Options Education Center

Explore strategies

Learn more

Upgrade options level

Learn more

Building a Safety Net around Your Stocks: The Collar Option Strategy

Introduction

Collar options strategies typically offer stock traders cost-effective downside protection while maintaining reasonable upside potential. Think of a collar like putting both a safety net below and above your stock investment. Collars limit how much you can lose while also capping how much you can gain, making them valuable when you own stocks but worry about short-term market volatility.

This strategy combines two types of options:

- A protective put to guard against losses

- A covered call to generate income and capital gains

Unlike buying puts alone (which can be expensive) or selling calls without protection, collars offer a balanced approach that often costs little to nothing, making them particularly attractive for long-term investors who want to stay in the market but reduce their risk exposure during uncertain times.

How collar options work mechanically

A collar strategy consists of three essential parts that work together like a financial safety system. To use it, you need to own at least 100 shares of stock (since each options contract controls 100 shares) and then add two different options contracts with the same expiration date.

- The stock or ETF

You must first own an asset you want to protect. Since options are based on 100 shares, you need to own at least 100 shares or a multiple of 100 shares to use the collar strategy - Protective put

This acts like insurance for your stock. A put gives you the right to sell your shares at a specific price (called the strike price), no matter how low the stock price falls. For example, if you own stock trading at $100 and buy a put with a $95 strike price, you can sell your shares for $95 even if the stock drops to $80. You pay a premium (the insurance cost) for this protection. - Covered call

This generates income, but it also limits your upside. A covered call means you sell someone else the right to buy your shares at a set price above the current market price. Using our $100 stock example, you might sell a call with a $105 strike price, collecting premium income. If the stock rises above $105, the buyer can force you to sell your shares at $105, and you would miss out on any gains above that level.

The magic happens when you combine both options. The premium you collect from selling the call helps pay for (or might completely cover) the cost of buying the protective put. This strategy creates affordable downside risk protection while keeping reasonable upside potential. The two options create a “collar” that limits your stock’s effective trading range between the put strike below and the call strike above.

How to set up a collar strategy

Creating a collar requires careful planning and proper sequencing of your trades.

- Own the stock or ETF

Begin by owning or purchasing at least 100 shares of the underlying security you want to protect. This stock ownership forms the foundation of your strategy since both options will reference these shares. - Choose your protection level (put option)

Select a put strike price below the current stock price. Many traders often choose puts that are 5-10% lower to balance protection and cost. For example, if your stock is $100, a $95 or $90 put would provide substantial downside protection. Remember, puts closer to the current price cost more but offer better protection. - Select your profit cap (Call option)

Choose a call strike price above the current stock price. Collars can be customized to match your market outlook. If you are mildly bullish, choose a strike slightly above the current price. For a strongly bullish view, opt for a higher strike. You might want a strike above a resistance level to reduce the chances of early assignment. Calls that are closer to the current price offer more premium income but also restrict your potential upside more significantly. - Match expiration dates

Ensure both options have identical expiration dates, typically 30-90 days in the future. This matching expiration keeps your strategy balanced and easier to manage. - Execute the trades

Once you’ve selected your strikes and expiration, execute the trades. OptionStation Pro allows you to enter all components as a single “collar” order, which can improve your execution and reduce costs. This is done while viewing the option chain and selecting “Collar” in the spread dropdown menu. It is located just under the symbol on the top left of the window. - Calculate net cost

Subtract the call premium received from the put premium paid. If the call premium equals or exceeds the put premium, you have a zero-cost or credit collar – meaning you receive money while adding protection to your stock position.

Benefits and advantages of collar strategies

Collars offer several components that make them popular among both individual and institutional investors.

- Cost-effective downside protection

The primary benefit is cost-effective downside protection. You obtain meaningful insurance for your stock position without having to pay the full cost of that insurance. Instead of spending several dollars per share on a protective put alone, the collar might cost just pennies or even generate a small credit. - Defined risk and reward

Risk becomes predictable and quantifiable with collars. You can estimate your maximum loss (stock price minus put strike, adjusted for net premium) and your potential maximum gain (call strike minus stock price, adjusted for net premium). This clarity helps with portfolio planning and risk management. - IRA-friendly and conservative

Collar strategies are well-suited for retirement accounts, such as IRAs, because they don’t require margin and are considered relatively conservative. Collars are often approved for investors at basic options levels. - Income generation

The strategy also helps generate modest income through the call premium while maintaining stock ownership for dividend payments and long-term appreciation. - Emotional discipline during volatility

During volatile market periods, collars can help investors maintain their investment without needing to sell their stocks. They enable you to maintain a long-term investment perspective while navigating shortterm market volatility. This psychological benefit often reduces emotional pressure to sell during market downturns, helping investors stick to their long-term plans.

Risks and disadvantages of collar strategies

While collars provide protection, they come with important limitations that traders must be aware of.

- Limited upside potential

The most significant drawback is capped upside potential. If your stock performs exceptionally well, you’ll miss most of those gains above the call strike price. In strong bull markets, collar users often underperform compared to simply owning the stock outright. - Assignment risk

If the stock rises above the call strike price, the option buyer may exercise their right to purchase your shares. This forced sale can happen at an inopportune time and may trigger unwanted tax consequences. You’ll receive the call strike price for your shares, but you’ll miss any further appreciation that may occur. - Transaction costs

Collars involve multiple trades – buying stock, buying a put, and selling a call. Each leg may incur commissions and fees. For smaller positions, these costs may outweigh the benefits of the strategy. Additionally, the complexity of managing three positions simultaneously requires more attention than simply owning stock. - Tax considerations

Selling covered calls may reset your holding period for tax purposes, potentially converting long-term capital gains into short-term gains. This tax impact is particularly problematic for stocks you’ve owned for nearly a year, as the collar might prevent you from achieving favorable long-term tax treatment.

Consult a qualified tax professional to understand how collar strategies may impact your specific financial situation and investment goals.

Conditions where traders use collar strategies

Collar strategies are most effective in specific market conditions and investor situations. The applications can vary slightly depending on your goals and the trading environment.

Moderately bullish with short-term uncertainty

Consider using collars when you’re moderately bullish but concerned about near-term volatility. This scenario often arises when you like a stock’s long-term prospects but are worried about upcoming earnings announcements, regulatory decisions, or general market uncertainty. The collar lets you stay invested while limiting downside risk.

High-volatility environments

Collars are more attractive because option premiums are elevated. When options are expensive, you receive more income from selling calls, and the cost difference between expensive puts and expensive calls often favors collar construction. Markets experiencing high volatility often favor collar implementations.

Protecting gains without selling

Consider collars when you’ve experienced significant gains and want to protect some profits without selling. If your stock has appreciated substantially and you’re approaching your target selling price, a collar can lock in most of your gains while allowing modest additional upside. This approach may be suitable for investors who intend to sell eventually but wish to hold their position for a few more months.

Approaching dividend dates or corporate events

Collars protect against adverse price movements around these events while maintaining your right to receive dividends or participate in corporate actions. Many institutional investors use collars specifically for event-driven protection.

When traders might avoid collar strategies

Strong bullish outlook

Avoid collars when you’re strongly bullish on a stock and believe it will significantly outperform the market. The upside cap becomes a significant disadvantage during powerful bull markets, causing you to miss substantial gains. If you expect your stock to appreciate by more than 10-15%, the collar limitations likely outweigh the protection benefits.

Low volatility environments

Low market volatility reduces the effectiveness of collars because option premiums become relatively cheap. When volatility is low, call premiums won’t generate much income to offset the put costs, making protection expensive. During calm market periods, the cost-benefit analysis often favors simpler strategies or no hedging at all.

Beginner options traders

Collars involve managing three positions simultaneously, understanding assignment risk, and making decisions about rolling or closing positions. New traders should start with simpler strategies, such as covered calls or protective puts, before moving on to collars.

Tip: TradeStation offers a simulated trading mode where you can practice placing collar strategies on various securities and see how they react to market changes. This lets you build your skills and confidence without risking any capital.

Illiquid stocks

Avoid collars on stocks with low trading volume that have wide bid-ask spreads for options. These spreads increase your transaction costs and make it difficult to enter or exit positions at fair prices. Stick to stocks with active options markets for smoother execution and trade efficiency.

Real-world examples

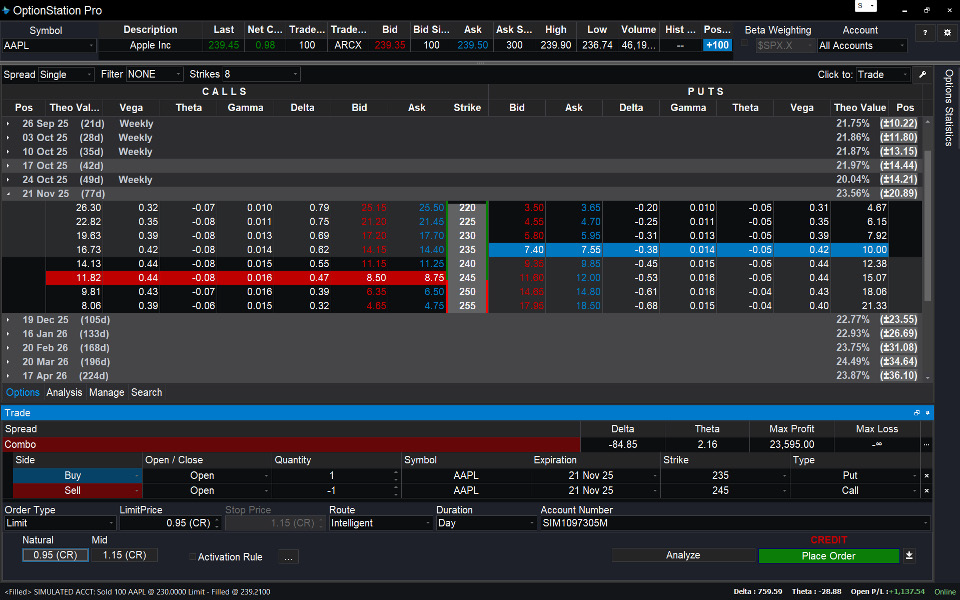

Apple Inc. (AAPL)

Let’s examine a practical collar example using real numbers. Suppose you own 100 shares of Apple Inc. (AAPL), trading at $240 per share. You originally purchased the shares at $231.66, giving you an unrealized profit. You’re concerned about market volatility over the next two months, but don’t want to sell your position.

You construct a collar:

- Buy a $235 put for $7.55

- Sell a $245 call for $8.50

- Both expiring in 77 days

Your net credit is $0.95 per share, meaning you receive money while adding protection.

$8.50 received – $7.55 paid

You have locked in a potential profit of $4.29 per share or $429 total.

$235 (put strike) – $231.66 (purchase price) + $0.95 (net credit)

Your maximum gain is $14.29 per share or $1429 total.

($245 (call strike) – $231.66 (purchase price) + $0.95 (net credit)

If AAPL falls to $230 at expiration

- Without the collar, your position would be down $1.66 per share

$230 – $231.66 = $1.66 per share or $166 total

- With the collar, you can exercise your put to sell at $235, capturing the $3.34 profit per share

$235 – $231.66 = $3.34 per share or $334 total

- Add the $0.95 premium received, and your total gain becomes $4.29 per share, or $429 in total

If AAPL rises to $250 at expiration

- You capture $13.34 per share, plus the $0.95 credit, for a total of $14.29 per share, or $1,429 total

$245 – $231.66 + $0.95 credit = $14.29 per share or $1,429 total

- Without the collar, your unrealized gain would be $18.34 per share, or $1,834 total

$250 – $231.66 = $18.34 per share, or $1,834 total

- While you missed $5.00 per share in gains, you received downside protection and a small credit for this trade-off

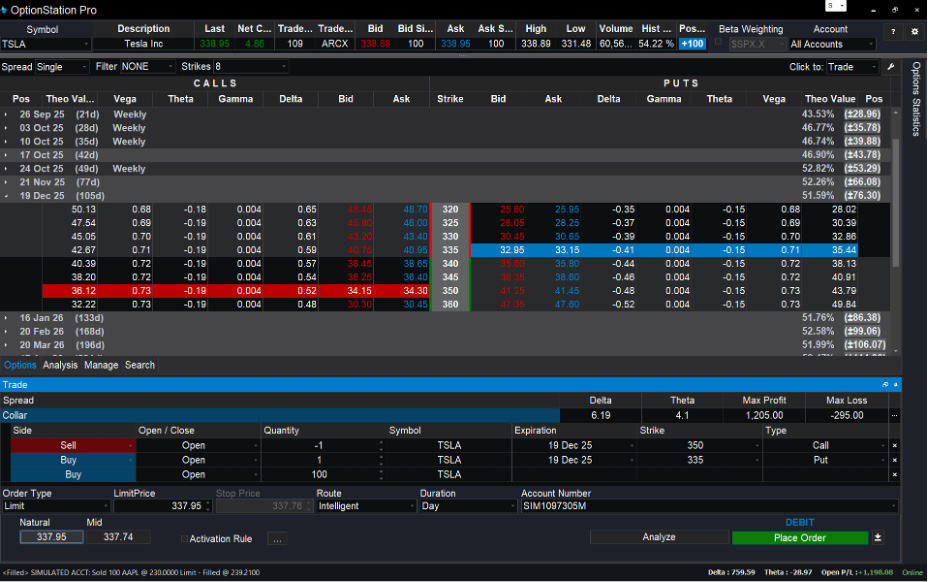

Buying Tesla Inc. (TSLA) with protection

Suppose you are looking to buy 100 shares of Tesla Inc. (TSLA), which is trading near $339. To protect those shares from possible market volatility in the next three months, you will also open a collar position simultaneously.

- Buy 100 shares of TSLA at $338.95

- Buy a $335 put for $33.15

- Sell a $350 call for $34.15

The $1.00 per share credit received from the options ($34.15 received minus $33.15 paid) would reduce the effective cost of the shares to $337.95.

The maximum loss for the position is $295 total.

|

The maximum gain is capped at

|

If TSLA drops to $330 at expiration

You could exercise your put and sell the shares at the $335 strike.

- This results in the maximum loss of $2.95 per share, or $295 total.

- Even if the price continued to decline, you could not lose more than that maximum.

If TSLA rallies to $360 at expiration

Your $350 call will likely be exercised, and your share will be sold at the strike price.

- You earn the maximum profit of $12.05 per share, or $1,205 total.

- Selling your TSLA shares at the $350 call strike prevents you from participating in any profits above that price. You miss out on the additional $10.00 per share additional profit.

This is why collars are preferred when you are moderately bullish but worried about short-term volatility. You would not want to limit your potential profits in a strong bullish market.

Common mistakes traders make with collars

Several recurring mistakes can undermine the effectiveness of the collar strategy.

1. Poor strike selection

New collar traders often choose strikes that are too close to the current stock price, creating expensive protection with limited upside potential, or strikes that are too far away, providing minimal protection with excessive upside caps.

Tip: Aim for strikes approximately 5-10% away from the current stock price as a starting point, adjusting based on volatility and your risk tolerance.

2. Ignoring assignment risk

Many traders overlook the fact that the call they sold can be exercised at any time, especially as expiration approaches or before dividend dates.

Tip: Always have a plan for assignment scenarios – know what you’ll do if your stock gets called away and whether you want to buy it back or find alternative investments.

2. Mismatched expiration dates

Using different expiration dates for the put and call can create unnecessary complexity and may result in unbalanced risk. One option’s leg may expire before the other, leaving you with unwanted risk exposure requiring additional trades to correct.

Tip: Always match expiration dates to maintain the collar structure and make it easier to manage.

4. Emotional decision-making

When markets become turbulent, some traders panic and close their positions at precisely the wrong time – selling their protective puts when they’re most valuable or buying back their calls when assignment would be beneficial.

Tip: Stick to your original plan and let the collar work as designed.

Variations of collar strategies

The basic collar can be modified to suit the different needs of investors and market conditions.

1. Zero-cost collars

This represents the most popular variation, where the call premium exactly equals the put premium, resulting in no net cost for the protection. Achieving zero cost often requires adjusting strike prices— perhaps using a $94 put and a $106 call instead of $95/$105—until the premiums match.

2. Credit collars

These generate immediate income by selecting strikes where the call premium exceeds the put premium. This often means choosing a call strike closer to the current stock price than the put strike. For example, with stock at $100, you might use a $90 put and $104 call, generating a net credit while providing protection. The income helps offset potential losses, but it also reduces upside potential.

3. Debit collars

This variation prioritizes maximum protection over income generation. Here, you choose a put strike closer to the current stock price than the call strike, resulting in a net cost but better downside protection. Using our $100 stock example, a $97 put and a $106 call might cost $1.50 net, but they protect against smaller price declines.

4. LEAPS collars

LEAPS (Long-Term Equity Anticipation Securities) collars use long-term options (lasting one year or more) to provide extended protection. While more expensive due to higher time value, LEAPS collars may suit investors who want protection for extended periods without constantly rolling shorter-term positions. These may work well for concentrated stock positions or situations where you expect prolonged market uncertainty.

How collars compare to other protective strategies

Understanding collar alternatives helps you choose the most appropriate risk management approach.

1. Protective puts

Protective puts alone offer unlimited upside potential, but they cost more because you pay the full put premium without call income to offset expenses. If you anticipate significant stock appreciation, protective puts may justify their higher cost by maintaining unlimited profit potential

2. Covered calls

Covered calls generate income but provide no downside protection. While you collect call premiums, your stock can still lose substantial value. Covered calls work best when you expect modest stock appreciation and want to generate additional income, but they leave you vulnerable to market declines. Collars essentially combine covered calls with protective puts for balanced risk management.

3. Stop-loss orders

Stop-loss orders provide free protection but can lead to poor execution in volatile market conditions. Stop losses can be triggered by temporary price spikes, forcing you to sell at precisely the wrong time. Collars, by contrast, provide price protection without forced selling, letting you maintain your position through temporary volatility.

4. Diversification

Diversification remains a fundamental risk management tool, but it doesn’t mitigate concentrated positions or declines in entire markets. Collars complement diversification by providing position-specific protection, especially valuable for large individual holdings or when you want to maintain specific stock exposure despite market concerns.

Final thoughts on collar strategies

The collar options strategy offers a sophisticated yet accessible approach to risk management, combining downside protection with upside participation at minimal cost. By understanding the mechanics, benefits, and limitations of collars, traders can make informed decisions about when to implement this strategy. Remember that successful collar trading requires practice, patience, and careful attention to position management. Start small, learn from experience, and gradually increase position sizes as your comfort and expertise grow. Most importantly, consider collars as one tool in a broader risk management framework rather than a complete solution to all investment challenges. When used thoughtfully and with precision, collars can help investors navigate uncertainty while staying aligned with their long-term investment goals.

Important Information and Disclosures

This content is for educational and informational purposes only. Any symbols, financial instruments, or trading strategies discussed are for demonstration purposes only and are not research or recommendations. TradeStation companies do not provide legal, tax, or investment advice.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on www.TradeStation.com/Important-Information.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a brokerdealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission. TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly-owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com/DisclosureTSCompanies for further important information explaining what this means.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.

Any examples or illustrations provided are hypothetical in nature and do not reflect results actually achieved and do not account for fees, expenses, or other important considerations. These types of examples are provided to illustrate mathematical principles and not meant to predict or project the performance of a specific investment or investment strategy. Accordingly, this information should not be relied upon when making an investment decision.

ID5023120