Volatility is fading this month, just as a wave of companies looks to go public.

Prominent firms including WeWork (WE) and SmileDirectClub (SDC) are expected to raise more than $1 billion each in their initial public offerings (IPOs). Combined with other big names like Uber Technologies (UBER) in May and Pinterest (PINS) in April, the market’s on pace for its busiest year since 2014.

Less volatility tends to help IPOs by making investors more willing to take risk. Issuance generally slows at times when the broader market crashes. We saw that in late 2018.

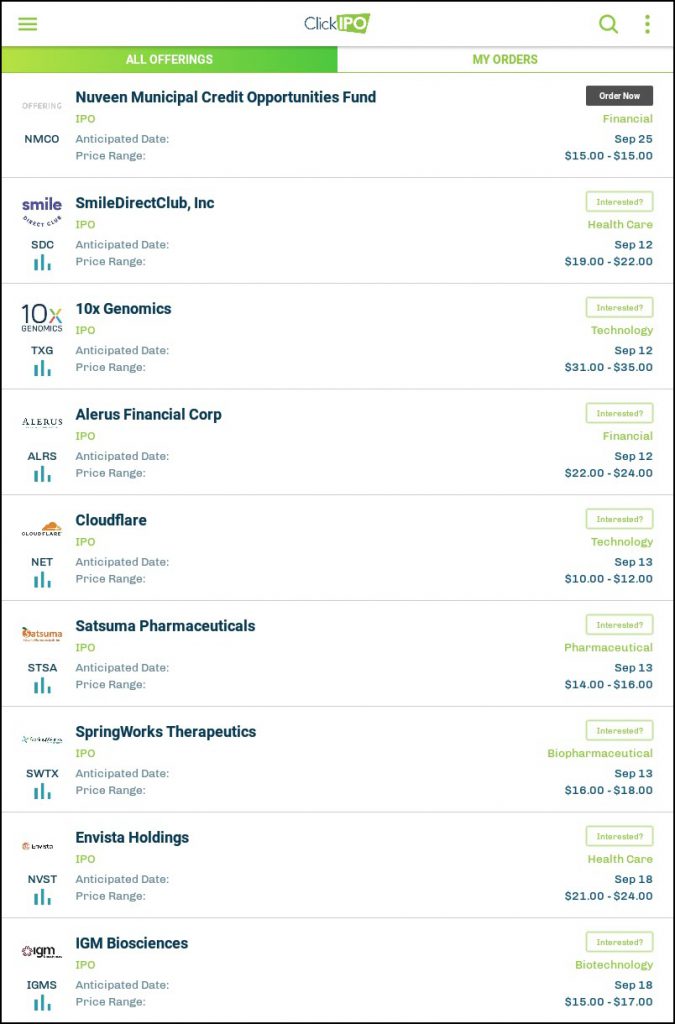

SDC is the largest deal scheduled so far, looking to raise about $1 billion next Thursday, according to ClickIPO. The company fits and sells teeth aligners over the Internet. It then provides online monitoring by professional orthodontists, more than halving the cost of traditional braces. Like cloud computing, it’s another example of how new firms are using technology to innovate.

It’s not the only disrupter in the market. Thanks to another breakthrough — ClickIPO’s mobile app — TradeStation clients can now access IPOs before they start trading. Yep, a world once controlled by huge institutional money managers is now available to retail investors on their smart phones.

Other large deals currently on ClickIPO include:

- 10X Genomics (TXG): A provider of biotechnology systems looking to raise about $300 million on Thursday, September 12.

- Cloudflare (NET): An Internet-delivery and security firm looking to raise about $385 million on Friday, September 13.

- Envista (NVST): Another dental deal, this time spun off from Danaher (DHR). It’s expected to raise about $600 million on Wednesday, September 18.

What About WeWork?

WE’s IPO could be even bigger. Press reports say the provider of shared office space wants to raise about $3.5 billion, with investor presentations starting as early as next week. Real-time updates will be available on ClickIPO.

Several other companies are highly anticipated but not yet officially scheduled:

- Peloton (PTON): A provider of networked exercise bikes.

- Cloudminds (CMDS): Perhaps the first pure-play robotics company in the U.S. market.

- Endeavor (EDR): A 121-year old talent agency representing actors, athletes, chefs and authors.

Something else could make the pipeline even more active. What if President Trump strikes a trade deal with China? Smoother relations between the world’s two biggest economies wouldn’t just help calm tensions. It could also draw Chinese tech companies back to the market. Remember they were some of the biggest deals in 2018.

In conclusion, markets have seen IPO booms before. But this time it’s different because offerings are more accessible than ever thanks to TradeStation and its relationship with ClickIPO.