Intel has been running since the end of summer, and some options traders could be looking for more upside.

Call toll-free 800.328.1267

Market Insights

Opportunity knocks for those with trading in their DNA.

Curiosity creates opportunity. Insights create strategy. Born traders create their destiny.

Key Options Knowledge: Time, Volatility and Different Kinds of Value

Options confuse a lot of investors because several factors impact their value. Unlike stocks, they don’t just go up and down based on supply and demand. This post will explain three of the most important concepts you need to get started: time, volatility and intrinsic...

How Have Markets Reacted to the Fed’s Rate Cut?

The Federal Reserve lowered interest rates last week, while signaling it might not cut again soon. How have markets reacted to the news? This article compares two strategies designed to capture a positive response to Wednesday's move. One uses options on the heavily...

The Year’s Leading Megacap Reports Earnings Thursday

Did you know Broadcom has risen twice as much as Nvidia so far in 2025?

Traders Face Choices After Pullbacks in Big Tech

Tesla, Nvidia and Palantir may be stabilizing after a bout of volatility, and active traders face big choices.

Diagonal Spread: How it Works & How to Use it

Balancing directional bias with premium collection isn't always straightforward, even for the most dedicated options traders. Diagonal spreads stand out as a sophisticated strategy that might allow you to potentially profit from time decay, volatility shifts, and...

Updated Mobile App: A Big Win for Options Traders?

TradeStation has updated its mobile app to to help users trade, manage and monitor options more easily. The new functionality is especially powerful for complex, multileg strategies.

Are Traders Bullish Before Nvidia’s $500 Billion Question?

The AI giant reports earnings with prices at support and momentum potentially slowing.

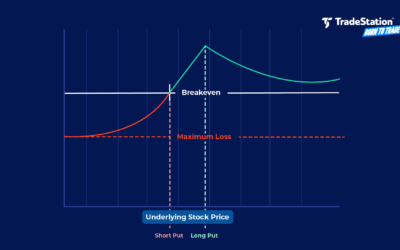

Key Points About Selling Credit Spreads

A previous post covered debit spreads, when you pay a debit looking for a stock or ETF to move in a certain direction. Credit spreads are just the opposite, with traders collecting premium up front in hope that the stock won’t move a certain way. What a Credit Spread...