TITAN X Has Arrived. Matrix Will Never Be the Same

The next generation of our award-winning platform has arrived, with powerful new tools and functionality.

Call toll-free 800.328.1267

Balancing directional bias with premium collection isn’t always straightforward, even for the most dedicated options traders. Diagonal spreads stand out as a sophisticated strategy that might allow you to potentially profit from time decay, volatility shifts, and price movement simultaneously.

The diagonal spread is a multi-leg options play that blends elements of vertical and calendar spreads, helping you position for bullish or bearish moves with more flexibility, while managing risk and premium collection. Paired with TradeStation’s advanced tools, you can identify candidates, analyze risk profiles, and manage these positions more efficiently.

How diagonal options spreads work

A diagonal spread consists of two option contracts of the same type (calls or puts) with different strike prices and expiration dates:

The two legs:

Buy a longer-term option (typically 60-90 days out)

Sell a shorter-term option (typically 30-45 days out)

The long option provides staying power and defines your maximum loss. The short option generates premium income and benefits from accelerated time decay. Unlike vertical spreads, where both options expire simultaneously, the short option in a diagonal spread expires first, potentially allowing you to sell another short-term option against your still-open long position.

Understanding diagonal spread strategies and variations

A diagonal option spread is constructed by buying and selling calls or puts on the same underlying asset, but with differing strike prices and expirations. This hybrid structure blends the vertical spread’s strike-based approach with the calendar spread’s expiry-based setup.

Diagonal spreads stand out by offering both strike and expiry flexibility, unlike calendar spreads, which use the same strike price but different expirations, and vertical spreads, which use the same expiration but different strikes.

The beauty lies in their adaptability. After the short option expires or is closed, traders can potentially sell another option against their long position, a process that can be repeated multiple times. This versatility allows you to customize risk/reward profiles, adjust to changing market conditions, and manage exposure to both price and volatility strategically.

Profit potential and risk/reward analysis

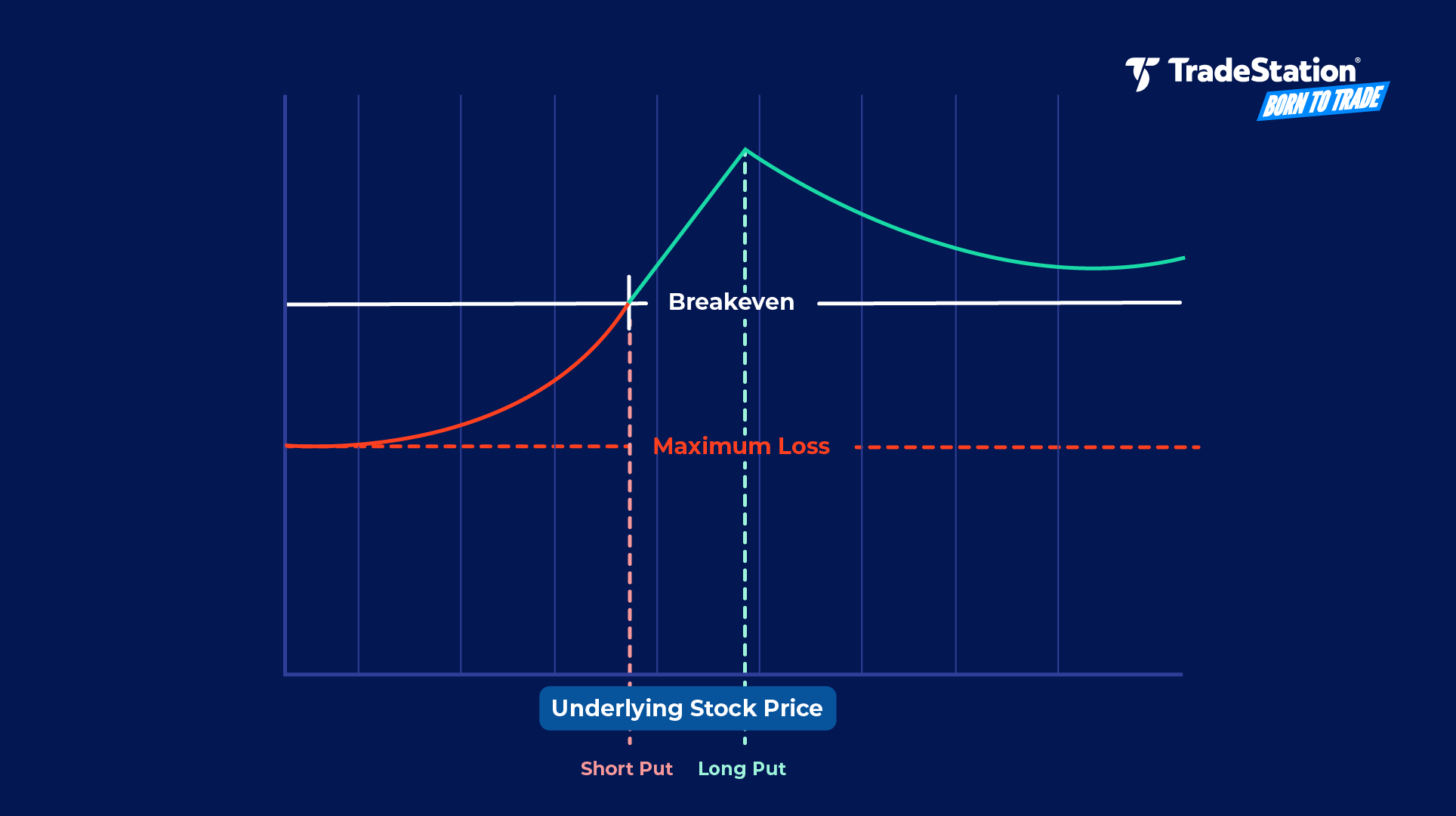

Diagonal spreads aim to generate profit through a combination of premium collection and favorable price movement. Unlike strategies with fixed profit and loss, diagonal spreads have variable risk profiles that depend on when you close the position.

For credit diagonal spreads, the initial credit collected represents potential profit if the short option expires worthless. Maximum profit for debit spreads occurs when the underlying moves favorably and the long option gains intrinsic value while the short option expires worthless or loses value quickly.

Maximum profit: Variable and dependent on timing of exit. For credit spreads, initial credit collected if short option expires worthless. For debit spreads, the gain from the long option’s appreciation minus the debit paid.

Maximum loss: For debit spreads, the premium paid is the maximum risk if both options expire worthless. For credit spreads, maximum loss is the width of the spread minus the credit received if both legs are closed at the short option’s expiration.

Assignment risk exists with diagonal spreads. If assigned on a short put, you must purchase shares at the strike price. Assignment on a short call requires delivering shares. Your long option provides protection and can be exercised to fulfill assignment obligations.

To help you prepare, the Simulated trading environment on TradeStation’s desktop platform provides an excellent space to practice diagonal spread management before committing real capital.

Managing and adjusting diagonal spreads

Rolling represents one of your most valuable adjustment techniques. When your short-term option approaches expiration, you can close it and open a new short option with a later expiration date. If the short option expires out-of-the-money, you can repeat this process, potentially multiple times, against your still-open long position.

The rolling process is straightforward in TradeStation’s OptionStation® Pro. You can close your short option, then sell a new option 30-45 days out against your long position. The ability to execute multi-leg orders as single transactions simplifies this process significantly.

Consider using TradeStation’s Activation Rule Tool to automate certain management decisions. You can set conditional orders that trigger if the underlying breaches specific price levels or if your position reaches predetermined profit or loss thresholds. This feature proves particularly valuable for diagonal spreads, which can move quickly as expiration approaches for the short leg.

Building a bull put diagonal spread

Constructing a diagonal spread starts with selecting optimal strikes and expirations. You’ll want to consider your market outlook, implied volatility, and liquidity. TradeStation’s RadarScreen® can help make this process straightforward.

Once you’ve identified a candidate, use the Matrix tool to analyze market depth and order flow. This helps you visualize bid/ask spreads and assess fill quality, reducing slippage and execution risk.

Let’s walk through a step-by-step example of constructing a diagonal call spread on our platform.

The ideal outcome has the $95 put expiring worthless, allowing you to keep the $60 premium. If you remain bullish, you could sell another 30-day put against your long $85 put, perhaps at the $95 or $90 strike, depending on where the stock trades. This rolling approach aims to collect enough premium over time to potentially create a profitable position.

If the stock drops below $95 as expiration approaches, you might close both legs early to minimize loss, or roll the short put to a later date or different strike. The Activation Rule Tool can automatically trigger protective actions if the stock breaches your predefined levels.

Trading diagonal spreads on TradeStation’s platform

Managing diagonal spread strategies effectively requires tools designed for options analysis, execution, and ongoing monitoring. TradeStation provides experienced traders with comprehensive tools and capabilities to help build, adjust, and track multi-leg positions.

OptionStation® Pro lets you construct diagonal spreads with interactive risk graphs, real-time Greeks monitoring, and probability analysis. The 2D and 3D graphs visualize how your position behaves across different underlying prices and time periods. When you’re ready to trade, multi-leg orders execute as single transactions. SpreadMaster, a feature built into OptionStation Pro, recognizes filled legs and automatically groups them for streamlined position management.

RadarScreen’s filtering helps you identify diagonal spread candidates by tracking delta, implied volatility, and technical setups across hundreds of symbols simultaneously.

The Matrix provides lightning-fast execution when opportunity strikes, while customizable workspaces let you organize your trading environment around your specific workflow, and the Activation Rule Tool automates conditional orders based on your predefined criteria.

For a deeper exploration of diagonal spread mechanics, strategy variations, and additional examples, visit the complete guide in our Options Education Center: Diagonal Spreads: A Versatile Options Strategy. The Options Education Center offers comprehensive resources covering every major options strategy, helping you build expertise at your own pace.

Trade with a broker that gets it

You were born to trade. TradeStation equips you with the advanced tools, real-time data, customizable workspaces, and institutional-grade execution you need to navigate sophisticated options strategies like diagonal options spreads. Whether you’re an active trader or an institution, you’ll find powerful analytics, unique capabilities, and flexible position management designed to support your growth and performance.

Remember, all investments carry risk, and options trading is only appropriate for those with the experience and risk tolerance to manage potential losses. Consider your objectives, practice in simulated environments, and make informed decisions as you develop your diagonal spread expertise.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.

Any examples or illustrations provided are hypothetical in nature and do not reflect results actually achieved and do not account for fees, expenses, or other important considerations. These types of examples are provided to illustrate mathematical principles and not meant to predict or project the performance of a specific investment or investment strategy. Accordingly, this information should not be relied upon when making an investment decision.

ID4998843 D1125 P18281701152