The initial public offerings (IPOs) are surging as a new generation of technology and health-care stocks join the market.

Roughly $32.5 billion of deals priced between April and June, according to ClickIPO. That made it the most active quarter since July-September of 2015.

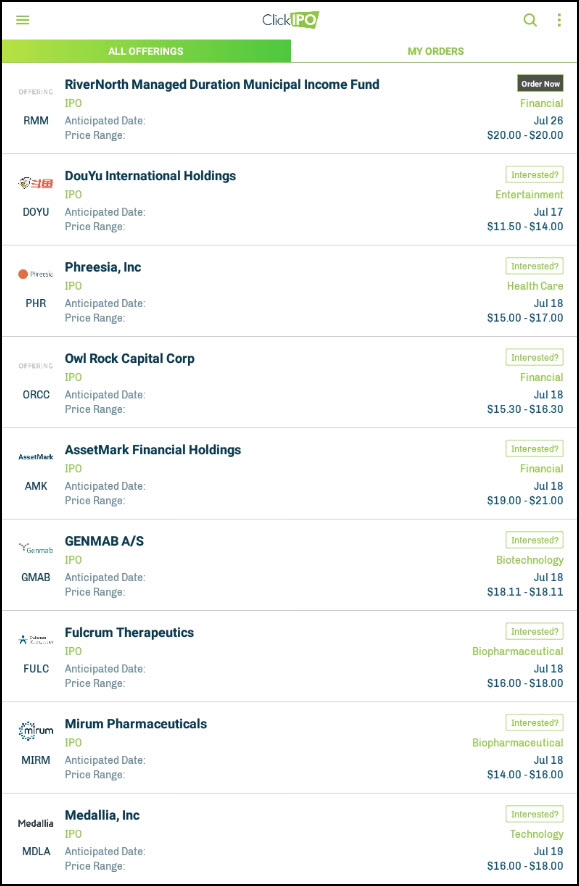

“A large number of offerings are in registration and expected to go public before August 15,” Scott Coyle of ClickIPO said earlier this week. “Wall Street wants to get business done before Labor Day and vacations at the end of next month.”

Slack (WORK) was the biggest deal last quarter, raising more than $7 billion. Although technically a direct listing rather than an IPO, WORK highlights the kind of company hitting the market these days.

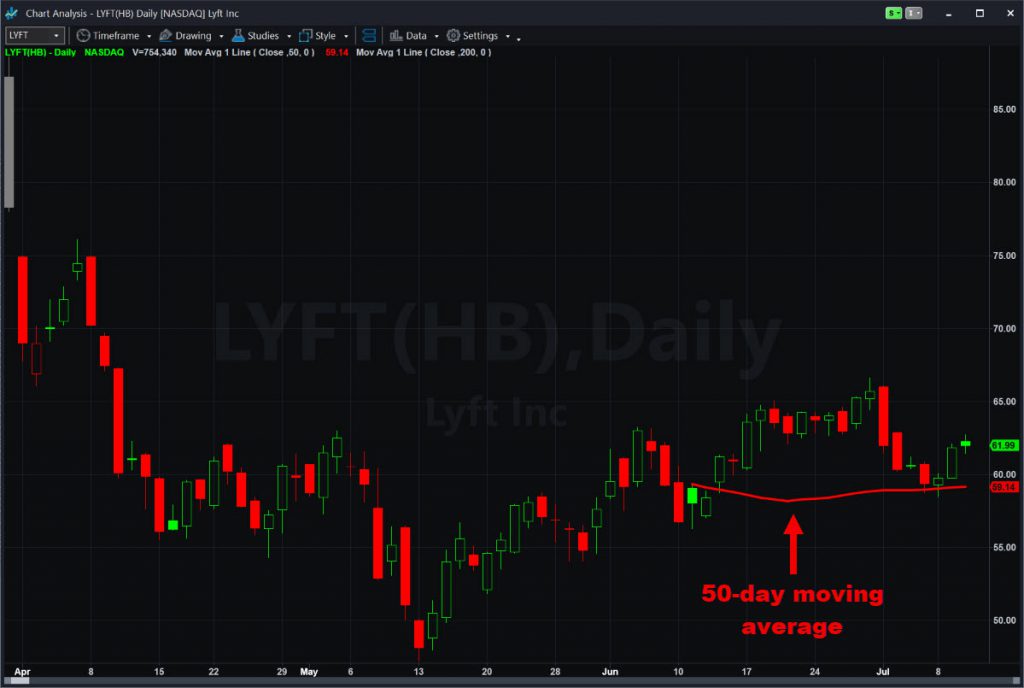

They’re often disruptive, changing how people communicate and how business gets done. Ride-sharing services Uber (UBER) and Lyft (LYFT) are obvious examples of that trend. Ditto for Zoom Video Communications (ZM), which rallied on a better-than-expected earnings debut last month.

Social Trend Setters

Other companies reflect changes in society and culture. Beyond Meat (BYND), the maker of plant-based meat substitutes, has been the hottest deal this year. You also have pet-toy maker Chewy (CHWY), which reflects America’s growing love of pets. Another smaller example is millennial fashion retailer Revolve (RVLV).

There are also a steady stream of biotechnology stocks including Avantor (AVTR) and companies rationalizing the medical industry, like Change Healthcare (CHNG).

Traders seeking access to deals before they go public can check out ClickIPO’s mobile app. The service integrates with TradeStation brokerage accounts, letting them track offerings and place orders on companies before they go public.

In conclusion, investors are embracing new stocks as the market pushes to new highs. And, Wall Street is preparing another round of deals before Labor Day. Those two trends are clear. The only question is whether you’ll be ready.