Futures Education Center

Learn to Trade Futures Spreads: From Analysis to Execution

Introduction

Futures spread trading offers traders a strategic approach to the derivatives market by simultaneously buying and selling related futures contracts. Rather than whether a single contract will move up or down, spread trading focuses on the relationship between two contracts and how that relationship changes over time. This approach can provide unique opportunities, typically while requiring less margin than outright futures positions. However, understanding the mechanics, recognizing the different types of spreads, and managing the associated risks are essential for anyone considering this trading strategy.

What are futures spreads?

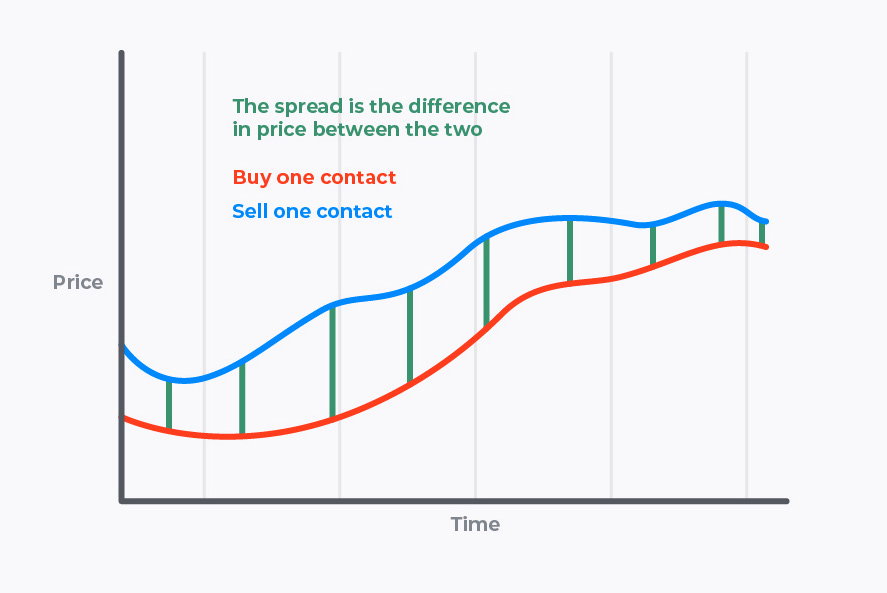

A futures spread involves taking opposite positions in two related futures contracts at the same time. You might buy one contract while selling another. The profit or loss comes not from the absolute price movement of either individual contract, but from changes in the price difference between them, which traders refer to as the spread. Think of it like tracking the gap between two runners in a race rather than watching their individual speeds.

One advantage that attracts many traders to spreads is the typically lower margin requirement compared to outright futures positions. Exchanges recognize that spread positions generally carry less volatility because the trader holds offsetting positions that provide a natural hedge. When one contract moves sharply in one direction, the related contract often moves in a similar direction, helping reduce overall position risk.

That said, lower margin requirements do not mean these trades are risk-free. Spreads can still move against your position, sometimes dramatically, and losses can exceed your initial investment. The key lies in understanding the three main types of futures spreads and analyzing and executing them properly.

Intra-market spreads: trading time differences

Intra-market spreads, also called calendar spreads or time spreads, involve the same underlying commodity but different contract months. For example, you might buy the December crude oil contract while simultaneously selling the March crude oil contract. These spreads aim to profit from price discrepancies across delivery months driven by factors such as storage costs, seasonal demand patterns, or changing market expectations about future supply.

Bull calendar spreads

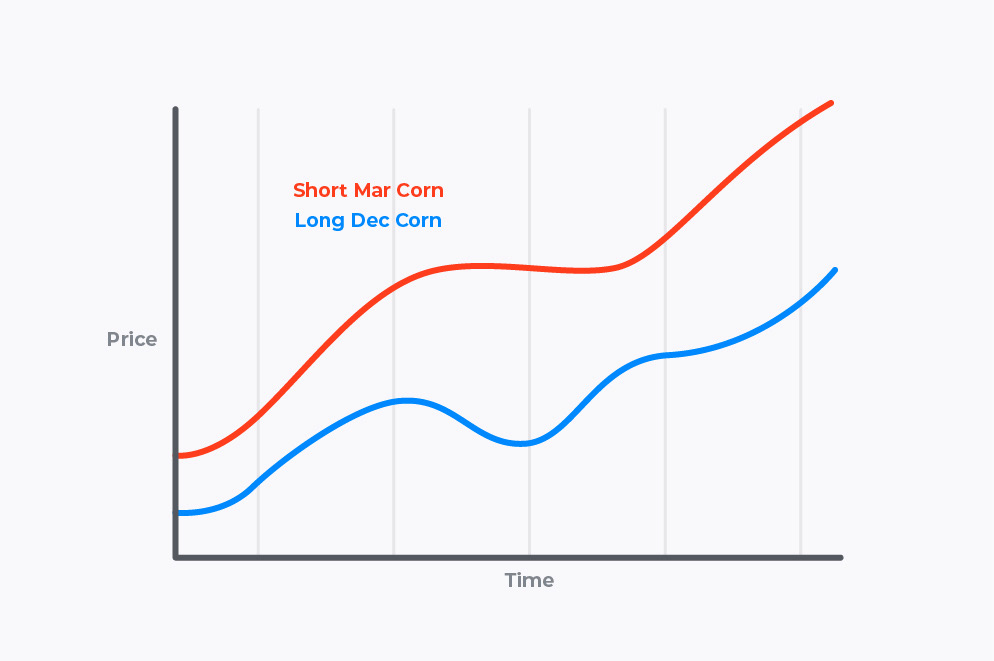

A bull calendar spread involves buying the near-term contract month while selling the deferred or longer-term contract. Traders who use this strategy expect the near-term contract to increase in value relative to the later one. This approach benefits when the market shifts from contango, where future prices trade higher than spot prices, toward backwardation, where near-term prices rise above deferred prices.

Some traders choose bull spreads instead of outright bullish positions in commodities to take advantage of lower margin requirements. When a commodity’s price rises, the front month typically increases faster and by a larger amount than the back months because it experiences higher trading volume and reflects more immediate supply and demand pressures. However, traders should understand that while the risk may be lower with spreads, the profit potential is also typically smaller than what you might achieve with an outright futures position.

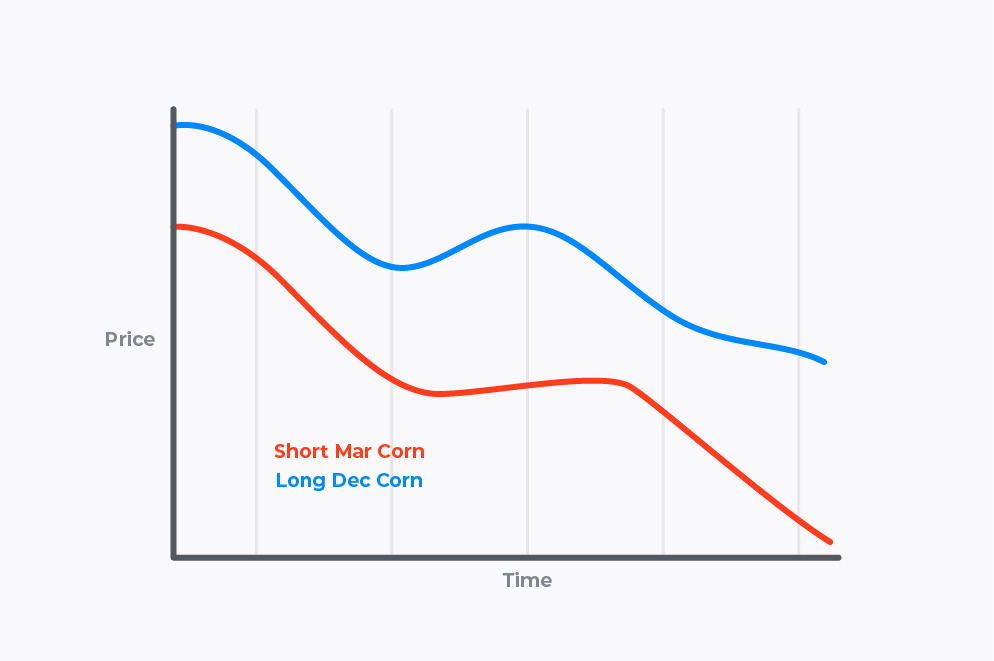

Bear calendar spreads

A bear calendar spread works in the opposite direction. You sell the nearby month and buy the deferred or farther-out month, expecting the spread to widen or for the deferred contract to outperform the nearby one. This strategy performs well when you anticipate the market moving further into contango, with future prices extending their premiums over spot prices.

Traders might opt for a bear spread rather than simply selling a futures contract outright for similar reasons as the bull spread: lower margin requirements and reduced volatility. When prices decline, the near-month contract, which trades with higher volume, typically falls faster than the longer-term contracts. The trade-off remains the same, though. Lower margin requirements come with lower potential profits than an outright short futures position.

Charting intra-market spreads

Since intra-market spreads use the same underlying commodity, charting them is relatively straightforward. Trading platforms calculate the spread by subtracting the price of one contract month from the other and plotting that difference over time. For instance, if December crude oil trades at $70.50 per barrel while the March contract trades at $71, the spread would be negative $0.50. TradeStation FuturesPlus allows traders to create custom spread charts by selecting both contract months and choosing the spread charting function. The platform then automatically calculates and displays the spread’s historical movements, making it easier to identify trends and potential trading opportunities.

Risk considerations for Intra-market spreads

While intra-market spreads generally require lower margins and exhibit lower volatility than outright positions, they still carry significant risk. Unexpected events can cause spreads to move dramatically and unpredictably. A sudden supply disruption, an unusual weather event, or geopolitical developments can all impact one contract month differently than another. In fast-moving markets, you might find it difficult or impossible to exit your positions at favorable prices. The risk of losing more than your initial investment remains real, and traders should never assume that spread trading automatically provides safety simply because margin requirements are lower.

Inter-Commodity Spreads: Trading Related Markets

Inter-commodity spreads involve related but different commodities. These spreads exploit price relationships between products that share economic connections. Examples include raw materials and their refined products, as well as competing commodities that serve similar purposes in the marketplace. Understanding how to structure these spreads properly requires grasping a vital concept: notional value.

Understanding notional value

Notional value represents the total dollar value controlled by a futures contract. Different futures contracts have different point values and tick sizes, so a one-dollar move does not necessarily result in the same profit or loss across commodities. This is where inter-commodity spreads become more complex than calendar spreads.

Consider soybeans and soybean meal as an example. One soybean contract represents 5,000 bushels. The smallest price movement, called a tick, is onequarter of a penny and is worth $12.50. Each full cent move in soybeans is worth $50. Compare this to soybean meal, where one contract equals 100 tons. The tick size is $0.10, worth $10, while a whole-point move is worth $100.

When creating inter-commodity spreads with contracts that have different tick and point values, you need to chart them using their notional values. This approach ensures you are accurately comparing the relative risk and potential profit or loss across the various contracts. By using notional value, which indicates the total market value of the position, traders can make more informed decisions about their actual risk exposure rather than being misled by raw price differences.

Delta-weighted spreads: balancing dollar exposure

The concept of delta weighting becomes critical when trading inter-commodity spreads. Let’s explore the corn-soybean spread, which traders monitor because these crops compete for the same farmland. At first glance, you might think you could trade one corn contract against one soybean contract and have balanced exposure. However, the mathematics tell a different story.

Both corn and soybean contracts represent 5,000 bushels and share the same tick and point values. But imagine corn is trading at $4.50 per bushel while soybeans are trading at $11.50 per bushel. The notional value of one corn contract would be $22,500, while one soybean contract controls $57,500 worth of soybeans. If you traded these one-to-one, your soybean position would dominate the spread’s performance. Any price movement in soybeans would have much more impact on your profit or loss than the corresponding movement in corn.

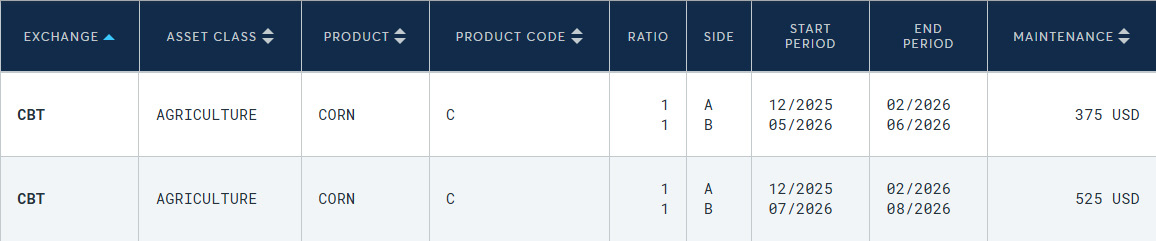

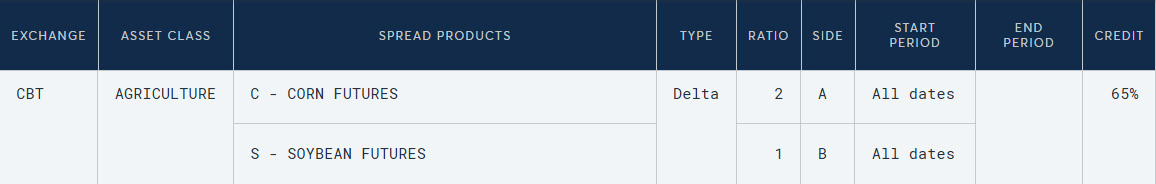

To properly delta-weight this spread and balance the dollar exposure, traders typically use a 2-to-1 ratio: two corn contracts for every one soybean contract. This ratio better balances the notional values and creates a more neutral hedge, allowing you to trade the relationship between the two commodities rather than being overly exposed to one commodity’s price moves. The CME Group’s website provides delta ratios for inter-commodity spreads on its margins page, helping traders properly structure these positions.

Charting inter-commodity spreads

Charting inter-commodity spreads requires accounting for these different notional values and proper ratio weighting. TradeStation FuturesPlus provides tools specifically designed for this purpose. When you create a spread chart between commodities with different contract specifications, you can adjust the ratio to reflect proper weighting and ensure your analysis accurately represents the economic relationship you are trying to trade.

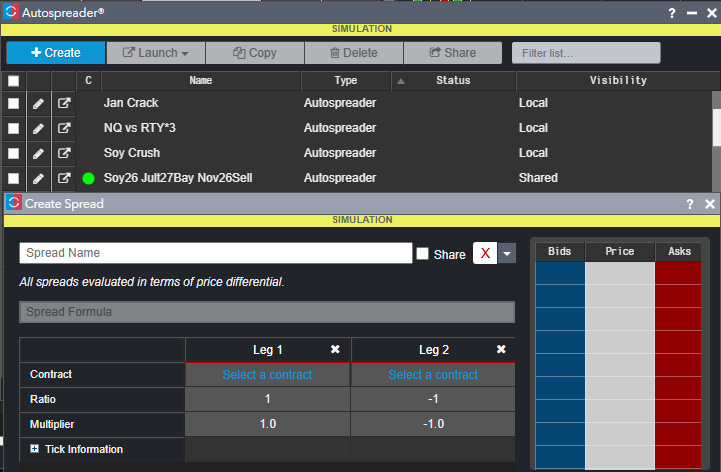

The process begins by building the spread in the Autospreader widget within FuturesPlus. After you select the commodities and customize the ratio, you can save the spread configuration. The platform then allows you to open charts, access a Spread Matrix, view a Market Grid, or use the MD Trader interface to analyze and execute trades on the spread. The multiplier row in the Autospreader lets you use market values or notional values by entering the point value for each commodity, ensuring your chart accurately reflects the genuine economic relationship between the contracts.

Risk considerations for inter-commodity spreads

Inter-commodity spreads can be more volatile than intra-market spreads because you are trading different products that may not move in perfect correlation. While related commodities often move together, they can also diverge significantly based on factors that affect one product but not the other. Changes in industrial demand, weather events that impact only one commodity, or shifts in production costs can all cause these spreads to move against your position in ways that might not be immediately predictable.

Additionally, margin requirements for inter-commodity spreads may be higher than for calendar spreads because the relationship between different commodities is less direct than the relationship between different months of the same commodity. Another significant risk comes from improper ratio weighting. If you fail to properly delta-weight your spread, you can inadvertently leave yourself exposed to outright price risk in one commodity, which defeats the purpose of spread trading. Taking the time to calculate and apply the correct ratios is not just a best practice but a necessity for managing risk effectively.

Seasonal Spreads: Trading Predictable Patterns

Another approach that many spread traders employ involves seasonality. Seasonal spread trading takes advantage of recurring patterns driven by predictable seasonal factors such as harvest cycles, weather-dependent demand, or storage limitations. These patterns can create opportunities for traders who understand the underlying fundamentals that drive them.

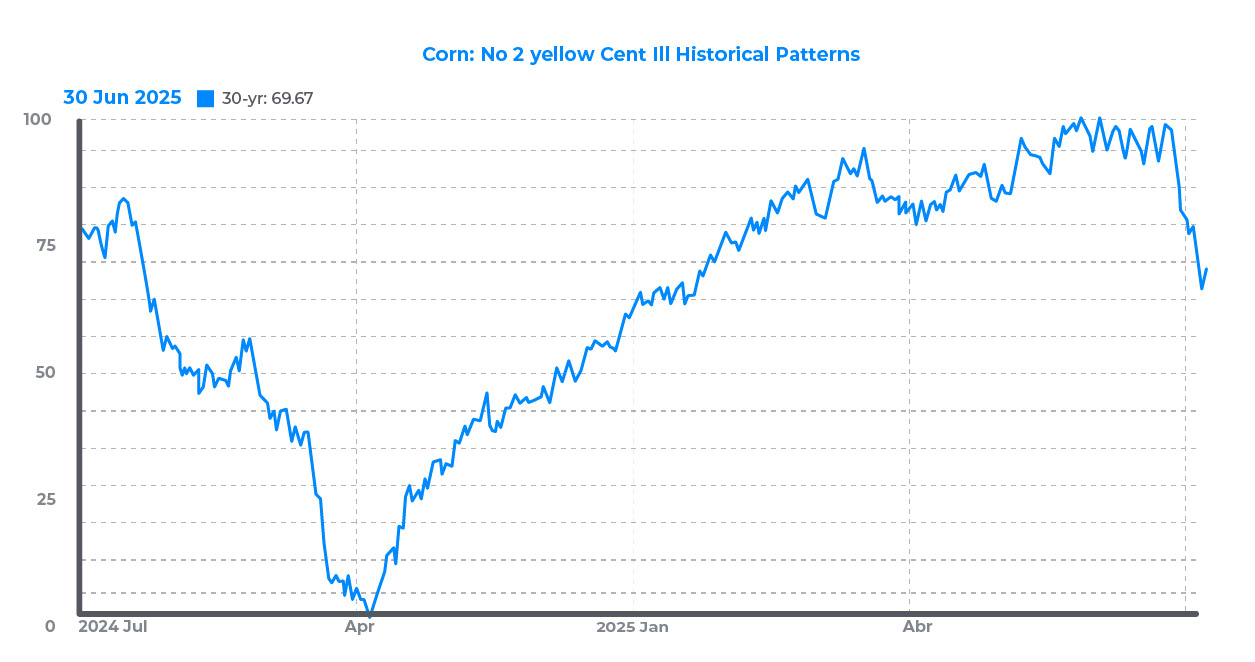

Corn prices, for example, often follow predictable patterns during planting and harvest seasons. Traders might use spread strategies that account for how oldcrop contracts behave differently from new-crop contracts as harvest time approaches. The relationship between these contract months can shift based on expectations about crop size, weather during the growing season, and storage capacity.

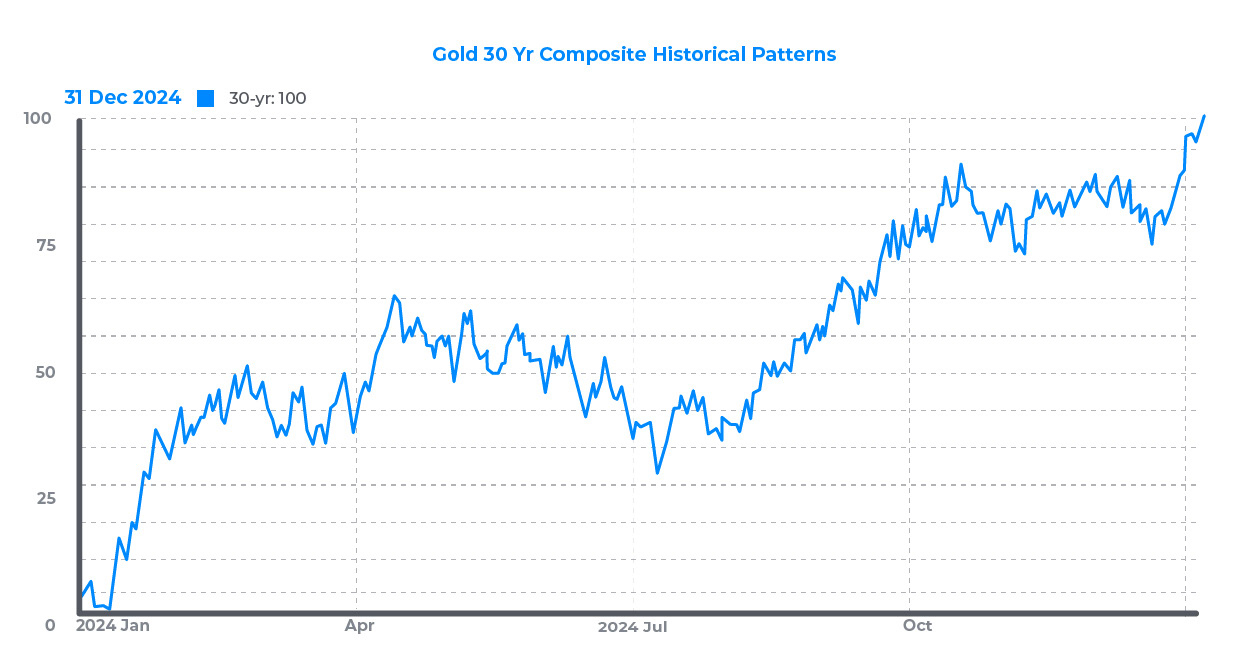

Gold demand fluctuates throughout the year, affecting futures contract prices. Demand typically rises in early fall as India begins its harvest and holiday season. This trend continues through winter, reaches a peak, and then ends with the Chinese New Year in February or March. After holiday demand drops off, both commodity prices and futures contract prices tend to fall until the cycle begins again the following year.

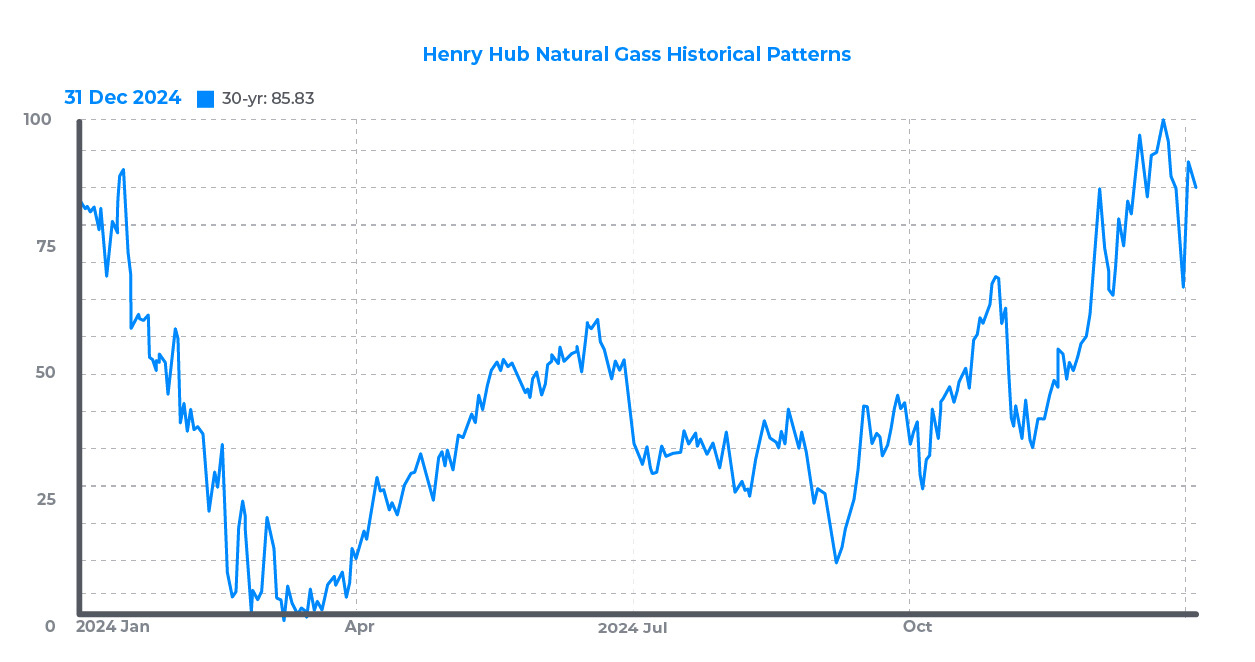

Natural gas exhibits particularly strong seasonal patterns driven by heating demand in winter and cooling demand in summer. Traders often use calendar spreads between summer and winter contracts to try to capitalize on predictable demand changes. The spread between these contract months tends to widen or narrow based on weather forecasts, storage levels, and expectations about future demand.

TradeStation FuturesPlus offers historical charting capabilities that help traders spot these seasonal patterns. You can overlay data from multiple years to see how spreads have behaved during similar timeframes in the past. This historical perspective can be valuable for identifying potential opportunities. The platform’s spread order functionality allows you to enter both legs of a seasonal spread simultaneously at your specified spread price, which can help reduce execution risk compared to legging into the spread by trading each contract separately.

Risk considerations for seasonal spreads

While seasonal patterns can be dependable over long periods, they are never guaranteed. Numerous factors can disrupt even well-established seasonal trends. An unusually warm winter can undermine natural gas spreads that depend on heating demand. Technological advances can change consumption patterns. Geopolitical events or unexpected supply disruptions can override typical seasonal behavior. Traders who rely solely on historical patterns without considering current market conditions and fundamental factors are setting themselves up for potential disappointment.

Most reliable seasonal patterns recur over 10 to 15 years, establishing a track record that traders can analyze. However, past performance of seasonal spreads does not guarantee future results. The market conditions that created historical patterns can change. Supply chains evolve, consumer behavior shifts, and regulatory changes can alter market dynamics. For these reasons, traders should approach seasonal spreads with the same risk management discipline they would apply to any other trading strategy. Using stop-loss orders to limit potential losses is essential, even when trading patterns that have worked reliably in the past.

Practice Before Trading Live

Futures spread trading offers traders the potential to profit from relative price movements while generally requiring lower margin than outright positions. The strategies we have discussed can provide unique opportunities distinct from directional trading. Understanding how to properly chart and weight these spreads, especially when dealing with different contract specifications and notional values, is essential to implementing these strategies effectively.

However, as we have emphasized throughout this article, these strategies still carry significant risks. The possibility of losses exceeding your initial investment is real. Market conditions can change rapidly. Spreads can move against your position in ways that surprise even experienced traders. The lower volatility that typically characterizes spread trading compared to outright positions can create a false sense of security if you are not vigilant about risk management.

Before trading spreads with real capital, we strongly recommend using TradeStation FuturesPlus in simulated trading mode. This feature allows you to practice identifying spread opportunities, calculating proper ratios, executing orders, and managing positions in a risk-free environment using real market data. You can test your understanding of notional value calculations, experiment with different ratio weightings, and experience how spreads behave under various market conditions without putting actual money at risk.

Take the time to build your skills and confidence before committing actual funds. Work through multiple examples of each type of spread. Practice charting intra-market spreads and identifying potential entry and exit points. Set up intercommodity spreads with proper delta weighting and observe their performance. Analyze seasonal patterns and test your ability to time entries based on historical trends. The experience you gain through simulated trading can be invaluable in preparing you for the realities of live trading.

Understanding the mechanics of spread trading, calculating proper contract ratios, identifying the right market conditions, and managing risk effectively are all essential components of a successful futures spread trading approach. The knowledge you build through education and practice, combined with disciplined risk management and realistic expectations about both the benefits and limitations of spread trading, will serve you well whether you eventually choose to trade these strategies with real capital or decide they are not the right fit for your trading goals.

Important Information and Disclosures

This content is for educational and informational purposes only. Any symbols, financial instruments, or trading strategies discussed are for demonstration purposes only and are not research or recommendations. TradeStation companies do not provide legal, tax, or investment advice.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on www.TradeStation.com/Important-Information.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a brokerdealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission. TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly-owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com/DisclosureTSCompanies for further important information explaining what this means.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.

Any examples or illustrations provided are hypothetical in nature and do not reflect results actually achieved and do not account for fees, expenses, or other important considerations. These types of examples are provided to illustrate mathematical principles and not meant to predict or project the performance of a specific investment or investment strategy. Accordingly, this information should not be relied upon when making an investment decision.

Futures trading is not suitable for all investors. To obtain a copy of the futures risk disclosure statement visit www.TradeStation.com/DisclosureFutures

ID5157125 D0126