Stocks Hold Support. Are Rate Cuts Coming?

Stocks held support last week, and the market could be pivoting toward potential rate cuts.

Call toll-free 800.328.1267

One of the newest advances in artificial intelligence has come to the brokerage industry.

TradeStation Securities now allows brokerage accounts to be linked to Anthropic’s Claude model, letting customers place trades, manage positions and plan strategies. The service uses a Model Context Protocol (MCP) connection to access account information via secure API.

MCP is available to TradeStation brokerage clients with account balances of at least $10,000 and requires an active Claude Pro subscription. The connection uses a defined set of tools to access account information, retrieve data and manage orders within established permissions. Claude can incorporate this information alongside broader context, such as current news and public data, providing traders a customized and conversational experience.

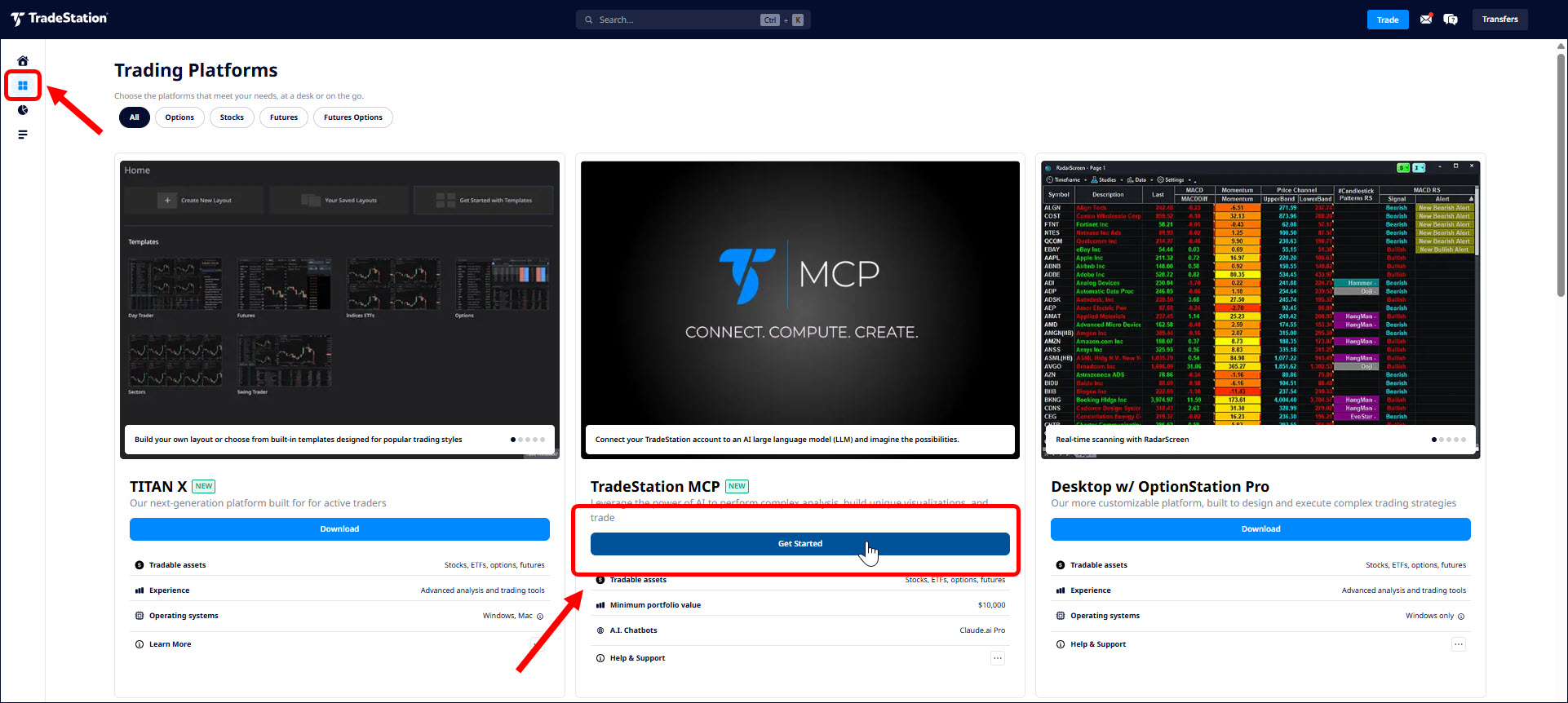

TradeStation HUB’s platform page, showing MCP signup.

Customers can get started by clicking the “Sign in” button at the top right of TradeStation.com. Once authenticated, they will enter HUB, the unified starting point for their accounts.

Clicking the Platform button on the left lists available tools. MCP will appear for customers with qualifying accounts. Clicking “Get Started” begins the process.

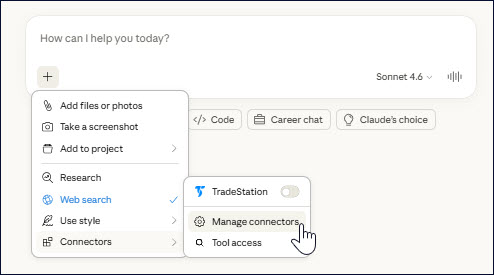

Once enabled, traders can follow these steps on Claude Pro:

Claude Pro, showing MCP connectors.

Once connected, Claude Pro can see account balances and positions. It can also access TradeStation’s pricing data on stocks and options. That can help with technical analysis and planning option strategies.

Claude interacts with TradeStation using a series of tools like “get-balances-summary” and “get-option-chain-snapshot.” Users are prompted the first time each tool is used. They can grant access once or always.

Users can conversationally ask questions like:

One of the most powerful and useful things about TradeStation’s MCP connection is that Claude Pro has all the functionality of an advanced AI model. It can survey news and search the Internet. It can reason about key events like earnings reports or investor conferences.

For example, Nvidia (NVDA) reports earnings next Wednesday, February 25. Given its importance in the broader technology sector, I asked Claude this question:

“If $NVDA has good earnings next week, what other stocks could benefit the most?”

It listed Micron Technologies (MU), Broadcom (AVGO) and Taiwan Semiconductor (TSM) because of their correlations to semiconductor industry. It also noted my paper-trading portfolio could be impacted because it had a simulated position in MU.

Here are some other potential prompts for Claude’s MCP:

Claude is perhaps even more useful helping to plan and execute trades.

Users can use the model to analyze stock charts. It can identify potential support and resistance levels, spot areas with significant historical volume and calculate technical indicators.

This data can be synthesized with other information, letting customers ask questions like:

Claude can also leverage TradeStation’s options chains to help create different strategies.

Here’s a question asked yesterday:

“I want to trade an iron butterfly expiring this Friday February 20. Which of these underliers could work the best? NVDA AMD TSLA AAPL MSFT META. Please look at their price action and options chains.”

Claude knows that iron butterflies involve selling two options and buying two others, looking for prices to remain trapped in a range. It studied the recent trading history of the stocks listed and determined that NVDA had the weakest directional trend.

Nvidia (NVDA), daily chart, showing recent range.

It then proposed this potential strategy:

It noted this potential trade could have a maximum profit of $488 if NVDA ends the week at $185. Claude also described the maximum loss at $262, with a breakeven range of $180.12 to $189.44.

Requests like this leverage Claude’s reasoning, including:

In conclusion, TradeStation is one of the first brokerages to offer AI-powered workflows. Thanks to MCP and our API connection, customers can draw on the power of AI models to plan, execute and manage transactions. It’s the start of an exciting journey, and hopefully this article helps you take the first step.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience.

See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.

This content is for educational and informational purposes only. Any symbols, financial instruments, or trading strategies discussed are for demonstration purposes only and are not research or recommendations. TradeStation companies do not provide legal, tax, or investment advice.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on www.TradeStation.com/Important-Information/.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission. TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly-owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com/DisclosureTSCompanies for further important information explaining what this means.