Plenty of customers were trading Apple (AAPL) yesterday before the company’s earnings report. Even if they didn’t log from their desks, they still could have placed orders on the go using TradeStation’s uber-powerful Mobile App.

In case you haven’t installed it yet, we took some screenshots of AAPL on the Mobile app showing before the numbers.

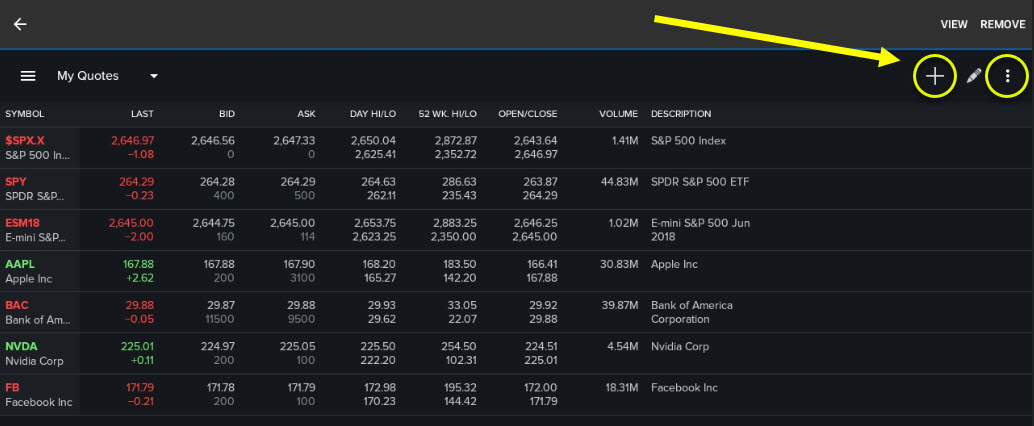

Start on the Quotes screen, the first choice from the main navigation menu ☰ on the top left. This is the place to keep your favorite tickers for quick and easy access. Add symbols by tapping the large ✚ at the top right. You can also change what values appear in the columns by clicking on the ⋮ menu.

Clicking on AAPL takes you to the main screen for the company. Tap CHART along the top to see a price chart. Control the time intervals at the bottom (1m, 5m, 10m, etc.) The screen shot below shows AAPL on an hourly chart. Notice the horizontal line around $165, which I drew previously around the April 4 low.

You can also see MACD, or the moving-average convergence divergence indicator, across the bottom. Icons in the top right control all of these features. (You can also alter the chart type or even share the image.)

Now go back to the main navigation along the top and select OPTIONS. The great thing about this screen is that it can build common strategies for you, like vertical spreads. Just tap directly under the price on the top left where it says “Single” (for single-leg strategies.). Then select Vertical from the drop-down list. Controls at the top manage the width of the spread and expiration date. (Click here to learn more about trading options.)

Say you were bullish and want to buy a long spread in hope of a rally to $175. You could click the ASK price (in blue), followed by the green TRADE bar at the bottom to generate an order ticket.

That’s it for now. Next time we’ll look at managing positions, where some exciting new features are coming out soon.

Disclaimer: Trading options may not be suitable for all investors.