Can Semiconductor Stocks Withstand an Oil Shock?

Semiconductors have led stocks higher since the AI rally began, but they may face new risks as oil prices jump.

Call toll-free 800.328.1267

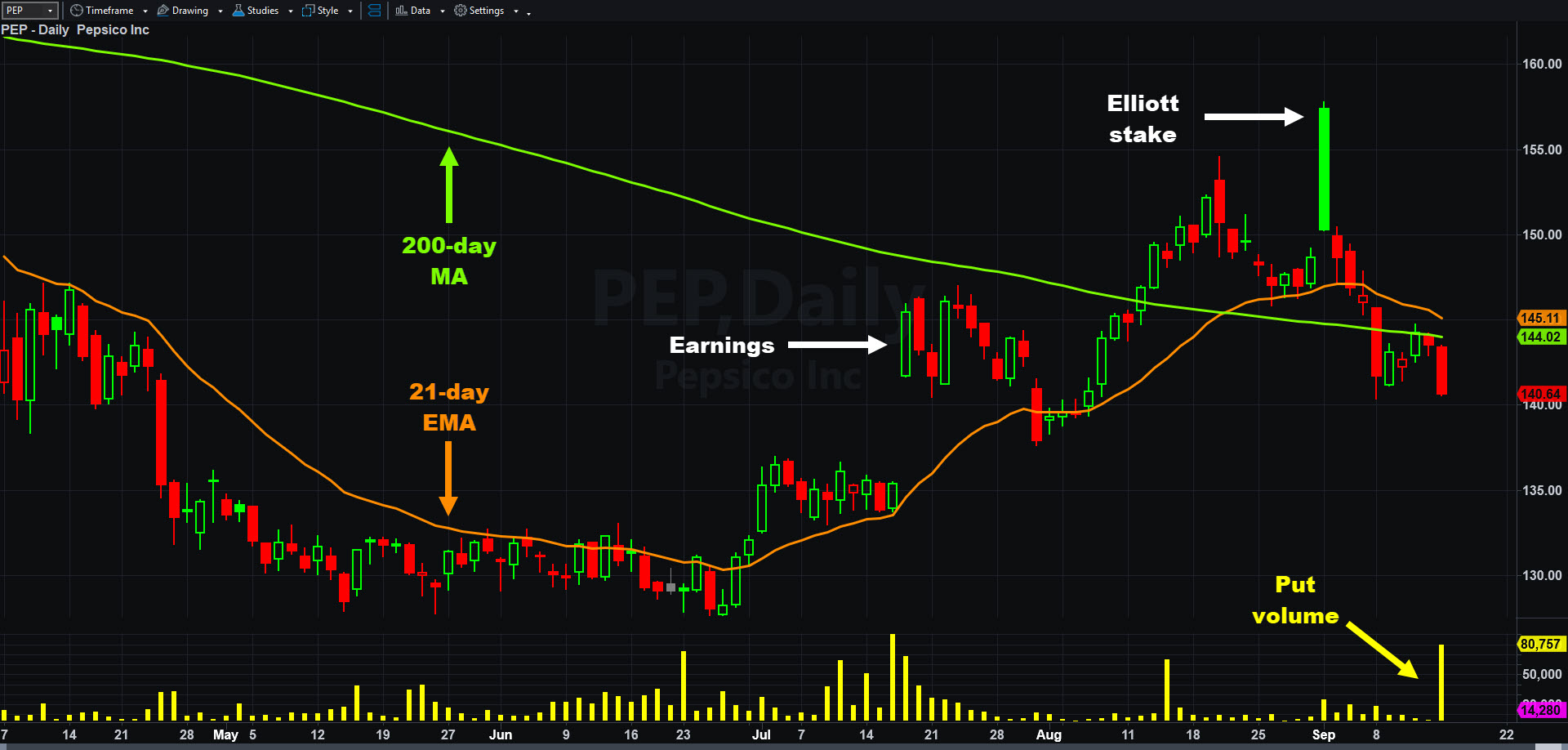

PepsiCo began September with a failed rally, and a big options trade yesterday seemed to target further downside.

This large transaction was detected yesterday afternoon in the soda and snacks company:

Puts gain value when prices fall because they fix the level where a security can be sold. Monday’s trader apparently entered the session with a profitable position in the October 140 puts. He or she unloaded those contracts and purchased the January 135s.

The adjustment cost roughly $7.5 million and gives them an additional three months of downside exposure. The new position will perform similarly to the old one because they both have a delta of roughly -1.2 million. However, there’s potentially more leverage now in the event of a big drop because the number of contracts increased.

PepsiCo (PEP), daily chart, with select patterns and indicators.

PEP ended the session down 2 percent at $140.64, its lowest closing price in over two months. The parent of brands like Mountain Dew and Rold Gold hit a five-year low in June before rebounding on strong quarterly results. It jumped further on September 2 after activist firm Elliott Investment Management took a $4 billion stake and pushed a turnaround plan.

Sellers hammered the stock that day and have remained active since. They drove PEP below its 200-day moving average last week — despite the broader market climbing to new record highs. Larger rival Coca-Cola (KO) has also struggled.

Overall option volume in PEP was about the daily average in the last month, according to TradeStation data. Puts accounted for a bearish 86 percent of the total.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.