Traders don’t know what to think before the biggest and most important stock reports earnings this afternoon.

Last month, Nvidia (NVDA) became the first and only company to reach a $5 trillion market capitalization. It’s pulled back from that high and is trying to hold a price zone around $180-185 where it peaked during the summer. Chart watchers may view this as a key line in the sand that could make the difference between a continuation of the AI-fueled bull market and a year-end reversal.

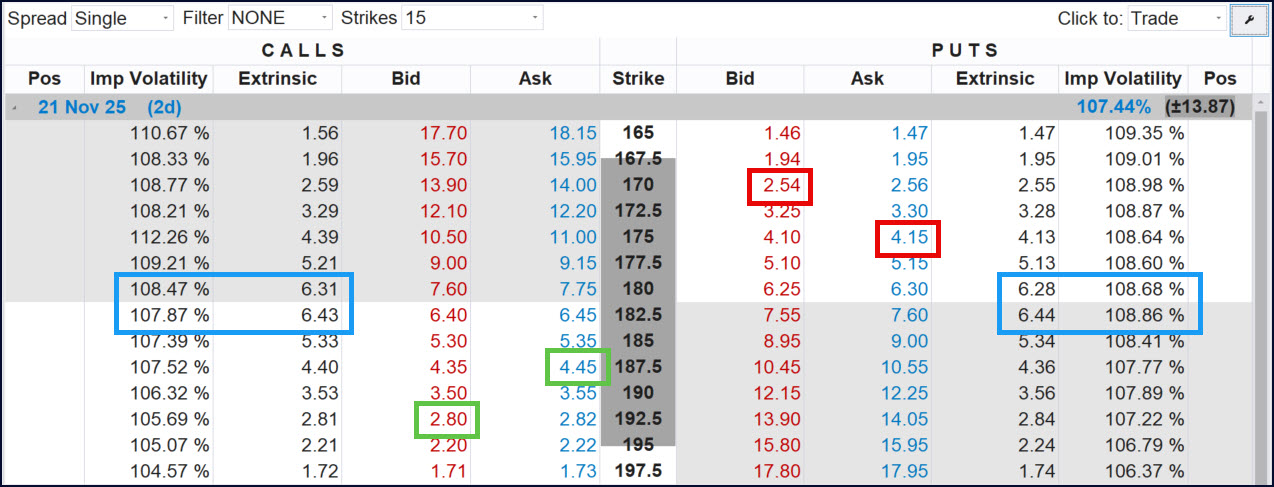

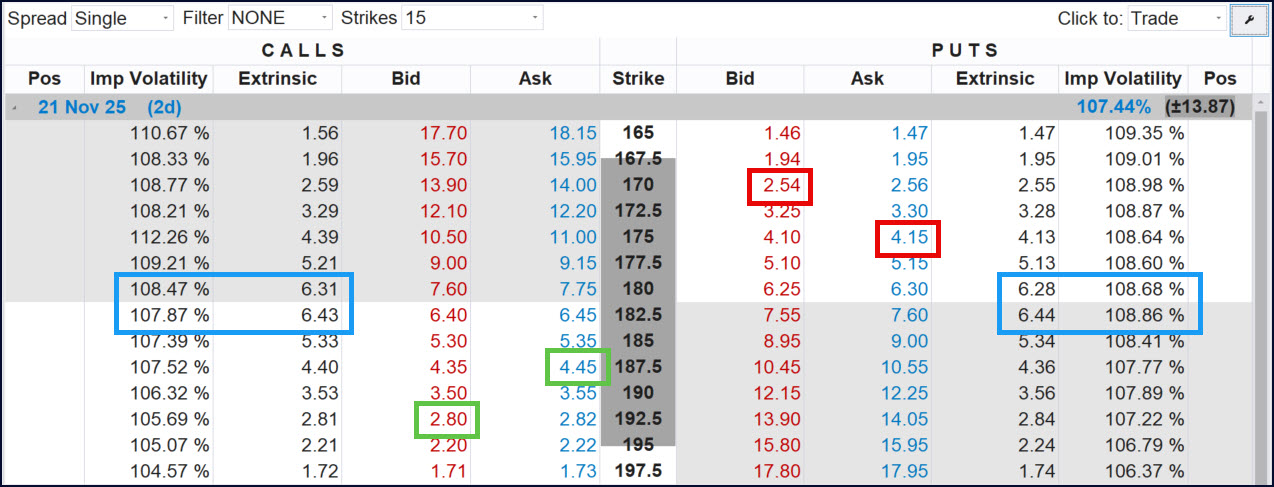

Options pricing painted a bullish picture until yesterday. TradeStation’s OptionStation Pro, for example, showed that near-the-money calls had more extrinsic value than puts and higher implied volatility. That suggests strong demand from call buyers lifted premiums relative to downside puts.

The put/call ratio provided another indication that the market was leaning in a bullish direction. Notice how open interest in puts has been falling relative to calls. That reflects more activity in upside contracts as the big earnings date approaches.

However the picture turned more ambiguous on Tuesday, with similar pricing on near-the-money calls and puts. (See the screenshot of OptionStation Pro below.)

NVDA ended the session down 2.8 percent to $181.36 and has lost 4 percent of its value so far this week.

Calls fix the price where investors can purchase a security. They tend to gain value when shares appreciate. Puts are the opposite, gaining value to the downside because they set the price where a stock can be sold.

Options for Earnings

NVDA is the busiest options underlier in the S&P 500, averaging more than 3 million contracts per day, according to TradeStation data. Traders often use calls and puts around key events like earnings, which can produce sudden moves from one session to the next. Holding shares through such events can result in significant risk, while options can help manage the volatility.

Vertical spreads are one of the most common strategies. If a trader expects NVDA to rally after the news, he or she might:

- Buy a 21-November 187.50 call for $4.45

- Sell a 21-November 192.50 call for $2.80

The position would cost $1.65 to enter. It could inflate to $5 if NVDA closes at $192.50 or higher on expiration this Friday. That’s a potential profit of 203 percent from the stock climbing 6.1 percent. (The trade will be worthless if the shares remain below $190, and its breakeven is at $191.50.)

Bearish traders looking for a move the other way could do just the opposite with puts:

- Buy a 21-November 175 put for $4.15

- Sell a 21-November 170 put for $2.54

That position would cost about $1.61. It could inflate to $5 if NVDA closes at $170 or lower on expiration. That’s a potential profit of about 222 percent from the stock declining 6.3 percent.

OptionStation Pro with blue boxes showing extrinsic values and implied volatility. Calls marked in green and puts marked in red.

Other investors could be sitting on longer-term gains after the chipmaker’s 260 percent rally in the last two years. They might opt for selling covered calls against shares. See this article for more on how that strategy can be customized for a wide range of conditions.

$500 Billion Question

“This is how much business is on the books: half a trillion dollars worth so far,” NVDA founder and CEO Jensen Huang said at a prominent speech on October 28. The shares — and the broader market — peaked a record high the following day and have been sliding since.

Wall Street remains focused on the $500 billion number cited by Huang. Stifel said yesterday it would represent more spending than customers have indicated, hiking its target price from $212 to $250. Much of that backlog reflects demand for NVDA’s new Blackwell systems and its broader AI platform, including networking and CUDA software.

Wells Fargo and KeyBanc issued similar notes on November 14. Both firms cited robust capex across the technology space.

Wedbush analyst Dan Ives wrote on Monday that investors should “expect good news” because channel checks with Asian suppliers confirm strong demand.

The results are due approximately 20 minutes after the closing bell, with a conference call at 5 p.m. ET. Wall Street analysts expect earnings of $1.25 per share on revenue of $55.03 billion, according to Yahoo Finance. The following quarter is currently estimated at $1.43 and $61.77 billion.

Overspending?

That aggressive spending has been a positive for NVDA, along with several other providers of data-center hardware. Data-storage company Western Digital (WDC) is the top-performing member of the S&P 500 this year. Similar companies like Seagate Technology (STX) and Micron Technology (MU) have also doubled, according to TradeStation data.

However users of the technology have struggled as costs mount and Wall Street adds up the bill. Morgan Stanley downgraded computer makers Dell Technologies (DELL), HP (HPQ) and Hewlett Packard Enterprise (HPE) on Monday because of higher memory prices squeezing margins.

Oracle (ORCL), which announced jaw-dropping demand for its cloud computing on September 9, has moved steadily lower as investors consider how that spending will impact its financial health.

Rothschild also downgraded Amazon.com (AMZN) and Microsoft (MSFT) yesterday, noting that the cost of AI equipment may hurt returns.

There have been other potential warning signs:

- SoftBank, the prominent Japanese tech investment firm, recently disclosed selling its entire $5.8 billion NVDA stake.

- Peter Thiel, the billionaire hedge-fund manager famous for his early bets on PayPal (PYPL) and Meta Platforms (META), exited a $100 million position in the chip giant.

- Gene Munster of DeepWater Asset Management cited a potential “Catch-22” scenario: Strong guidance from NVDA could spur more worries that companies are overspending, potentially hurting the broader tech space. Moderate guidance could also be viewed negatively as a sign of weaker growth.

Nvidia (NVDA), daily chart, with select patterns and indicators.

Charting Nvidia

NVDA is important because of its sheer size and position in the market-leading AI space. Even after its recent pullback, the market cap of Huang’s company exceeds runner-up Apple (AAPL) by $590 billion. That’s equivalent to the entire value of Visa (V).

Chart watchers could also have differing views of the price action.

Bullish traders may notice that NVDA has made steadily higher lows since April. They may also look for prices to hold lows from mid-October, which is near peaks two months prior.

But what if the old highs don’t hold and become new support? Bears might see risk of NVDA’s uptrend ending if the shares re-enter their longer-term range. They might also worry about the stock breaking its 50-day moving average as other short-term trend signals turn negative:

- The moving average convergence/divergence (MACD) oscillator is falling.

- The 8-day exponential moving average (EMA) recently crossed below the 21-day EMA.

Finally, traders may remember that the all-time high on October 29 also marked peaks for the S&P 500, Nasdaq-100 and Philadelphia Semiconductor Index. If it’s a bellwether for the broader market, this afternoon’s results could matter for a lot more than just NVDA.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.