Balancing directional bias with premium collection isn't always straightforward, even for the most dedicated options traders. Diagonal spreads stand out as a sophisticated strategy that might allow you to potentially profit from time decay, volatility shifts, and...

Call toll-free 800.328.1267

Market Insights

Opportunity knocks for those with trading in their DNA.

Curiosity creates opportunity. Insights create strategy. Born traders create their destiny.

Updated Mobile App: A Big Win for Options Traders?

TradeStation has updated its mobile app to to help users trade, manage and monitor options more easily. The new functionality is especially powerful for complex, multileg strategies.

TradeStation HUB Makes Trading Smoother than Ever

TradeStation recently added key trading functionality to HUB, the starting point for customers on our site. This article will explain some important updates. HUB trading is a unified starting point for new and existing customers. The view is clean and simple, but with...

AI Trade Pauses as Value Stocks Surge

Health care and financials are outperforming the S&P 500 as technology starts to lag.

Take Control of Order Management with TradeStation’s Trade Manager

Managing orders and positions is a real challenge, especially when markets heat up. Fast price moves can leave even the most seasoned traders scrambling to keep pace, making effective risk management difficult. TradeStation’s sophisticated Trade Manager provides an integrated order management solution to streamline your workflow, so you can stay focused when it matters most.

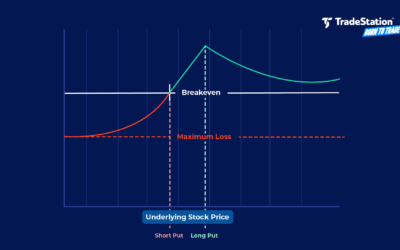

Key Points About Selling Credit Spreads

A previous post covered debit spreads, when you pay a debit looking for a stock or ETF to move in a certain direction. Credit spreads are just the opposite, with traders collecting premium up front in hope that the stock won’t move a certain way. What a Credit Spread...

Stocks Hold Key Levels as Breadth Recovers

New 52-week highs are outnumbering new lows again.

Is Technology The Only Game in Town?

Only 1/4 of the S&P 500’s members are up this week.

Rolling Options: Key Things for Traders to Know

“Rolling options” is a common transaction for options traders, but there are several ways to do it. This article will explain the different ways and reasons why traders might roll positions.