Can Semiconductor Stocks Withstand an Oil Shock?

Semiconductors have led stocks higher since the AI rally began, but they may face new risks as oil prices jump.

Call toll-free 800.328.1267

Major growth stocks may be stabilizing after a bout of volatility, and active traders are faced with big choices.

Tesla (TSLA), Nvidia (NVDA) and Palantir Technologies (PLTR) have led the market at various times in the past year. All three have been stalled for months, chopping below key moving averages and forming ranges as investors fret about fundamentals and potential bubbles.

Traders have heard this before. They know the valuation debates and depreciation theories — but so does the rest of the market. Analysts and pundits can write what they wish. Traders operate in a world of probabilities instead of hard truths: opportunities, risk and reward, potential outcomes. They make money by acting with an edge. Nobody pays them for being right.

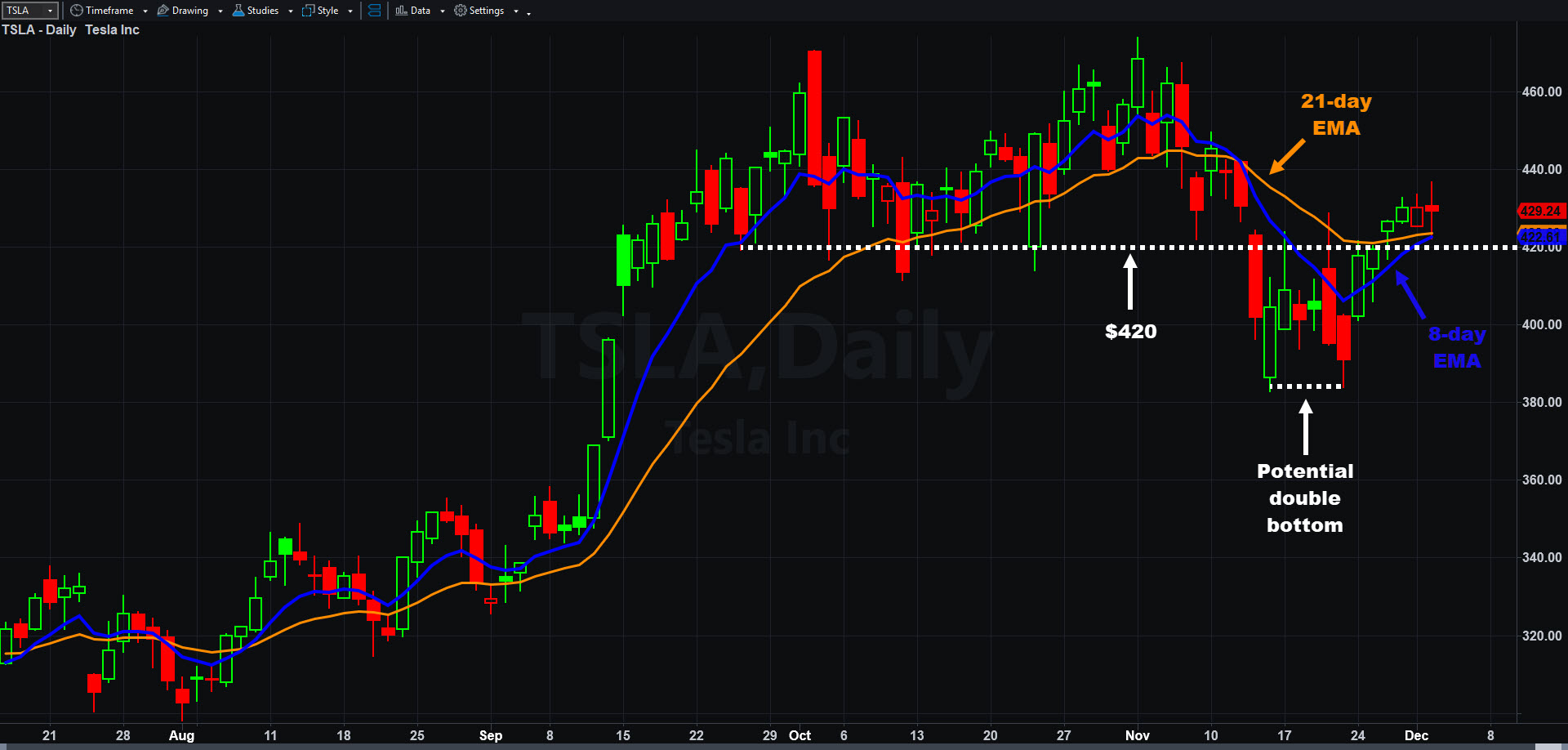

Tesla (TSLA), daily chart, with select patterns and indicators.

TSLA may be the most dramatic of the bunch. Competition is growing in the EV space, so Elon Musk is targeting self-driving cars and robotaxis. He wants to put more hardware on the road and monetize the software stack. It’s a real pivot. But TSLA has always thought about the future, and this may be its road forward. The expected launch of Optimus robots is also coming in 2026.

There are doubters, as always. Michael Burry, famed for his bearish bet against subprime mortgages, called the company “ridiculously overvalued.” European sales are slowing, but deliveries in China have risen for three straight months.

The stock’s price action reflects the mixed background. It approached record highs in October and early November, but slammed lower in the second half of last month. TSLA probed the low $380s on November 14 and 21 and held.

Two lows in the same spot in two separate weeks: A double bottom?

Traders looking for more upside may focus on some short-term indicators. For example, the 8-day exponential moving average (EMA) is rising from below and nearing a potential cross above the 21-day EMA. The last positive cross in August marked the beginning of a significant advance. The last negative cross also flagged the most recent pullback. Traders may view that as a probabilistic edge.

They may also eye the $420 area as important. TSLA held that level before its recent drop and has returned above it the last few sessions.

Nvidia (NVDA), daily chart, with select patterns and indicators.

TSLA is the second busiest stock for options traders in the market, trailing only NVDA. Traders may consider various strategies to capitalize on TSLA’s liquidity.

Vertical call spread: Buy a call and sell another further from the money. Money received from the contract sold reduces the overall cost, creating more potential for leverage.

Put credit spread: Sell a put and buy another further from the money. Collect the premium, while hedging against a major drop. Let time decay work in your favor.

Palantir Technologies (PLTR), daily chart, with select patterns and indicators.

NVDA and PLTR are also highly active underliers. Both remain more than 10 percent below their highs a month ago.

Chart watchers could see more obstacles for NVDA because its 8-day EMA is below its 21-day EMA. The moving average convergence/divergence oscillator (MACD) is also mired in negative territory. However, the AI chip giant is holding its price range from the summer around $180.

Traders may recognize that as a neutral environment, with potential for a range to form. They may select an iron condor or iron butterfly, which can profit from moving sideways in a range. Both strategies consist of selling credit spreads, looking for options to expire worthless. See this module in the Options Education Center for more.

PLTR may be turning more positive after crossing above a potentially important price zone around $170. The software company’s 8-day EMA remains below its 21-day EMA, with prices in between. Traders leaning bullish may consider put credit spreads in the near term. They could also wait for confirmation before using a vertical spread or selling a put credit spread.

In conclusion, current setups may be frustrating but strategies exist for navigating the volatility. Experienced traders focus on the market they have, and not one they wish they had. Even if stocks don’t make you happy, they might still make you money.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.