Can Semiconductor Stocks Withstand an Oil Shock?

Semiconductors have led stocks higher since the AI rally began, but they may face new risks as oil prices jump.

Call toll-free 800.328.1267

The leading megacap of 2025 reports earnings tomorrow afternoon, and traders may be looking for another move.

Broadcom (AVGO) has risen 75 percent this year. It’s twice the gain of AI rival Nvidia (NVDA), and the best performance by any stock with a trillion-dollar market cap, according to TradeStation data.

The semiconductor company has climbed the rankings with a one-two punch of AI products. It’s rapidly grown its custom chip business for companies like Alphabet (GOOGL), whose new Gemini 3 was successfully launched last month. The positive buzz around the new AI model drove AVGO above $400 for the first time. The stock bounced again this week on reports it may start performing similar work for Microsoft (MSFT).

Second, AVGO sells high-speed networking hardware for linking accelerators inside data centers. Its Tomahawk and Jericho switch chips are key plumbing in AI clusters, helping pipe data between processors. That segment has grown as hyperscalers build larger and more advanced AI farms.

The last earnings report on September 4 beat estimates across the board, with profit, revenue and guidance surpassing Wall Street’s expectations. The big surprise was news of a $10 billion order from a mystery customer. Initial reports identified OpenAI as the buyer, but that was denied, leading to speculation that Anthropic is the customer.

AVGO jumped above $320 following the last set of results and has remained there since.

Broadcom (AVGO), daily chart, with select patterns and indicators.

The stock had a new record closing high yesterday, up 1.3 percent to $406.29.

Rosenblatt Securities raised its price target from $400 to $440 yesterday, anticipating strong demand for GOOGL’s Tensor Processing Units (TPUs). JP Morgan said on Monday that AVGO may beat estimates because of growth in its AI and non-AI businesses. HSBC lifted its share-price projection from $400 to $535.

Earlier in the month, Morgan Stanley raised its price target from $409 to $443 because AI orders could increase “materially” in 2026. AVGO also jumped on October 13 after partnering with OpenAI to provide 10 gigawatts of custom AI accelerators.

Those headlines may create positive expectations heading into the report tomorrow afternoon.

Given the uncertainty and risk associated with quarterly reports, traders may take positions with options instead of shares.

Investors with a bullish outlook may consider a vertical call spread. That strategy entails buying a contract near the money and selling another further from the money, potentially leveraging a move between the two strike prices.

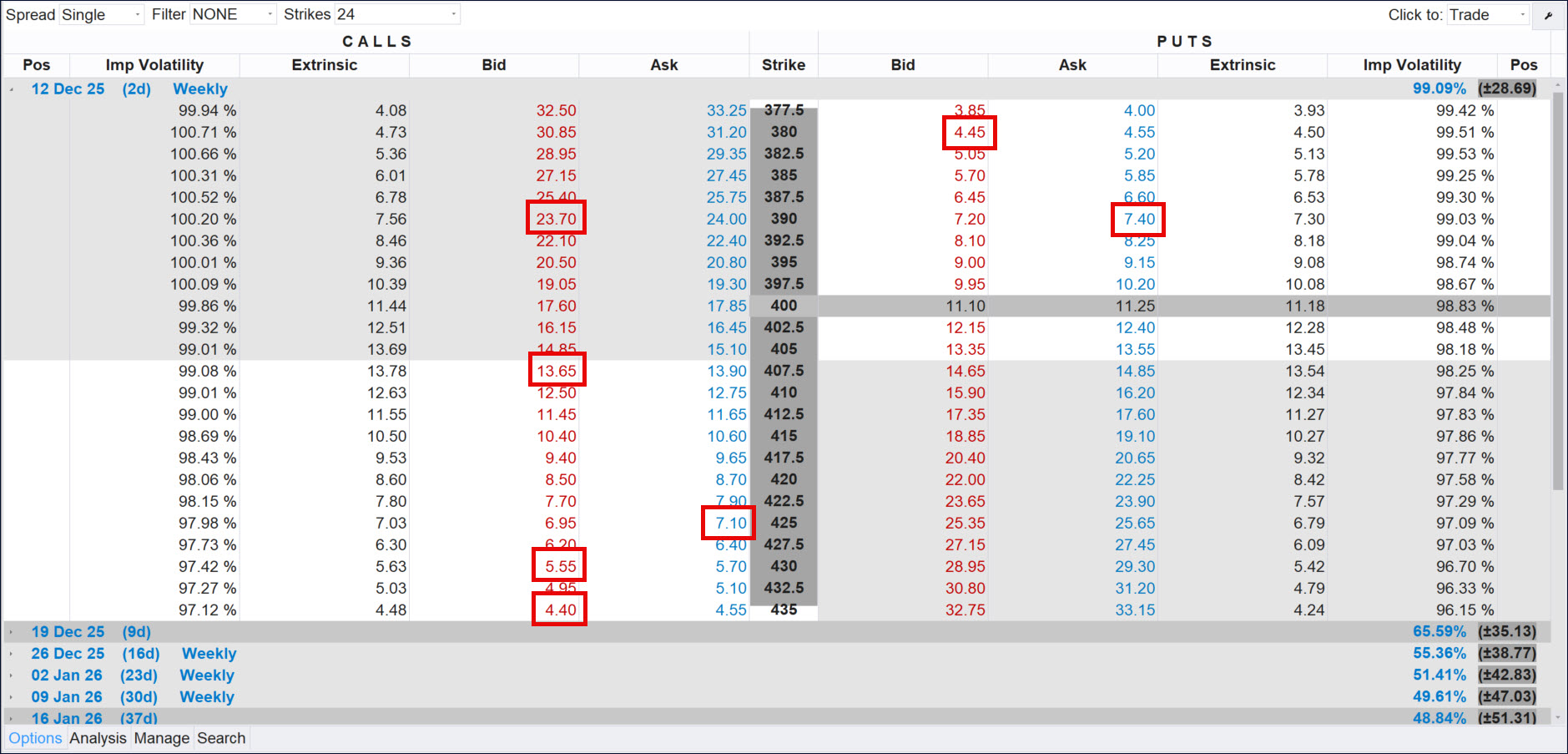

For example, they may purchase the 12-December 425 calls for $7.10 and sell the 12-December 435 calls for $4.40. That position would cost $2.70 and expand to $10 if AVGO closes at $435 or higher on Friday. That’s a potential gain of 270 percent from the stock rising about 7 percent.

Traders worried about a sharp drop may use puts in a vertical spread. They could potentially buy the 12-December 390 puts for $7.40 and sell the 12-December 380 puts for $4.45. The position would cost $2.95 and expand to $10 if AVGO closes at $380 or lower on Friday. That’s a potential gain of 239 percent from the stock declining 6.3 percent.

Calls can gain value to the upside because they fix the price where a security can be purchased. Puts are just the opposite, locking in a selling price and potentially appreciating when shares decline.

OptionStation Pro showing Broadcom (AVGO) options. Contracts mentioned in this article are marked.

Alternately, some investors may have bought the stock at lower prices and now have large unrealized gains. They may consider selling calls to collect premium and reduce risk. Here are some potential uses of the “covered call” strategy:

In conclusion, AVGO has emerged as a new leader among AI stocks in 2025. Sentiment and news flow have remained bullish into its final quarterly report of the year. Hopefully this article helps you understand the trends at play and how some traders may consider positioning into the key event.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.