Tech Splits: Is the Megacap Trade Finally Over?

The technology sector could be splitting as investors focus on smaller chip stocks and abandon megacaps.

Call toll-free 800.328.1267

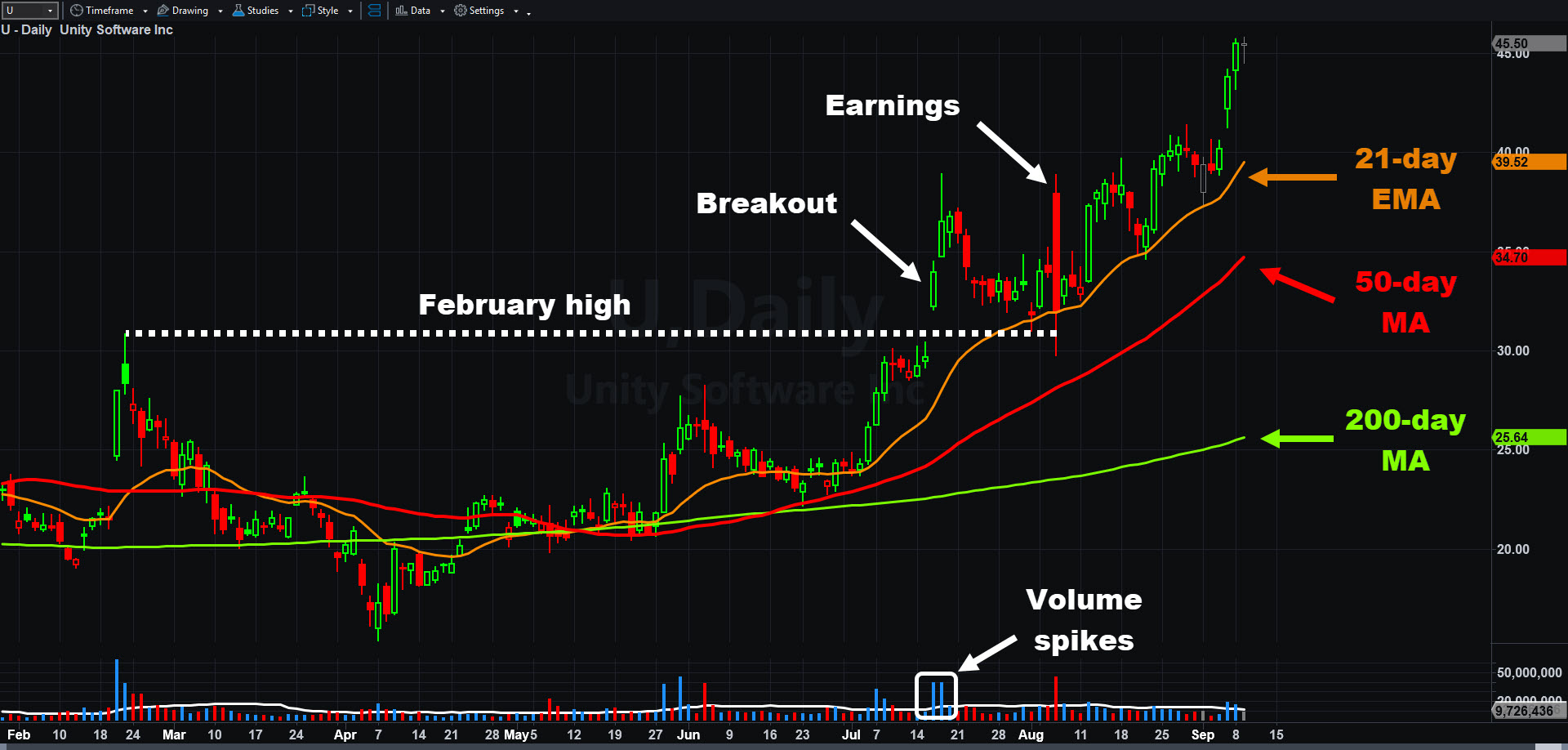

Unity Software has been coming to life as traders focus on its new AI powers in the world of mobile gaming.

The stock is up 84 percent in the last three months. That outpaces the gain of every company in the S&P 500 and Nasdaq-100 in the same period, according to TradeStation data.

U started in 2004 to let developers build video games once and then deploy on multiple platforms. It took off with the rise of smartphones a few years later and remained a niche programming tool until launching an advertising platform in 2014. Unity Ads let programmers integrate pop-ups and rewards into games created with its software. In addition to monetization, the company soon offered analytics, acquisition tools and promotional features.

The new growth positioned U to go public in September 2020 — the thick of the pandemic. Its shares were pitched at $44-48, but they priced at $52 thanks to strong demand. It more than tripled by December and peaked above $200 in November 2021. Then the Federal Reserve started raising interest rates and high-multiple growth stocks deflated. The stock was down about 90 percent by late 2022 and remained under pressure until some big research calls two months ago.

The first move came from Jefferies on July 16 when analyst Brent Thill raised his price target to $35 because of market-share gains.

The next day, Morgan Stanley declared that U has “a fundamentally more competitive ad product.” The team of analysts led by Matthew Cost estimated Unity Ads helped increase game installations and purchases by 15-20 percent. The analysts cited potential for an inflection point as the software started using a new model and data. “We expect that U’s ad customers will continue to move quickly to increase their ad budgets, as long as U’s technology continues delivering stronger results.”

Morgan Stanley also noted skepticism toward the stock could prompt traders to chase it to $40 — above their $25 target price. Even that was an underestimate because U closed yesterday unchanged at $45.50.

In addition to the newly released product, some analysts see longer-term opportunities in augmented reality. The company also has exposure to growth in overseas markets like Asia.

U was stuck below $30 in early July, but the analyst notes triggered a high-volume breakout through that level. Some 40 million shares changed hands both sessions, more than double the average daily turnover in the previous month.

Earnings and revenue beat estimates on August 6. CEO Matt Bromberg said, “enhanced delivery of customer value came together to spark demonstrable sustainable growth.” In particular he cited the new Unity Vector AI-powered platform, which helps select and time ad placement.

Unity Software (U), daily chart, with select patterns and indicators.

U tried to rally on the news but it remained trapped below its highs from July. Prices returned to their current range and continued to consolidate near the rising 21-day exponential moving average. Buyers returned on August 12, pushing the stock to its highest closing price in over a year. It pulled back and made a higher low two weeks later, followed by another higher low after Labor Day.

That kind of price action is often considered evidence of an uptrend, with demand outstripping supply and boosting prices.

The rally has also increased options activity as active traders react to movement in the shares. (TradeStation data shows U averaging 137,000 contracts per session, up from 54,000 in early July.)

Options traders may see potential for various strategies.

Say, for example, U pulls back to its August 28 high around $41. Traders may expect the old resistance to become new support and consider selling put credit spreads. They could also consider a trade like this:

The transaction would generate a credit of $0.37. It would also program a buy order at $42, letting them be assigned shares at that price if U is between $40 and $42 on expiration.

Calendar spreads are another potential strategy for upward-trending stocks. That would entail buying long-dated out-of-the money calls and selling shorter-dated calls at the same strike price. The shorter-dated calls would have faster time decay and expire sooner. The trader could then adjust the strategy by selling another call at a later expiration.

A third alternative is more straightforwardly bullish: the vertical spread. Traders could wait for a potential level like the August high around $41 or the 21-day EMA, and buy calls near the money and sell another further from the money. (The same expiration on both.) That would leverage a potential rebound following the pullback — a classic swing trade.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.