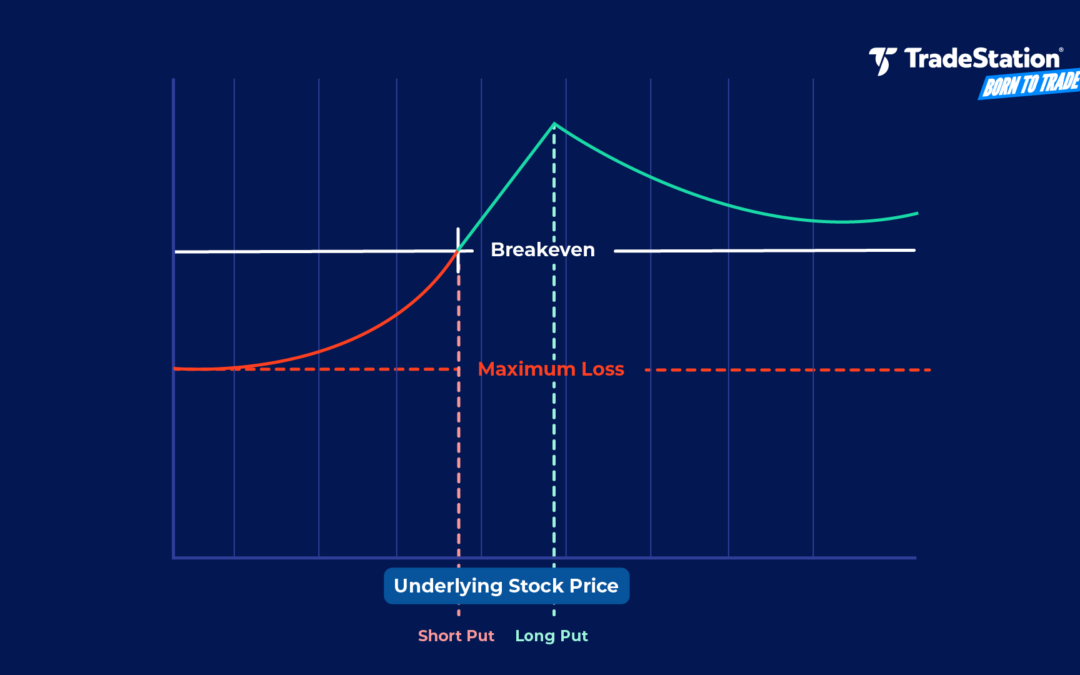

Diagonal Spread: How it Works & How to Use it

by TradeStation | Dec 3, 2025

Balancing directional bias with premium collection isn't always straightforward, even for the most dedicated options traders. Diagonal spreads stand out as a sophisticated strategy that might allow you to potentially profit from time decay, volatility shifts, and...

Options Alert: Calls Surge as Coca-Cola Rallies

by David Russell | Feb 12, 2025

Options activity surged in Coca-Cola yesterday as strong results triggered the biggest rally in years. More than 206,000 calls traded in the beverage giant on Tuesday, according to TradeStation Data. It was the highest total since June 2021, with transactions focused...

Options Alert: Are Puts in Gold Fields Bearish?

by David Russell | Feb 11, 2025

Gold Fields has been surging along with bullion, and yesterday someone took a position with options. This large transaction occurred less than an hour into Monday's session as the South African miner pushed above $19: 8,000 March 18 puts traded for $0.55. 8,000 March...

Quadruple Witching Dates for 2025: How Can They Impact Stock and Futures Trading?

by David Russell | Feb 11, 2025

What Is Quad Witching? Quadruple witching is an event in financial markets when four different sets of futures and options expire on the same day. Futures and options are derivatives, linked to underlying stock prices. When derivatives expire, traders must close or...

Stocks May Be Battered, But Are They Broken?

by David Russell | Feb 10, 2025

Stocks are trying to hold their ground amid a flood of bearish headlines and negative sentiment. For the second week in a row, the S&P 500 fell sharply on Monday before rebounding into Friday. The index held potentially important levels both times. (See "Charting...

Options Are Now Live via TradingView Connection

by David Russell | Feb 7, 2025

For years, stocks and futures have been supported by our integration with TradingView. Now options have joined the mix. TradeStation Securities is the first U.S. broker to launch options trading on TradingView, a platform used by millions for its charts and social...

Chart of the Day: Boeing May Be Attempting a Turnaround

by David Russell | Feb 5, 2025

Boeing has struggled for years, but now there may be signs of a turnaround in the aerospace giant. The first pattern on today’s chart is the series of lower highs between December 2023 and early December 2024. The stock has now pushed above that falling trendline,...

Top Stocks for Options Trading

Technology & Communication

Oil and War Are Not the Only Stories in the Market

by David Russell | Jun 23, 2025

Is a crypto revolution taking place as attention focuses on war in the Middle East?

Investors Return to Growth Stocks as a New Quarter Approaches

by David Russell | Jun 27, 2022

Investors just pivoted back to growth stocks as inflation worries fade and a new quarter approaches. The S&P 500 jumped 6.4 percent in the holiday-shortened week between Friday, June 17, and Friday, June 20. More than 95 percent of the index's members advanced,...

Chart of the Day: Is This Semiconductor Stock Rolling Over?

by David Russell | Jun 10, 2022

Nvidia had a sharp countertrend rally two weeks ago, but now the chip giant may be rolling over. Prices jumped over $183 on May 27. They remained above that level and started making lower highs on June 2. That kind of descending triangle is a potential bearish...

Bulls in the China Shop? Call Buyers Just Piled Into Alibaba

by David Russell | Jun 9, 2022

Most stocks have been under pressure lately, but there could be bulls in the China shop. E-commerce giant Alibaba (BABA) surged 15 percent to $119.62 despite the S&P 500 sinking more than 1 percent. The rally landed BABA at its highest closing price since February...

Chart of the Day: Has the Tide Finally Turned for This Chinese E-Commerce Giant?

by David Russell | Jun 8, 2022

Chinese stocks like Alibaba have been under pressure for the last 1-1/2 years, but now the tide could be turning. The first pattern on today's chart is the high-volume bullish gap on March 16 after officials in Beijing took a more supportive approach toward financial...