Futures Education Center

Explore strategies

Learn more

Upgrade options level

Learn more

An Introduction to Futures Spread Trading

Introduction

Futures spread trading aims to profit from the price differences between related futures contracts, rather than attempting to predict the direction of the markets. This strategy usually reduces your required trading capital by 50-75% due to lower margin requirements. It can also offer lower risk compared to standard directional futures trading, as futures spreads are potentially delta-neutral.

Increased volatility and geopolitical uncertainty in 2024-2025 created significant opportunities across energy, agriculture, and financial markets. These market conditions provide opportunities to learn about futures spread trading. As with all trading, there is a risk of loss, but futures spreads can offer exposure for new traders to understand futures markets while still allowing for profit potential.

This comprehensive guide explains what you might need to know to start spread trading, from basic concepts to real-world examples and common mistakes to avoid.

How futures spread trading works

Futures spread trading involves holding two opposite positions in related futures contracts simultaneously. Instead of trading market direction, you’re wagering on how the relationship between the two contracts will change.

There are several corn futures contracts available to be traded at any given time. The contract with the most trading volume is called the front month or near contract. The others are referred to as forward or back-month contracts.

When a market is bullish or bearish, the front month often moves the furthest and fastest in that direction. Suppose you are bullish on corn in October. You could buy the December corn future. This would require a margin of $1073.

Alternatively, you could buy the December corn contract and simultaneously sell the March corn contract as a spread. The margin for the entire position would be $303.

Example: Corn spread trade

- Buy December corn futures for $4.20 per bushel

- Sell March corn futures for $4.45 per bushel

You’ve established a “spread” with a $0.25 difference. Overall shifts in corn prices don’t directly impact your profit, since your two positions partially cancel each other out. Instead, the position profits if one side gains more than the other loses.

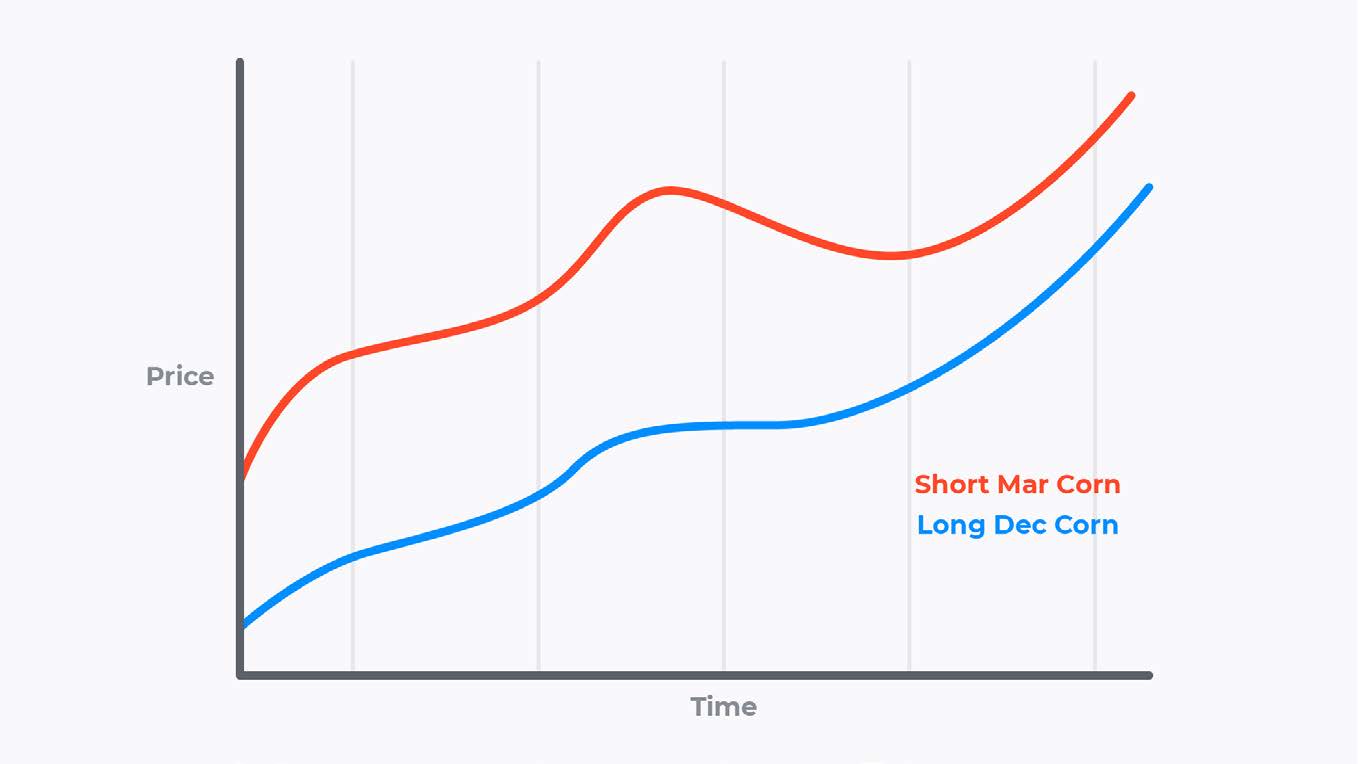

Scenario 1: Corn increases, spread narrows

- December corn rises to $4.35

- March corn rises to $4.55

- December long gains $0.15, while the March short loses $0.10

- The spread has narrowed to $0.20, and your spread trade has profited $0.05

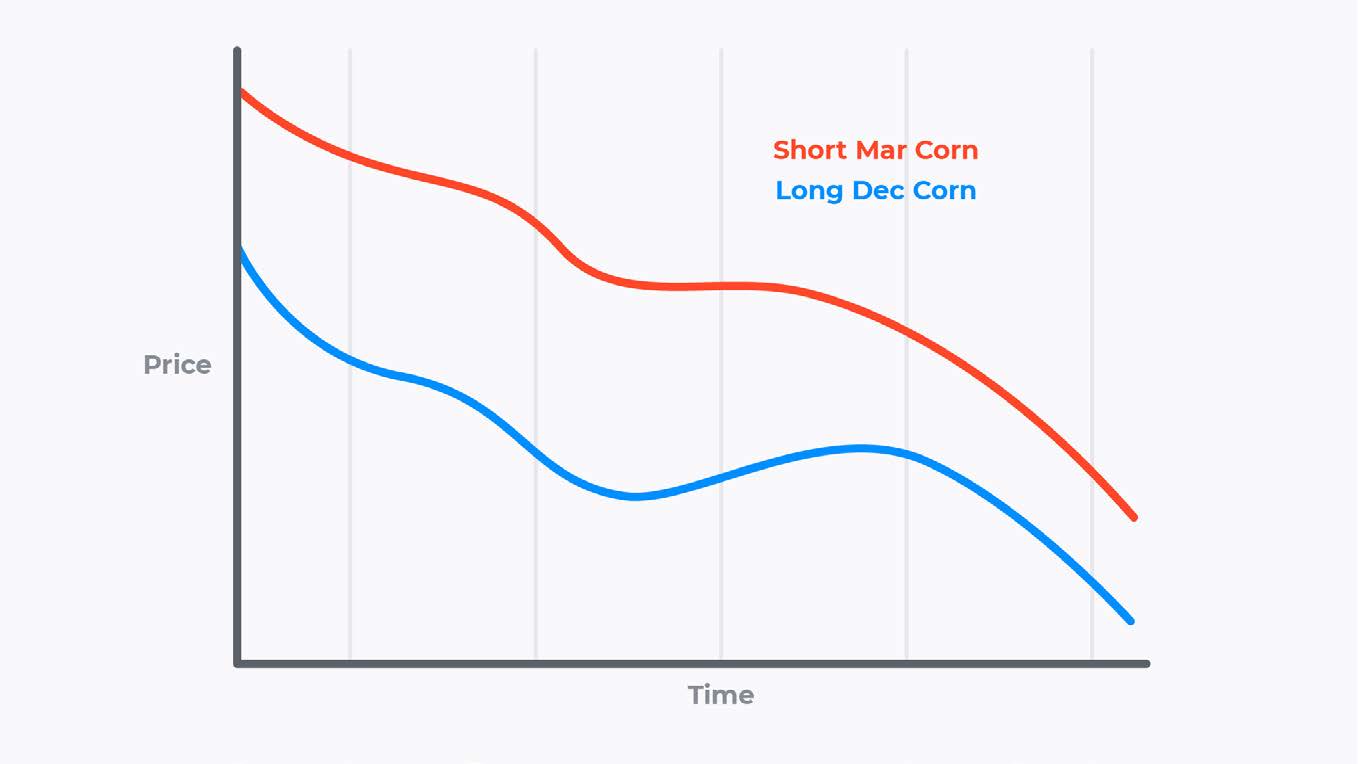

Scenario 2: Corn drops, spread narrows

- December is now trading at $4.05

- March is now trading at $4.20

- The December long loses $0.15, while the March short gains $0.25

- The spread narrowed to $0.15, and you would have a $0.10 unrealized profit

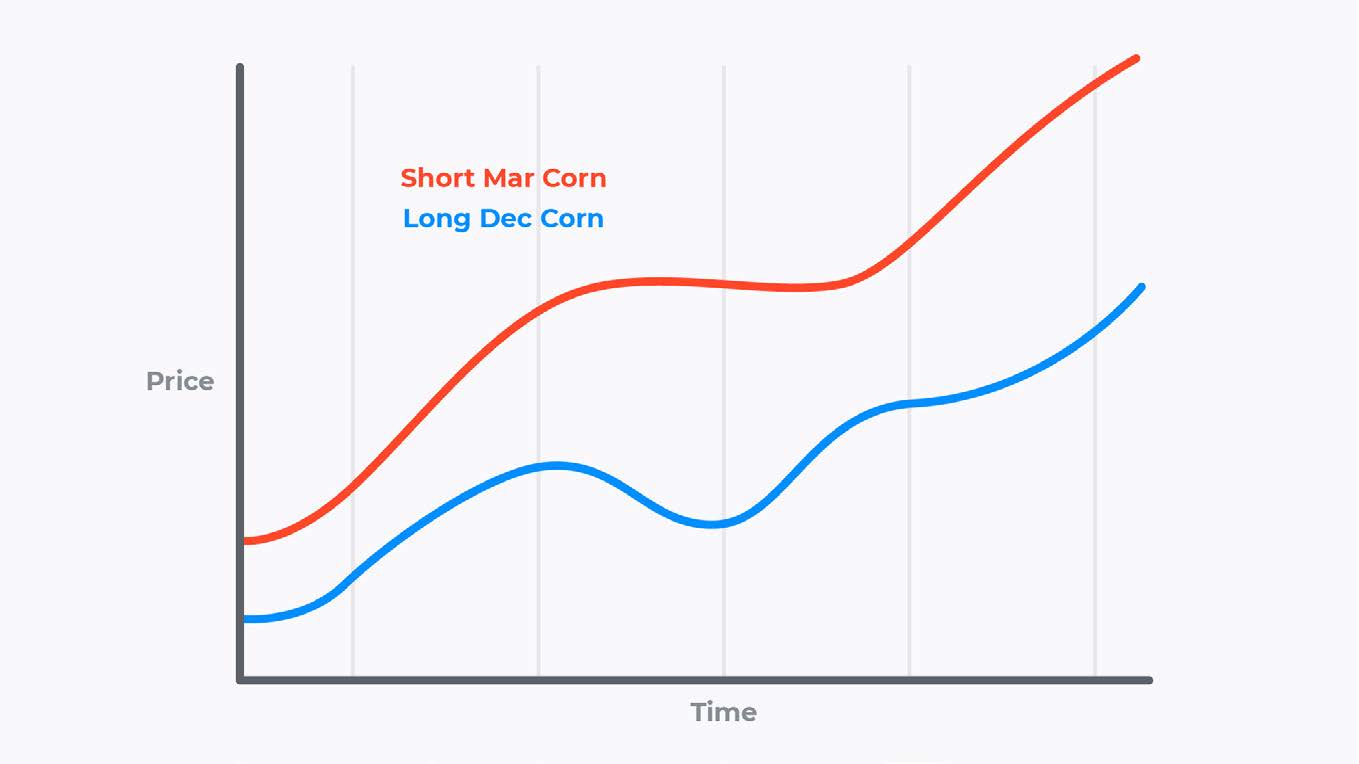

Scenario 3: Corn rallies, spread widens

- December corn rallies to $4.35

- March surges to $4.70

- The December long gains $0.15, while the March short loses $0.25

- The spread is now $0.35, and the position is losing $0.10.

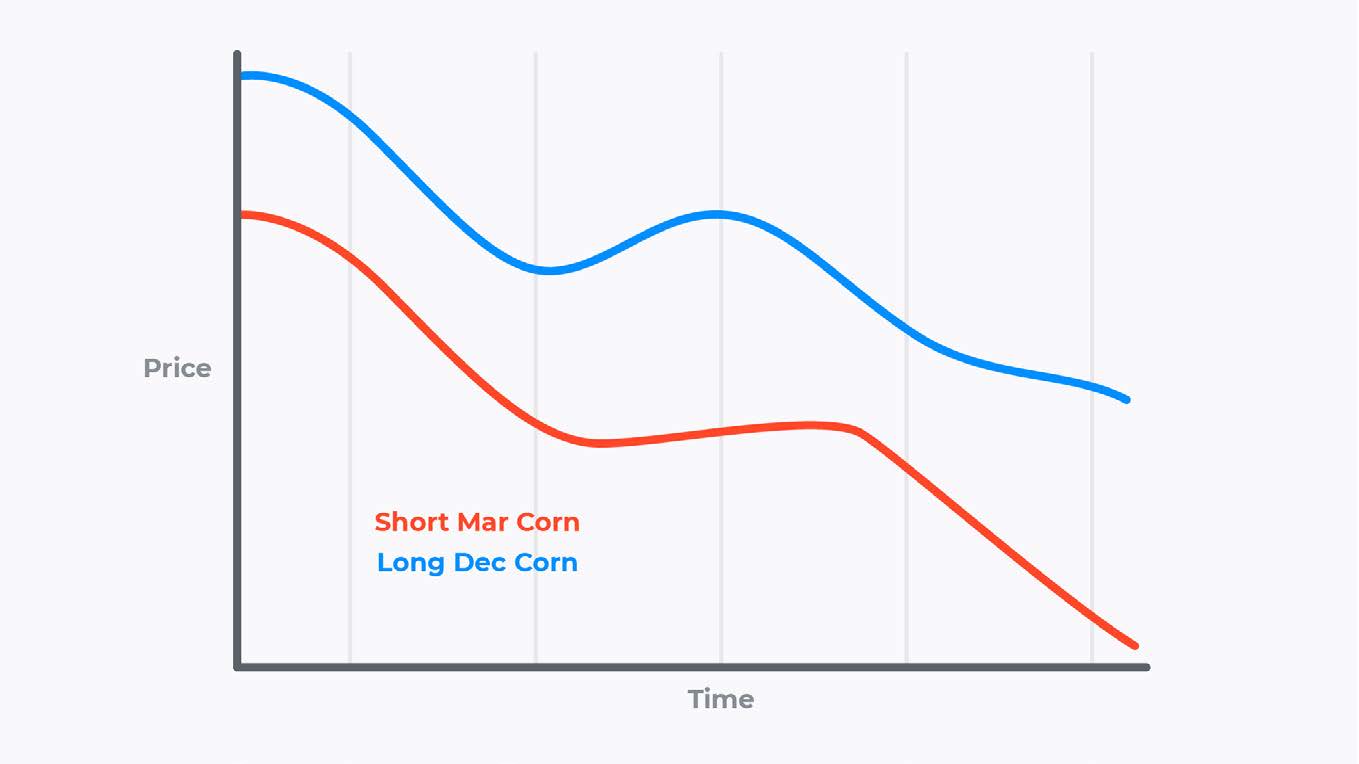

Scenario 4: Corn falls, spread widens

- December corn retreats to $4.05

- March drops to $4.35

- The December long loses $0.15, while the March short only gains $0.10

- The spread is now $0.30, and the position is losing $0.05

The spread trade would lose money if the spread were to widen. It does not matter whether the legs go up or down.

Main types of futures spreads

Calendar spreads use the same commodity with different delivery months. Example: Buy March crude oil, sell June crude oil. These spreads profit from seasonal patterns, storage costs, and supply timing differences.

Inter-commodity spreads use different but related products and can use the same or different delivery months. Example: Buy December corn futures, sell December wheat futures, or buy October feeder cattle and sell December live cattle. These spreads capture economic relationships between competing or related products.

Product spreads combine a raw commodity with its processed products. The classic example is the “soybean crush” – buying soybeans and selling soybean meal and soybean oil. This simulates the economics of processing soybeans into meal and oil.

Essential terms every spread trader needs to know

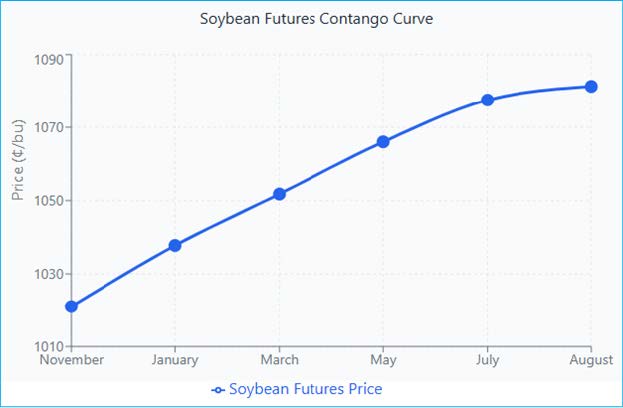

Contango describes when futures with farther expirations are higher in price than current spot and front-month prices, creating an upward-sloping curve.

This happens when storage costs, insurance, and financing make it expensive to hold commodities. For example, if gold costs $3,200 per ounce today but gold for delivery in one year costs $3,500 per ounce, that’s contango.

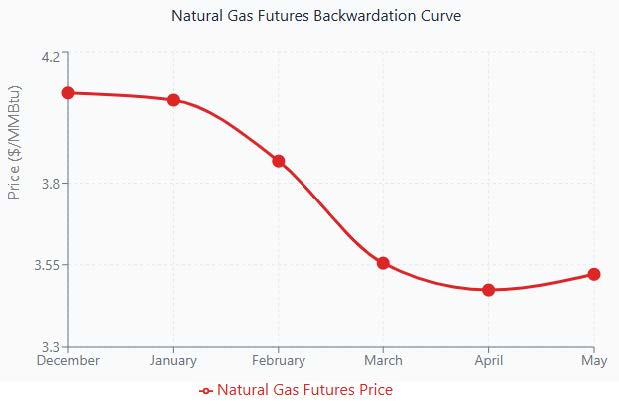

Backwardation is the opposite, when front month and spot prices are higher. This occurs when immediate demand is high or supplies are tight. Natural gas often shows backwardation in winter when heating demand spikes, but future supply is expected to be adequate.

Margin is the amount of money you need to deposit with your broker to open and maintain a futures position. It’s essentially a good-faith deposit that serves as collateral.

Futures contracts are leveraged instruments, meaning you can control a large contract value with a relatively small amount of capital. Margin is what allows this leverage to work. For example, you might control a $100,000 futures contract by depositing only $5,000 in margin.

Notional value represents the total dollar amount of a futures contract, calculated by multiplying the contract size by the current price, even though you only put up a fraction of this amount as margin. For example, one E-mini S&P 500 futures contract controls $50 times the index value – if the S&P 500 is at 6,711, the notional value is $335,550 ($50 x 6,711), but you might only need $23,400 in margin to control this position. In spread trading, you’re controlling the notional value of both legs simultaneously, which is why spreads can offer such high leverage even with reduced margin requirements.

Understanding notional value helps you grasp the true size of your market exposure and calculate appropriate position sizes based on your account value. A common rule is never to have total notional exposure exceed 3-5 times your account balance across all positions.

Basis means the difference between the cash (spot) price and the futures price. The formula is: Basis = Cash Price – Futures Price. Understanding basis helps you see whether futures are expensive or cheap compared to the physical commodity.

What makes spread trading attractive?

Dramatically reduced margin requirements represent the biggest advantage. Futures spread trades require much lower margins than outright futures trading. CME Group examples show a corn versus soybeans spread requiring only $1,385 instead of $3,960 for separate positions – a 35% reduction. Corn-wheat spreads receive a 55% margin credit, cutting requirements from around $2500 to $1,225. Treasury spreads receive 70% credits, while E-mini Nasdaq 100 calendar spreads require only $358.60 in total margin, which is about 98.9% lower than the overnight margin for the E-mini Nasdaq 100 futures contract.

Capital efficiency means the same money controls more positions. Due to the lower margin requirements, you might control 10 spread positions with the same capital needed for one outright futures contract. This allows better portfolio diversification with the same capital allocation while reducing exposure to market maker manipulation.

Lower volatility exposure provides more predictable trading. A single spread position experiences significantly less volatility than a single outright futures position because the two legs partially offset each other. For example, academic research on calendar spreads shows that outright futures positions can be 20 to 40 times more volatile than single spread positions in the same commodity. This protection against broad market swings and systemic risk allows for more predictable price movements and less stressful trading. However, it’s important to note that if you scale up the number of spread contracts to match the dollar risk of outright positions, this volatility advantage may diminish.

Market-neutral characteristics create profit potential in both rising and falling markets. Instead of needing to guess market direction, you focus on price relationships. This provides protection against broad market volatility while capturing market inefficiencies and pricing discrepancies.

Understanding the real risks involved

Basis risk represents the main danger when price relationships between contracts diverge from historical norms. Correlation breakdowns during market stress can cause spreads to move unpredictably. Weather events, geopolitical developments, or supply disruptions can break traditional relationships you’re counting on.

However, these disruptions can also present opportunities for experienced traders, as they might trade futures spreads that benefit from prices returning to the norm.

Execution risk comes when spread orders execute sequentially rather than simultaneously. Your first leg might fill at the desired price, but the second leg fills at a worse price, particularly during high volatility periods. This can result in unintended directional exposure instead of the spread position you wanted. Legging in is a strategy where a multi-leg position is entered one side at a time. It should not be used for spread trading. Spread orders are preferred where both legs execute simultaneously at a specified differential, eliminating legging risk.

Liquidity risks affect some spread combinations involving less liquid contracts. You might face wider bid-ask spreads during execution and have trouble exiting positions during market stress. For example, palladium futures can have 8-point bid-ask spreads ($1,260 bid/$1,268 ask) during thin trading sessions.

Timing and roll risk affect contracts with different expiration dates. You may need to roll positions forward if a contract is nearing expiration. The basis can widen unexpectedly near contract expiration. You need to be aware of the first notice date to avoid potential delivery delays and properly plan the timing of your exits.

Margin requirements and execution mechanics

Inter-commodity spreads typically offer significant margin reductions. Energy spreads, such as crude oil versus gasoline, usually provide 50-65% margin credits. Grain spreads, such as those between corn and soybeans, receive 55% credits. Metal spreads, such as gold versus silver, typically receive 40-50% credits. The margin information can be found on the exchange website.

Intra-commodity calendar spreads use the formula: (outright rate for leg one minus outright rate for leg 2) plus intra spread charge. For example, a month 2 versus month 4 spread might require a margin of ($750 minus $500) plus $50, totaling $300. Most calendar spreads need only 15-25% of outright margin.

Common mistakes that cost new traders money

Trading without a comprehensive plan represents the biggest mistake. Unlike outright positions, spreads require understanding the relationship between both legs. New traders jump in without clear entry and exit rules or risk management strategies. Fix this by developing a trading plan that includes position sizing, stoploss levels, and profit targets for the spread differential, rather than individual contract prices.

Misunderstanding margin requirements trips up many beginners who assume spread margins work like outright futures margins. While spread margins are typically lower (often 75% credit), you’re still trading two positions. Calculate total margin exposure and maintain buffer capital. Remember: soybean futures at $3,000 margin plus corn at $1,500 equals $4,500 outright, but the spread might only require $1,125.

Ignoring liquidity considerations leads to problems when trading exotic or illiquid spread combinations. Some spreads lack sufficient trading volume, making exits difficult. Focus on established spreads with good liquidity: cornsoybean, gold-silver ratio, treasury note spreads (2-year versus 5-year).

Over-leveraging occurs because new traders often use excessive leverage, believing spreads are “safer” due to the lower margin requirements. You can still lose money on both legs if correlations break down. Treat position sizing conservatively as you would with directional futures trading. A good rule to follow is to never risk more than 1-3% of your account per spread trade.

Failing to monitor both legs means focusing only on the spread value without watching individual contract behavior. One leg can experience unexpected moves due to specific factors like weather, news, or supply disruptions. Monitor both legs and the factors affecting each individually.

When spreads work well versus when they struggle

Optimal conditions for spread trading include high-volatility environments where spreads often provide more stable returns than outright positions while correlations between legs remain relatively intact. Seasonal transition periods create reliable spread opportunities through natural supply and demand cycles, while interest rate environment changes make Treasury spreads respond predictably to Fed policy expectations.

Challenging conditions include correlation breakdown scenarios when individual contract-specific news affects one leg disproportionately. For example, an oil refinery severely damaged by a hurricane might affect gasoline prices but not crude oil prices. Low volatility environments can keep spread differentials static for extended periods, creating limited profit opportunities while commission costs remain constant.

Markets conducive for spread trading include agricultural commodities with strong seasonal patterns, energy products driven by weather and seasonal demand, financial futures with clear interest rate relationships, and precious metals with economic hedge relationships. More challenging markets include single-stock futures with idiosyncratic risks, cryptocurrency futures with limited historical data and extreme volatility, and exotic currency pairs with liquidity issues.

Building your spread trading foundation

To trade futures spreads through TradeStation, you will need to use TradeStation’s Futures Plus platform, which is available online and as a mobile app. You can log into the platform in a simulated trading mode that will allow you to practice futures spread trading with the risk of losing real money.

Start with simple calendar spreads in liquid markets like corn, soybeans, crude oil, or Treasury notes. These same-commodity, different-month spreads can be easier to understand and analyze. Focus on markets with strong seasonal patterns and reliable historical data.

Review and conclusion

When trading futures spreads, position sizing should never exceed 2% risk per spread trade. Account for commission costs on both legs and maintain a minimum margin requirement of 3-4 times as buffer capital. Set stops based on spread differential, not individual contract prices, using historical spread ranges to determine reasonable stop levels.

Risk management requires limiting spread trades to 15-20% of your total portfolio, diversifying across different spread types and commodities, monitoring correlation between spread positions, and maintaining adequate cash reserves for margin calls.

Futures spread trading offers traders a compelling way to participate in futures markets with reduced risk, lower margin requirements, and protection from broad market volatility. It is not without risk, though. The strategy typically provides 50- 75% margin savings and 40-60% lower volatility compared to outright futures positions while maintaining good profit potential.

Success requires understanding market relationships, proper risk management, and avoiding common beginner mistakes like overleveraging or ignoring liquidity. Market conditions have created exceptional opportunities across energy, agricultural, precious metals, and financial markets, making this an ideal time to learn spread trading.

Start with simple calendar spreads in liquid markets and focus on understanding the fundamental relationships driving your chosen spreads. With proper preparation and disciplined execution, spread trading can provide a more controlled and educational path to futures market success while building essential risk management skills that will serve you throughout your trading career.

The combination of reduced capital requirements, lower volatility, and multiple profit opportunities makes spread trading an attractive strategy for traders willing to invest time in learning market relationships and maintaining disciplined risk controls.

If you’re ready to put futures spreads into practice, TradeStation’s FuturesPlus platform gives spread traders the tools to build spreads, visualize relationships in a matrix grid, request exchange quotes, and place spread trades while tracking account activity—all in one interface. You can seamlessly switch to Simulated Trading to rehearse entry and exit rules in a risk free environment before going live, and stay agile with mobile access to monitor markets and manage positions on the go.

Important Information and Disclosures

Futures trading is not suitable for all investors. To obtain a copy of the futures risk disclosure statement visit www.TradeStation.com/DisclosureFutures

This content is for educational and informational purposes only. Any symbols, financial instruments, or trading strategies discussed are for demonstration purposes only and are not research or recommendations. TradeStation companies do not provide legal, tax, or investment advice.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on www.TradeStation.com/Important-Information.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a brokerdealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission. TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly-owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com/DisclosureTSCompanies for further important information explaining what this means.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.

Any examples or illustrations provided are hypothetical in nature and do not reflect results actually achieved and do not account for fees, expenses, or other important considerations. These types of examples are provided to illustrate mathematical principles and not meant to predict or project the performance of a specific investment or investment strategy. Accordingly, this information should not be relied upon when making an investment decision.

ID5034050