Top 5 Highest Performing Stocks, 2002 ‐ 2022

Have you ever seen a stock turn a small investment (like $1,000) into hundreds of thousands? Or even… millions?

Well, get ready. We used TradeStation’s Scanner tool to find some of the highest performers over the past 20 years, and some may surprise you. All numbers are as of March 31, 2022, and reflect stock performance between March 2002 – March 2022.

Keep in mind that it’s very hard to predict which stocks might have this kind of performance. This is not a recommendation and past performance is no guarantee of future performance.

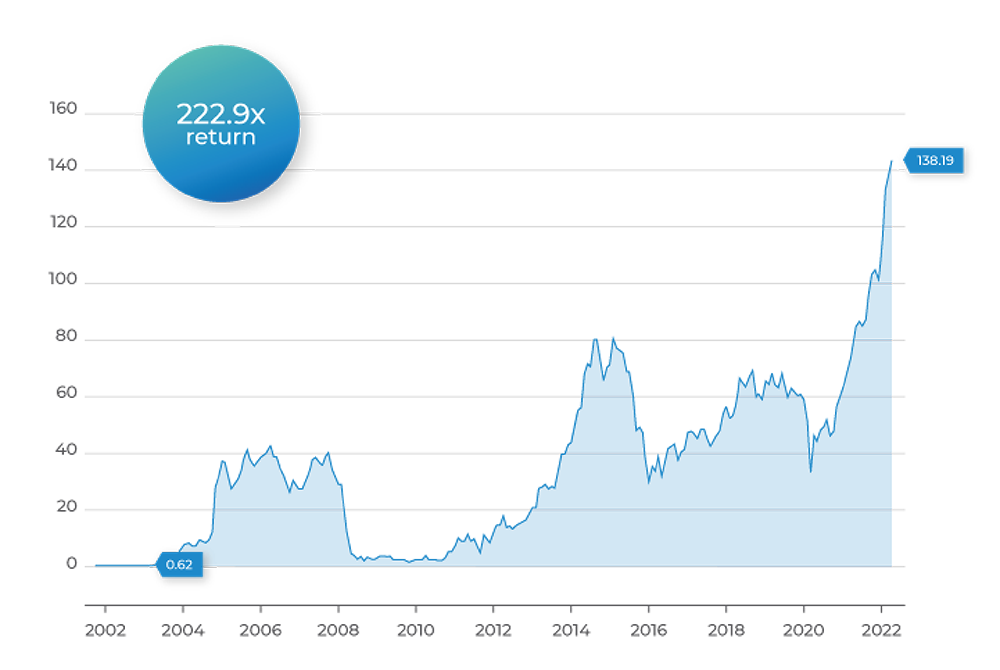

Cheniere Energy, Inc ($LNG)

(Historical Stock Chart, March 2002 – March 2022)

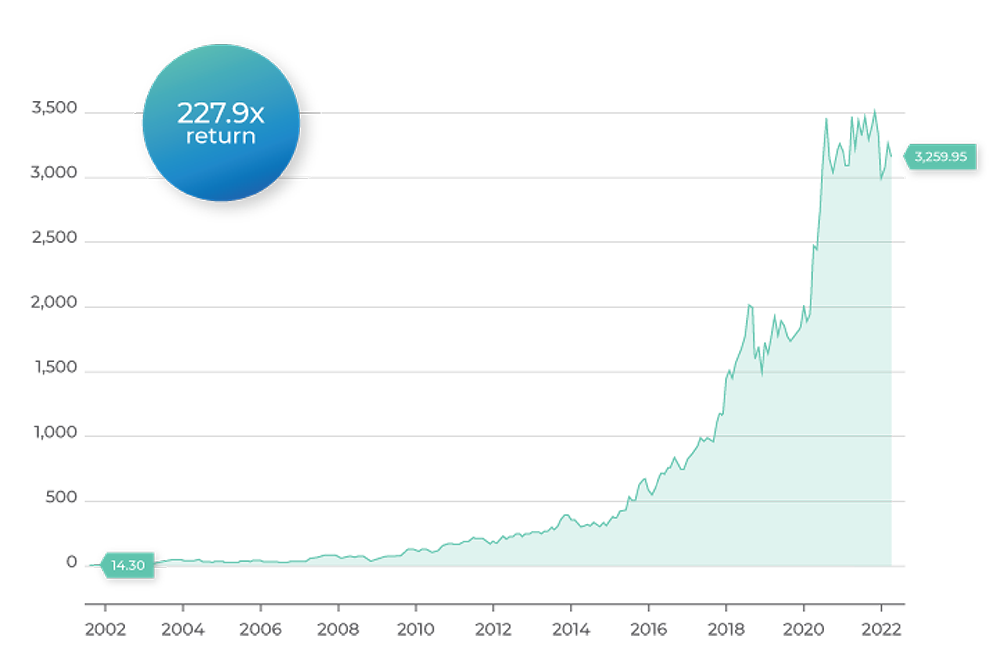

Amazon.com, Inc ($AMZN)

(Historical Stock Chart, March 2002 – March 2022)

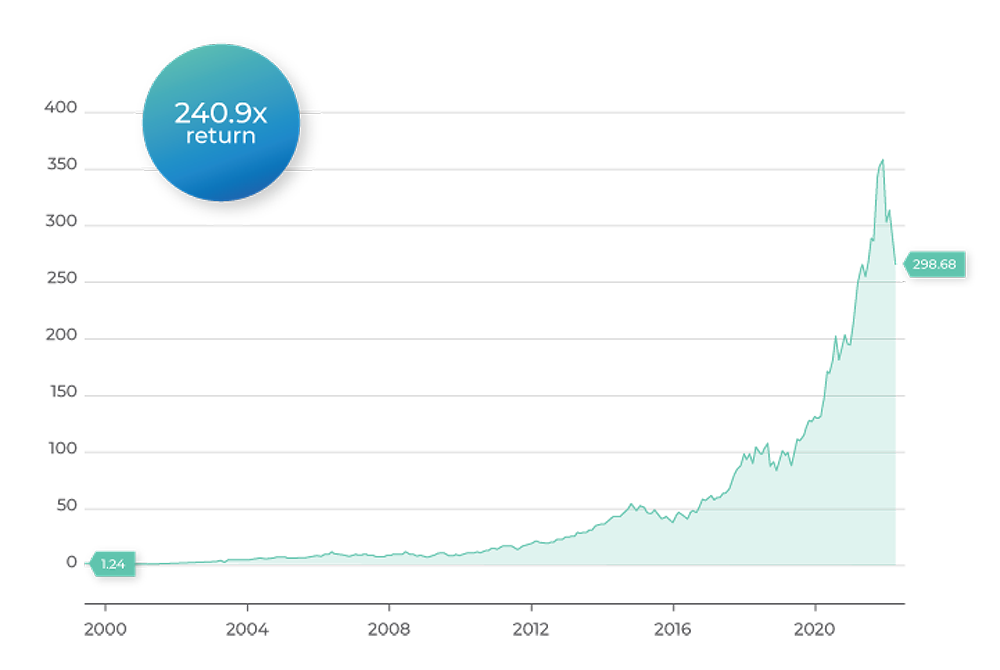

Old Dominion Freight Line Inc ($ODFL)

(Historical Stock Chart, March 2002 – March 2022)

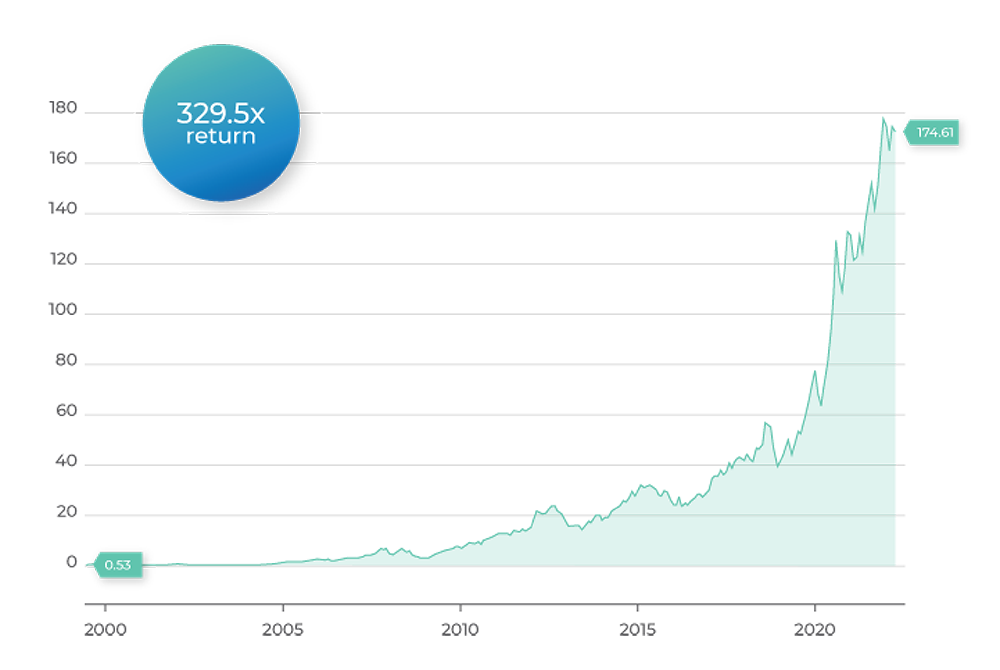

Apple Inc ($AAPL)

(Historical Stock Chart, March 2002 – March 2022)

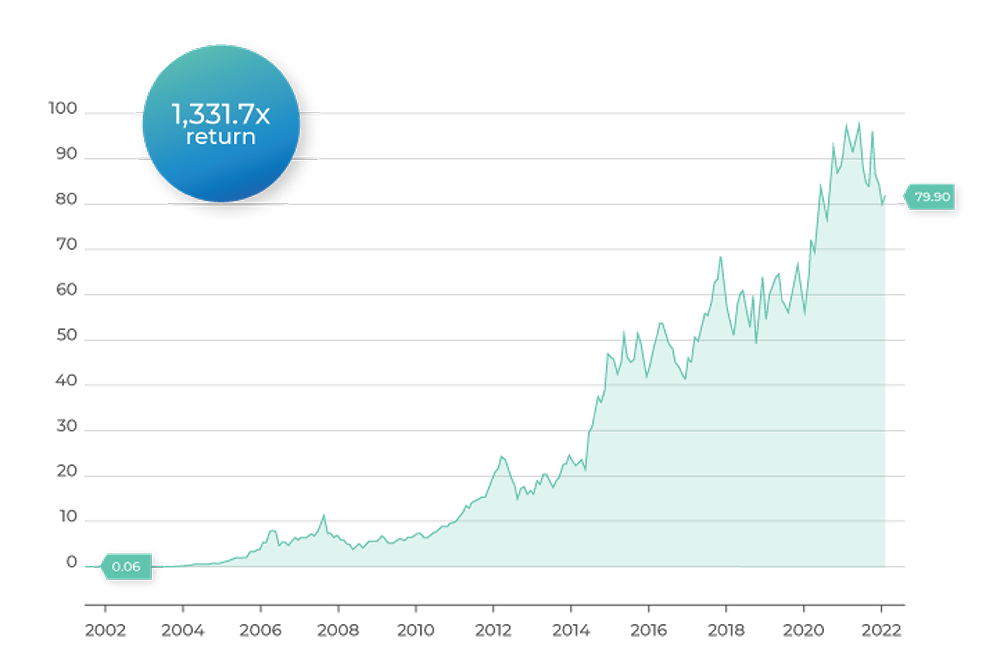

Monster Beverage Corp ($MNST)

(Historical Stock Chart, March 2002 – March 2022)

NEXT STEPS

Related Content

Disclosures:

Data provided by TradeStation Securities, Inc. as of March 31, 2022.

Any examples or illustrations provided are hypothetical in nature and do not reflect results actually achieved and do not account for fees, expenses, or other important considerations. These types of examples are provided to illustrate mathematical principles and not meant to predict or project the performance of a specific investment or investment strategy. Accordingly, this information should not be relied upon when making an investment decision.

2183417.0522