Tech Splits: Is the Megacap Trade Finally Over?

The technology sector could be splitting as investors focus on smaller chip stocks and abandon megacaps.

Call toll-free 800.328.1267

Volatility is returning to the stock market as tariff fears return. There are also new worries about the U.S. economy.

The S&P 500 slid 2.4 percent between Friday, July 25, and Friday, August 1. It was the biggest weekly drop since mid-May, with almost 80 percent of the index’s members losing value.

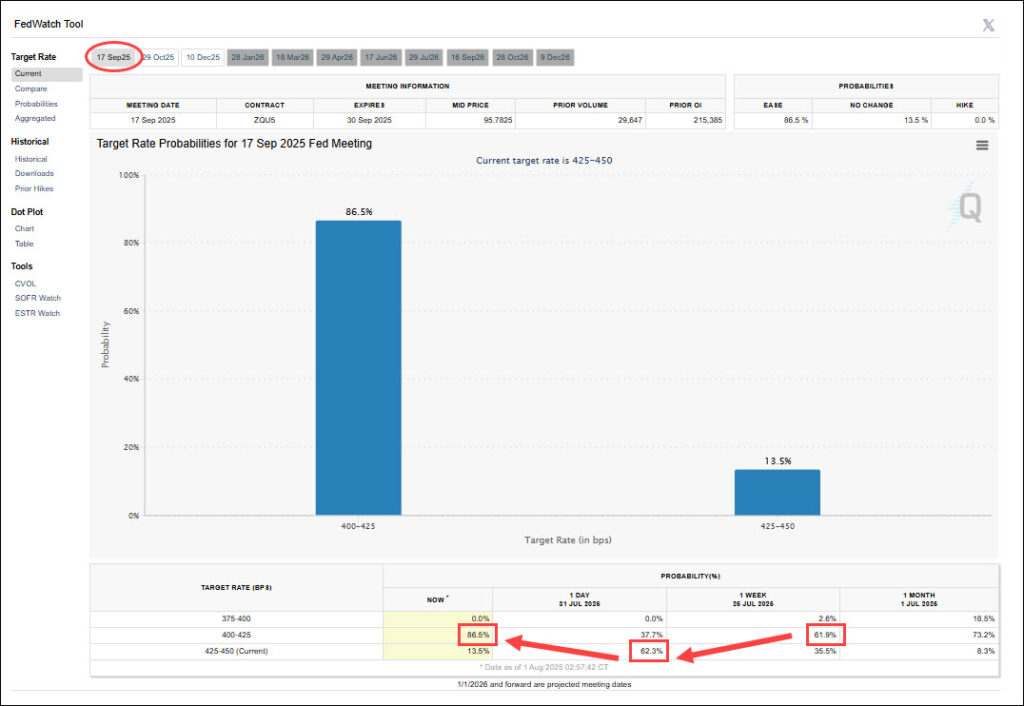

The first big event was the Federal Reserve’s meeting on Wednesday. Policymakers shunned political pressure to cut interest rates, emphasizing its commitment to lower inflation. The market quickly priced out the odds of a dovish move in September. (See the image of CME’s FedWatch tool below.)

But then on Friday morning, the Labor Department issued sharp downward revisions to recent payroll reports. Job growth in May and June was lowered by 258,000, the biggest markdown since the pandemic. Despite the change, unemployment inched up by just 0.1 percentage point and wages rose more than expected.

CME’s FedWatch tool showing probabilities of a September rate cut. Notice the sharp changes over the course of last week.

While economists attributed the downward revisions to foreign-born workers leaving the labor force, the news had a chilling impact on sentiment. Treasury yields plunged as the market quickly pivoted back to a rate cut in September. Volatility also spiked and economically sensitive sectors fell sharply. President Trump responded by firing the commissioner of labor statistics — a highly unusual and attention-grabbing move.

Next, the White House imposed tariffs on countries like Switzerland, Canada and Brazil. Trump is additionally threatening 100 percent sanctions on countries that buy Russian oil (like China and India). While the administration has frequently changed course on foreign trade, the moves reignited worries about tariffs. Will some of the dramatic gains since April be reversed?

Speaking of trade, the duties are hurting profits. Ford Motor (F), Stanley Black & Decker (SWK) and Procter & Gamble (PG) said tariffs will squeeze earnings. United Parcel Service (UPS) hit a five-year low on weaker volumes from China. Whirlpool (WHR) struggled with foreign competitors front-running planned tariffs on South Korea.

Utilities were the only positive sector last week. They benefited from optimism about AI datacenters increasing electricity demand. They are also viewed as potential safe havens with less risk in the event of a recession. Gold — another safety play — bounced.

| Align Technology (ALGN) | -34% |

| Eastman Chemical (EMN) | -25% |

| Baxter (BAX) | -25% |

| Coinbase Global (COIN) | -20% |

| Moderna (MRNA) | -19% |

| Source: TradeStation data |

Meanwhile, stocks that benefit from confidence and risk appetite fell. Materials led the selling, along with consumer discretionaries, financials and industrials. Global stocks also had their biggest weekly drop since Trump’s “Liberation Day” tariffs in early April. The same was true for transportation stocks, industrials, financials, materials and consumer discretionares: all cyclical groups.

Even with economic worries rising, health care stocks crumbled. They’re the worst-performing sector in the last year because of deteriorating fundamentals.

Dental company Align Technologies (ALGN) and blood supplier Baxter (BAX) both had their biggest drops in over two decades after announcing weak quarterly results. Vaccine company Moderna (MRNA) also trimmed the high end of its forward guidance.

Eastman Chemical (EMN) had its biggest weekly drop ever after cutting guidance. U.S. tariffs played a role by hurting Chinese demand for chemicals used in synthetic fabrics like polyester.

All told, 36 members of the S&P 500 experienced double-digit drops last week. Just six rose at least 10 percent.

It was also the busiest week of earnings season. Microsoft (MSFT) and Meta Platforms (META) shot to new all-time highs after AI pushed their results far above estimates. MSFT benefited from strong demand for Azure cloud computing. META used computer models to boost engagement and advertising revenue. Both companies raised capital-spending plans.

| Generac (GNRC) | +23% |

| Teradyne (TER) | +16% |

| EBay (EBAY) | +13% |

| Corning (GLW) | +12% |

| Western Digital (WDC) | +11% |

| Source: TradeStation data |

Apple (AAPL) tried to rally after profit and sales beat estimates, but got swept lower in Friday’s selloff. Amazon.com (AMZN) traded similarly after announcing strong results and guidance.

Other economic news was mixed last week. Gross domestic product surprised to the upside as trade distortions faded, but consumption was weak. Employment costs and personal consumption expenditure (PCE) inflation readings were higher than expected. Initial jobless claims were lower than estimated.

Manufacturing data from the Institute for Supply Management, on the other hand, fell more than anticipated to its lowest reading since January.

The S&P 500 has been in a steady uptrend, but last week had several potentially bearish patterns.

First, Wednesday and Friday saw higher highs and lower lows than preceding sessions. Such “outside candles” can signal potential reversals. A bearish outside candle also appeared on the weekly chart.

Second, the index closed below its open each day. Those solid candlesticks can indicate investors are selling into strength. A bearishad an oalso an outside candle on the weekly time frame.

Third, the S&P 500 closed below its 21-day exponential moving average for the first time since late April. Similar drops below the EMA (like last February or July 2024) have been followed by more downside.

Next, the number of index members making new 52-week lows is increasing as new highs become less common. The advance/decline line is also falling. Those signals may reflect weakening breadth. (See chart below.)

Traders expecting further weakness may look for potential support around 6,201, a weekly low from July 7 and 16.

SPDR S&P 500 ETF (SPY), daily chart, with select patterns and indicators.

This week has another steady flow of earnings, with about one-quarter of the S&P 500 announcing results. (However, fewer large growth companies report.) Geopolitical news could also be a catalyst because of Trump’s Friday deadline for Russian to stop fighting Ukraine.

Palantir (PLTR) is the most actively traded company reporting numbers this afternoon.

Caterpillar (CAT) is slated for tomorrow morning, along with ISM’s service-sector index. Advanced Micro Devices (AMD) and Super Micro Computer (SMCI) are the big names after the closing bell.

Wednesday features earnings from Walt Disney (DIS), McDonald’s (MCD), DoorDash (DASH) and Airbnb (ABNB). Crude-oil inventories are also due.

Initial jobless claims and unit labor costs are on Thursday morning. Eli Lilly (LLY), Constellation Energy (CEG) and Vistra (VST) report earnings.

Under Armour (UAA) issues results on Friday morning.

| ETF | 1 Year | 5 Years | 10 Years |

| SPDR S&P 500 (SPY) | +14.75% | +93.58% | +200.28% |

| As of August 1, 2025. Based on TradeStation data | |||

Exchange Traded Funds (“ETFs”) are subject to management fees and other expenses. Before making investment decisions, investors should carefully read information found in the prospectus or summary prospectus, if available, including investment objectives, risks, charges, and expenses. Click here to find the prospectus.

Performance data shown reflects past performance and is no guarantee of future performance. The information provided is not meant to predict or project the performance of a specific investment or investment strategy and current performance may be lower or higher than the performance data shown. Accordingly, this information should not be relied upon when making an investment decision