Market Insights

Opportunity knocks for those with trading in their DNA.

Curiosity creates opportunity. Insights create strategy. Born traders create their destiny.

Stocks

Options

Futures

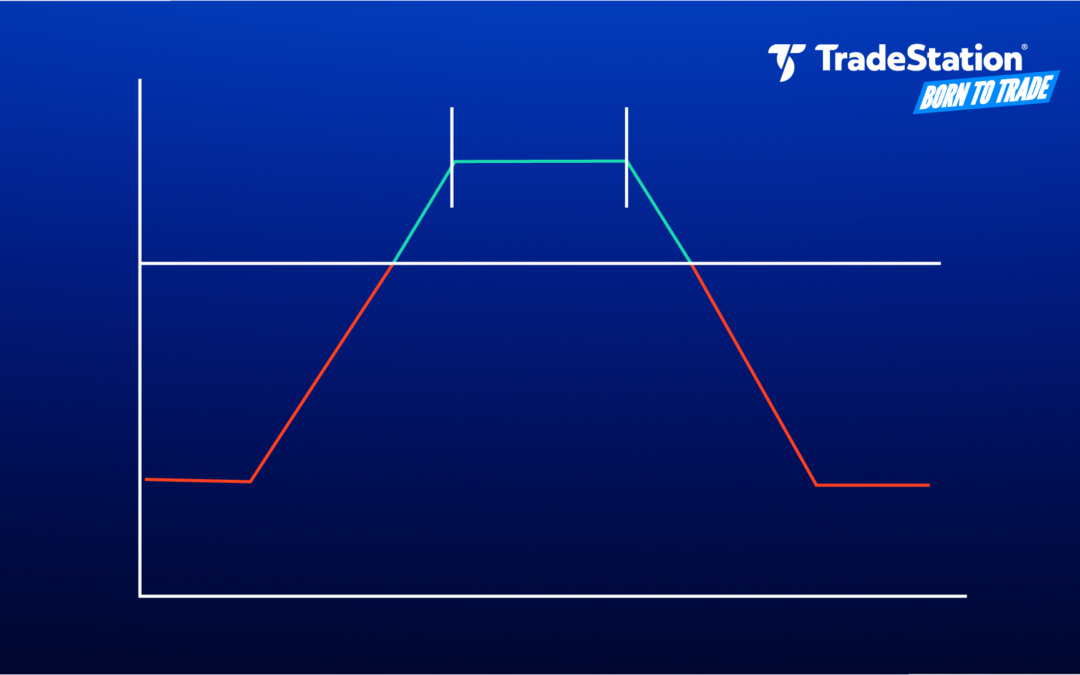

The Iron Condor Strategy: A Guide to Options Trading Neutral Markets

by TradeStation | Oct 28, 2025

The iron condor is a commonly used strategy among experienced traders who wish to navigate neutral markets and tightly manage risk.

Rotation Intensifies as Tesla, Alphabet Drop: Market Trends This Week

by David Russell | Jul 25, 2024

Downloads are available here. TradeStation’s ideas on TradingView are available here. Check out our new webinar "State of the Market," launching on Monday. Sizing Up the S&P 500 S&P 500 revisits mid-June price range, 50-day MA Lowest RSI since early May...

Oil Could Be Teetering Before OPEC+ Meeting Next Week

by David Russell | Jul 24, 2024

Crude oil has been sputtering, and OPEC+ isn't expected to provide much relief next week. Ministers from the energy cartel, led by Saudi Arabia and Russia, are scheduled to meet on Thursday, August 1. Reuters reported on July 18 that they will probably let oil...

Tech Stocks Fall Again. Has the ‘Great Rotation’ Begun?

by David Russell | Jul 22, 2024

Some investors have worried that overconcentration in large growth stocks could hurt the broader market. Now it might be coming true. The S&P 500 fell almost 2 percent between Friday, July 12 and Friday, July 19. It was the first drop in three weeks and the...

Big Technology Companies Report Earnings Soon

by David Russell | Jul 18, 2024

Second quarter earnings season has begun. Financials have already reported, and attention will soon turn to major technology companies like Microsoft and Apple. This article will cover some key dates and recent news on these stocks....

No ‘Stag’ and Not Much ‘Flation’? Market Trends This Week

by David Russell | Jul 18, 2024

Downloads are available here. TradeStation’s ideas on TradingView are available here. Sizing Up the S&P 500 S&P 500 has risen in 10 of the last 12 days. New records in nine of the last 10 days. Breadth widens: New 52-week highs increase...

Small Caps Surge as a Potential ‘Trump Trade’ Takes Shape

by David Russell | Jul 17, 2024

The stock market is changing quickly as investors anticipate potential rate cuts and a second Trump Administration. TradeStation data shows a dramatic shift away from large growth stocks in favor of smaller companies and value plays. Banks, financials, small caps,...

Top Stocks for Options Trading

Technology & Communication

Is Alibaba Leaving Silicon Valley in the Dust?

by David Russell | Mar 18, 2025

Officials in Beijing plan to boost stimulus as the U.S. economy shows signs of slowing.

Technical Alert: Death Cross in Netflix

by David Russell | Jun 3, 2021

The economy is reopening. People are going back to work. It's great news for a lot of stocks, but Netflix isn't one of them. Today, the streaming-video giant's 50-day simple moving average (SMA) closed at $513.97, or $0.53 below its 200-day SMA. That "death cross" may...

Junior Nasdaq Beating QQQ Again as Low Volatility Draws Risk Takers Away From Apple

by David Russell | May 28, 2021

Big-cap technology stocks like Apple are lagging again, even as investors start buying smaller companies on the Nasdaq. The chart below compares the Invesco Nasdaq Next Gen ETF (QQQJ) with the Invesco QQQ (QQQ). It shows percentage change, with hourly bars, since the...

Options Activity Is Rising in ‘Meme’ Stocks Like AMC and GameStop

by David Russell | May 27, 2021

Heavily shorted stocks like AMC exploded higher in January. Now they may be moving again, with options traders jumping on board. The theater chain rallied 19 percent yesterday, following a 20 percent gain on Tuesday. AMC is up 62 percent since last Friday, its biggest...

Golden Crosses in Wireless Tower Stocks: Chart of the Day

by David Russell | May 26, 2021

Wireless-tower stocks have been in long-term uptrends as mobile devices and usage proliferate. American Tower is the largest of the three, followed by Crown Castle International and SBA Communications . AMT has moved sideways for the last year. It hit an all-time high...