Tech Splits: Is the Megacap Trade Finally Over?

The technology sector could be splitting as investors focus on smaller chip stocks and abandon megacaps.

Call toll-free 800.328.1267

Nvidia reported earnings yesterday, but traders also focused on a new megacap leader in the AI race.

Alphabet (GOOGL) has been rallying on a series of positive headlines. Yesterday, it hit a new high as another catalyst arrived: the launch of its Gemini 3 AI model.

Gemini 3 has advanced reasoning that is more able to understand nuances and complex ideas. Multimodal functionality lets it understand and combine information from text, video, audio and still images. It also has more powerful software-writing (“vibe coding”) and customized views. Over time it will also include agents that can help manage calendars and email.

Users and analysts quickly praised Gemini 3, which helps GOOGL keep up with rivals like OpenAI. TechCrunch called it “an immediate contender for the most capable AI tool on the market.” Evercore ISI analyst Mark Mahaney said the company remains an “innovation engine” with products “that lead to additional monetization.” Loop upgraded GOOGL from Hold to Buy, raising its price target from $260 to $320.

Gemini 3 is also notable because it was trained and deployed on Google’s proprietary chips called Tensor Processing Units (TPUs). It’s a shift away from relying on Nvidia (NVDA) GPUs, letting the company optimize its own stack and reduce costs.

Alphabet (GOOGL), daily chart, with select patterns and indicators.

Even before Gemini 3, GOOGL was riding a wave of positive news.

The rally began on September 3 after a federal antitrust judge ruled the company doesn’t have to divest Chrome, the world’s most-widely used Internet browser. It was a major victory in an antitrust case brought by the Biden Administration that had dragged on GOOGL shares.

The stock immediately broke out to new highs and continued to advance until the next big event: earnings on October 29. While profit and revenue handily beat estimates, Wall Street was especially impressed by the strong growth in cloud computing. GOOGL uses that same division to upsell other services like AI.

Another big surprise came on November 17, when Berkshire Hathaway (BRK.B) reported a $4.9 billion stake in the company.

BRK.B is run by Warren Buffett, the most famous value investor. That highlights GOOGL’s relatively low valuation compared with other large tech stocks.

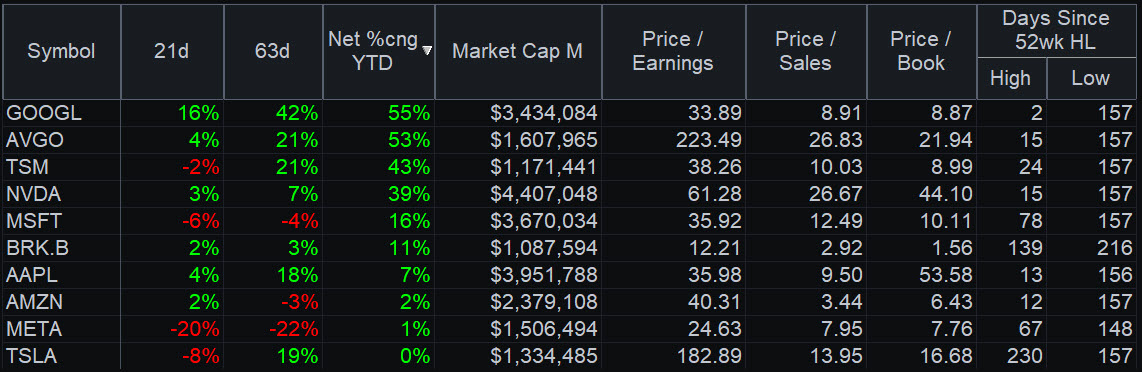

TradeStation data shows that GOOGL trades for 34 times earnings and less than 9 times sales. That is below the multiples of most other megacap growth stocks like NVDA, Tesla (TSLA), Microsoft (MSFT) and Apple (AAPL). (BRK.B has lower valuations but isn’t a growth stock.)

The screenshot below compares GOOGL with other companies sporting market caps of at least $1 trillion. GOOGL is the best-performing company on the list in the last month (21d), last three months (63d) and year-to-date. It’s also the only member of the group to hit a new high in the last two weeks. That highlights its relative strength as the broader Nasdaq-100 pauses.

GOOGL ended Wednesday’s session up 3 percent at $292.81.

RadarScreen® showing key metrics on U.S.-listed companies valued above $1 trillion.

Given how much the stock has risen, some traders may consider taking positions with options instead of shares. Our example will focus on calls, which fix the price where a security can be purchased.

Traders expecting further gains might consider calendar spreads. That involves buying long-dated contracts and selling shorter-dated options at the same strike. For example, investors could:

The net cost would be $8.91, however that could change over time because the 28-November 310 calls will expire worthless if GOOGL ends next week below $310. Traders could then sell another call expiring 1-2 weeks later, capturing the quick time decay that occurs near the end of an option’s life.

Traders might also consider selling put credit spreads or using covered calls to earn credit.

In conclusion, GOOGL has come to life in recent weeks as Wall Street focuses on several new positive catalysts. While the stock has moved significantly, traders may see opportunities to participate by focusing on key levels and managing risk with options.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.