TITAN X Has Arrived. Matrix Will Never Be the Same

The next generation of our award-winning platform has arrived, with powerful new tools and functionality.

Call toll-free 800.328.1267

Navigating neutral markets can be a challenge even for those born to trade. Many active traders and institutions seek out consistent performance while carefully managing risk. The iron condor is a commonly used strategy among experienced traders who wish to navigate neutral markets and tightly manage risk. When paired with appropriate tools, this multi-leg options approach may offer a balanced method designed to profit from range-bound price action.

By combining credit spreads and leveraging time decay, the iron condor strategy can offer a potential way to collect premium while defining risk parameters. Many advanced traders and institutions use iron condors to build steady performance, and with TradeStation’s suite of tools, such as RadarScreen®, Matrix, Scanner, and OptionStation® Pro, you can analyze, execute, and manage these strategies confidently.

How the iron condor strategy works

An iron condor consists of four option contracts with the same expiration date:

The four legs:

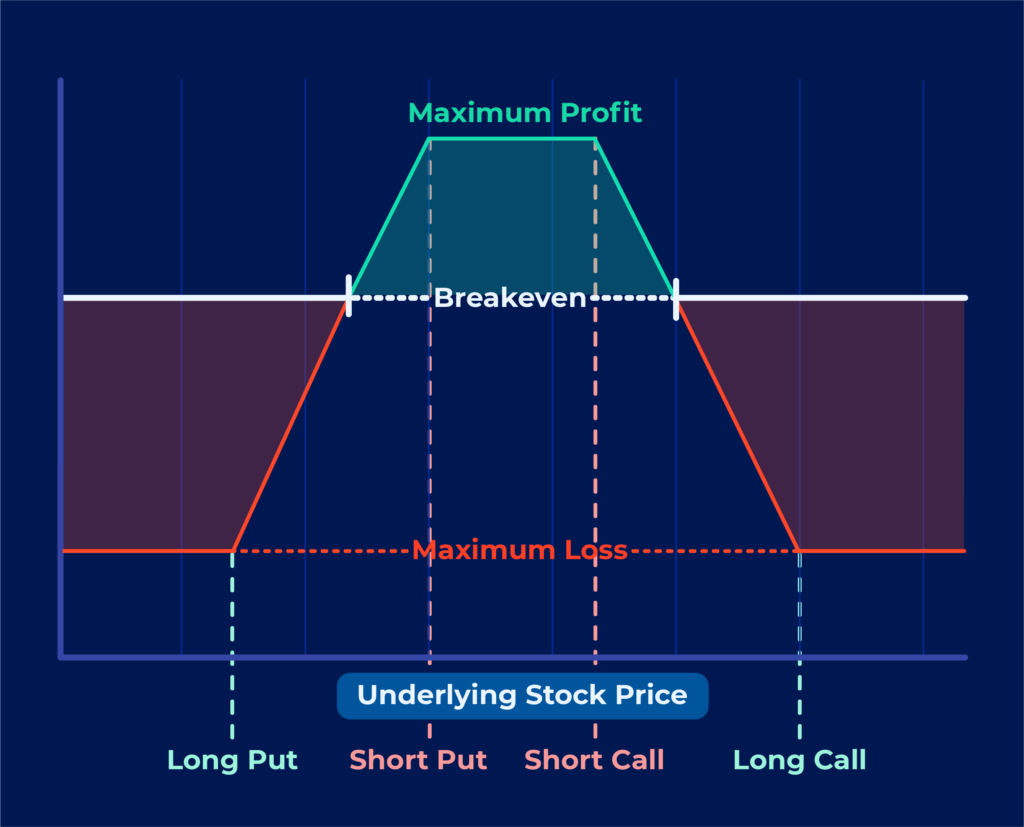

The short put strike is typically placed below the current price where the trader believes the underlying won’t reach before expiration. The short call strike is set above the highest price the underlying is expected to reach. The long options, purchased for protection, limit the maximum potential loss on either side.

Understanding the mechanics of iron condors

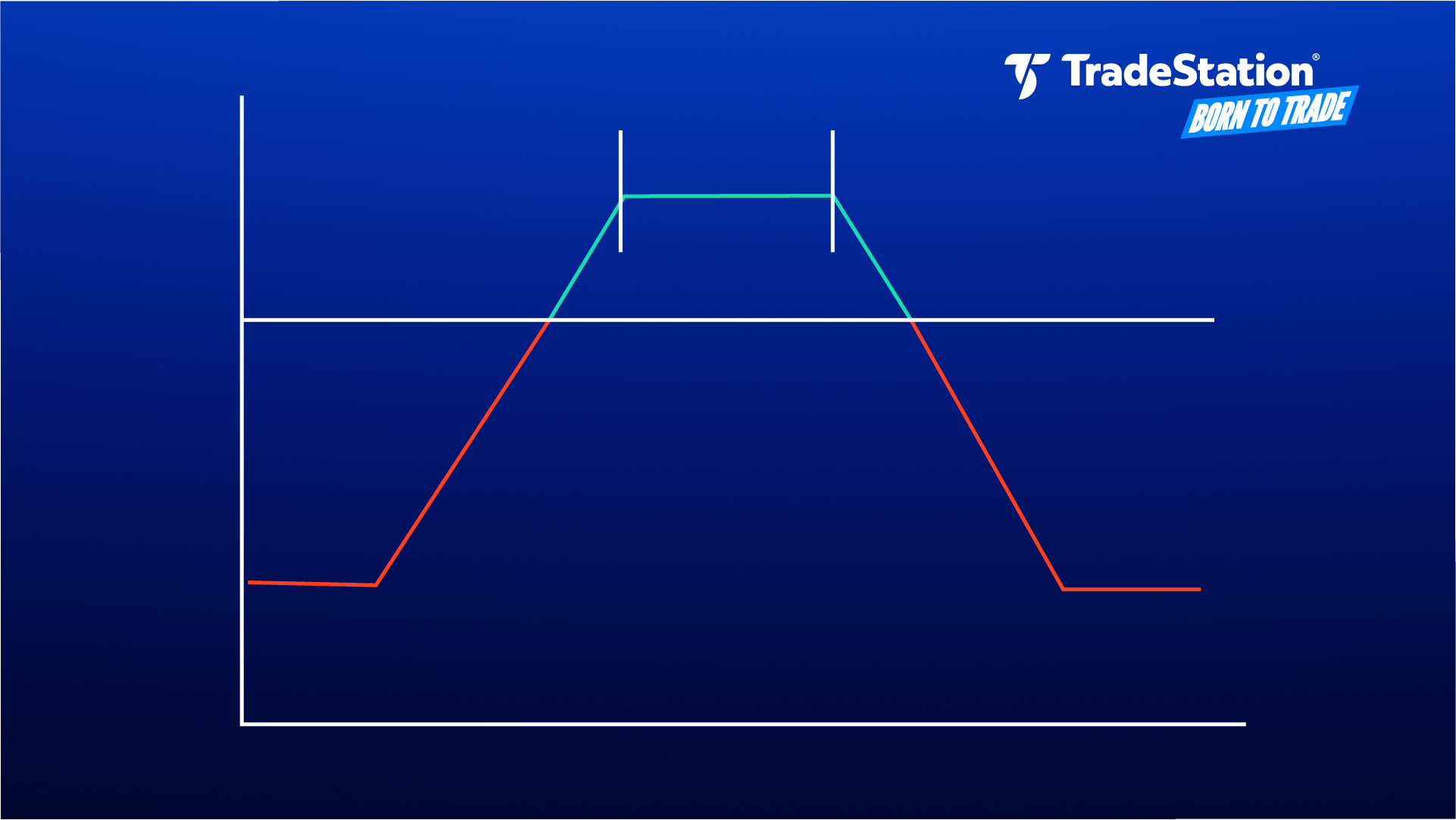

The iron condor is a four-leg options setup that merges two spreads (a ) to create a neutral options strategy positioned to benefit when the underlying asset trades within a specific price range.

The structure of the iron condor involves selling one OTM put and one OTM call, while simultaneously buying a further OTM put and call to define risk. The beauty of this options strategy lies in its potential to generate income from premium collection, with the goal of all options expiring worthless. Iron condors are particularly appealing to experienced options traders because they offer a high probability of profit when structured correctly, with clearly defined risk parameters. The options setup aims to capitalize on time decay and volatility contraction, making it well-suited for neutral market conditions where minimal price movement is expected.

Profit potential and risk/reward analysis for iron condors

The iron condor strategy generates profit from the net premium collected when establishing the spread. Maximum profit is realized when the options expire with the underlying price between the two short strikes. Ideally, all four options expire worthless, and the trader keeps the entire premium collected. The strategy may also profit before expiration if the position’s value decreases due to time decay or declining volatility, allowing traders to close the position at a lower cost.

Selling options exposes traders to assignment risk. If assigned on the short put, the trader must purchase shares at the strike price. Assignment on the short call requires delivering shares at the strike price. To fulfill assignment obligations, traders can exercise their long option at its strike price, with the loss limited to the difference between strikes minus the initial premium collected.

Maximum profit: The maximum potential profit equals the net premium collected when establishing the position. This profit may be realized if all options expire worthless.

Maximum loss: Maximum loss is defined and occurs if the underlying price moves beyond one of the long strike prices. The loss equals the difference between the short and long strikes on either side, minus the premium collected.

Breakeven points: There are two breakeven prices:

So long as the underlying closes between these two breakeven points at expiration, the position may produce some profit. By defining maximum risk and reward, iron condors help you benefit from range-bound markets while maintaining control over potential losses. TradeStation’s integrated margin calculators and risk alerts make it easy for you to stay informed and compliant every step of the way.

Iron condor vs iron butterfly: key differences

When comparing the iron condor strategy to the iron butterfly, traders often look most closely at the risk profiles and potential performance. While both strategies seek to profit from neutral markets and volatility decay, there are key structural differences that traders should understand.

The primary distinction lies in strike selection. An iron condor uses four different strikes—the short put and short call are placed at different OTM strikes, creating a wider profit zone. An iron butterfly, by contrast, uses the same at-the-money (ATM) strike for both short options, with long options purchased further out to define risk.

Iron condors offer a wider range for profitability than iron butterflies do. The underlying can move anywhere between the two short strikes and still produce profit. This makes iron condors more forgiving when market forecasts aren’t perfectly accurate.

Iron butterflies require more precision. Maximum profit is only achieved if the underlying closes exactly at the short strike at expiration. However, this tighter structure typically allows for higher premium collection relative to the capital at risk.

The tools you use can make understanding which is right for you a simple process. TradeStation’s OptionStation Pro tool lets you simulate both strategies, compare payoff diagrams, and test scenarios using historical data. RadarScreen and the Scanner can help you identify which strategy fits current market conditions, while the Matrix can help execute multi-leg orders efficiently.

Executing the iron condor strategy effectively

Successfully implementing iron condors requires thoughtful strike selection and position management. Range-bound stocks with stable price action and sufficient liquidity are ideal candidates. The RadarScreen and Scanner tools can help you identify these opportunities by monitoring implied volatility, historical price ranges, and liquidity metrics in real time.

Market conditions, volatility considerations and time frames:

The iron condor strategy performs well in neutral or sideways markets where the underlying is expected to trade within a defined range. Stocks or indexes consolidating after a significant move, or trading in established channels, often present suitable opportunities. Traders typically avoid iron condors when expecting significant directional moves, during periods of extreme volatility expansion, or ahead of major news events that could cause large price swings.

Iron condors benefit from opening positions when implied volatility is elevated and expected to decline. Higher implied volatility inflates option premiums, allowing traders to collect more credit. As volatility contracts toward expiration, the position’s value may decrease, creating opportunities to close profitably before expiration.

For time frames, traders who use iron condors typically target expirations ranging from 30 to 45 days to balance premium collection with time decay acceleration. Shorter-term options decay faster but offer less premium and are more sensitive to price changes. Longer expirations collect higher premiums but experience slower decay and increase assignment risk exposure.

Many traders close iron condors before expiration to avoid assignment risk, particularly if significant profit has been captured. A common approach is to close when the position has captured 50-75% of maximum profit. Stop losses may also be employed to limit losses if the underlying moves against the position.

Trading iron condors on TradeStation’s advanced platform

OptionStation Pro lets you construct iron condors with interactive risk graphs, probability analysis, and real-time Greeks monitoring. Simulate adjustments, roll-outs, and stress-test positions under various market conditions.

Identify trading candidates with RadarScreen by tracking implied volatility and price action across hundreds of symbols simultaneously, while the Scanner lets you filter for liquidity and volatility criteria specific to neutral strategies. Generate watchlists of candidates that meet your strategy requirements and feed them directly into RadarScreen and Matrix for further analysis.

Matrix lets you assess market depth and order flow across options chains for efficient multi-leg order execution. Visualize bid/ask spreads and liquidity at different strikes, with the goal of reducing slippage and improving fill quality.

Trade with a broker that gets it

You were born to trade. TradeStation equips you with the advanced tools, multi-platform access, advanced charting capabilities, and institutional-grade brokerage execution to help you navigate complex options strategies like the iron condor and iron butterfly. Whether you’re an active trader or an institution, you’ll find powerful analytics, simulated trading environments, and strategy templates designed to support your growth and performance.

Remember, all investments carry risk, and options trading is only appropriate for those with the experience and risk tolerance to manage potential losses. Consider your objectives, practice in simulated environments, and make informed decisions as you navigate your trading journey.

Want to discover more advanced options strategies?

Visit our Options Education Center to find a wealth of resources for comprehensive options strategy learning, including in-depth guides, quick reference guides, and workspace setup instructions.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.

Any examples or illustrations provided are hypothetical in nature and do not reflect results actually achieved and do not account for fees, expenses, or other important considerations. These types of examples are provided to illustrate mathematical principles and not meant to predict or project the performance of a specific investment or investment strategy. Accordingly, this information should not be relied upon when making an investment decision.

ID4927638 P18130270751 D112025