The setup is nearly perfect. The market is bullish, implied volatility is low, and the underlying stock is coiling tight against a key resistance level.

You are not looking for a complex multi-leg spread here. You are looking for pure, unadulterated delta. You want to grab an at-the-money (ATM) call and ride the breakout for 15 minutes.

The signal fires. The stock breaks resistance.

On a standard retail platform, this is where you can easily fail. You scramble to open the option chain. You hunt for the right expiration. You try to calculate the limit price while the stock rapidly ticks higher. By the time you click the Transmit button, the premium has jumped 15 cents.

You chase the bid. You get filled at the top. The stock pulls back three ticks, and you are already underwater.

You were right on the direction. You were right on the timing. But your interface was too slow to capture the edge.

The Pivot: Calculate Your “Retail Tax”

When you are scalping gamma and delta, you cannot afford to navigate menus. You need the infrastructure of a market maker.

Do the math on your current workflow. If you slip just 2 cents on a 50-lot of because of a slow interface, that is $100 gone. Do that twice a day, and you are paying a $50,000 “Retail Tax” every year.

Stop calling it slippage. Call it what it is: a voluntary pay cut.

To stop donating your edge to the market, you need to strip away the noise and focus on one thing: Execution Velocity.

TradeStation Desktop allows you to bypass the friction of standard order tickets. It gives you three distinct weapons to execute the ATM Call Buy with the speed of an algorithm.

The Solution: Surgical Strike Capabilities

1. The Matrix: Atomic Execution

Stop trading options off a static chain. For an intraday scalp, you need to feel the flow of the premium.

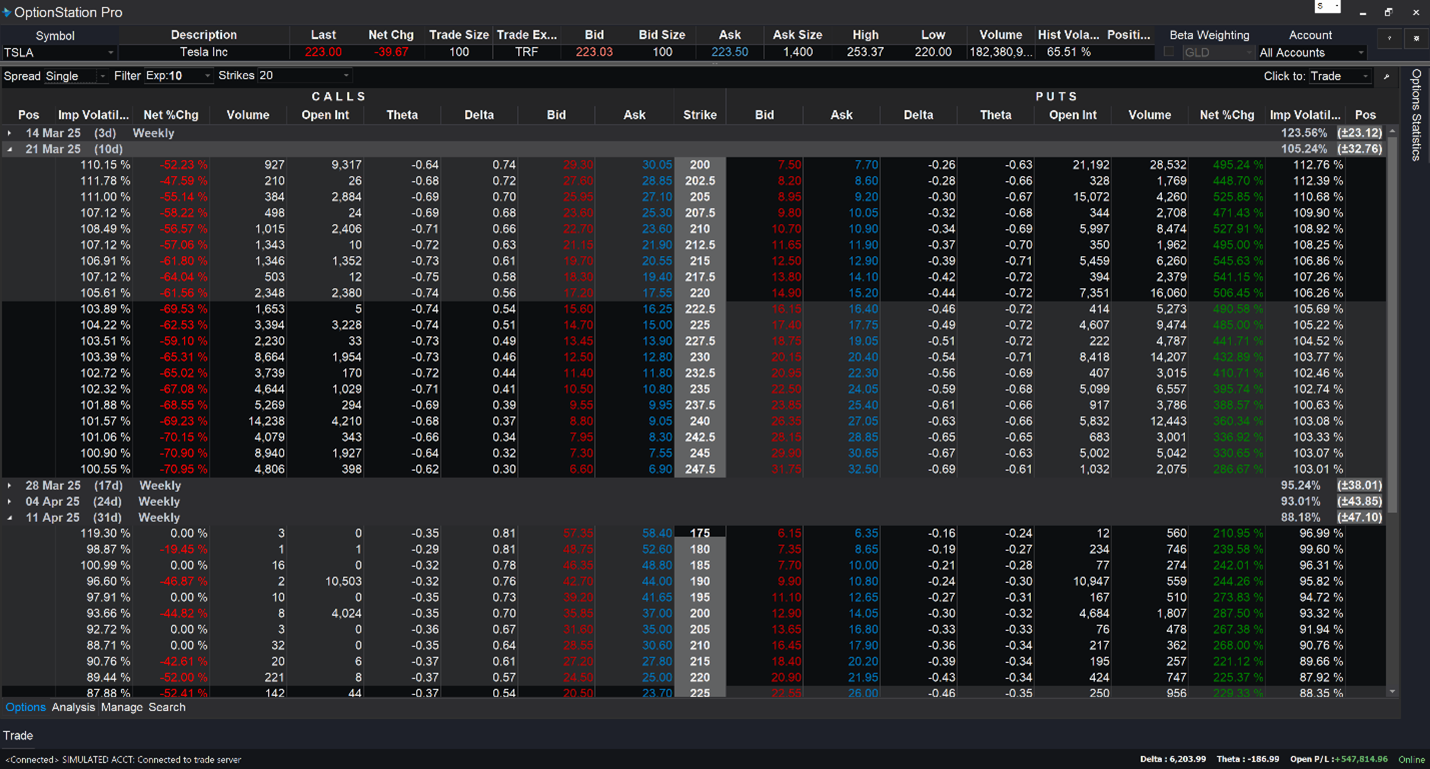

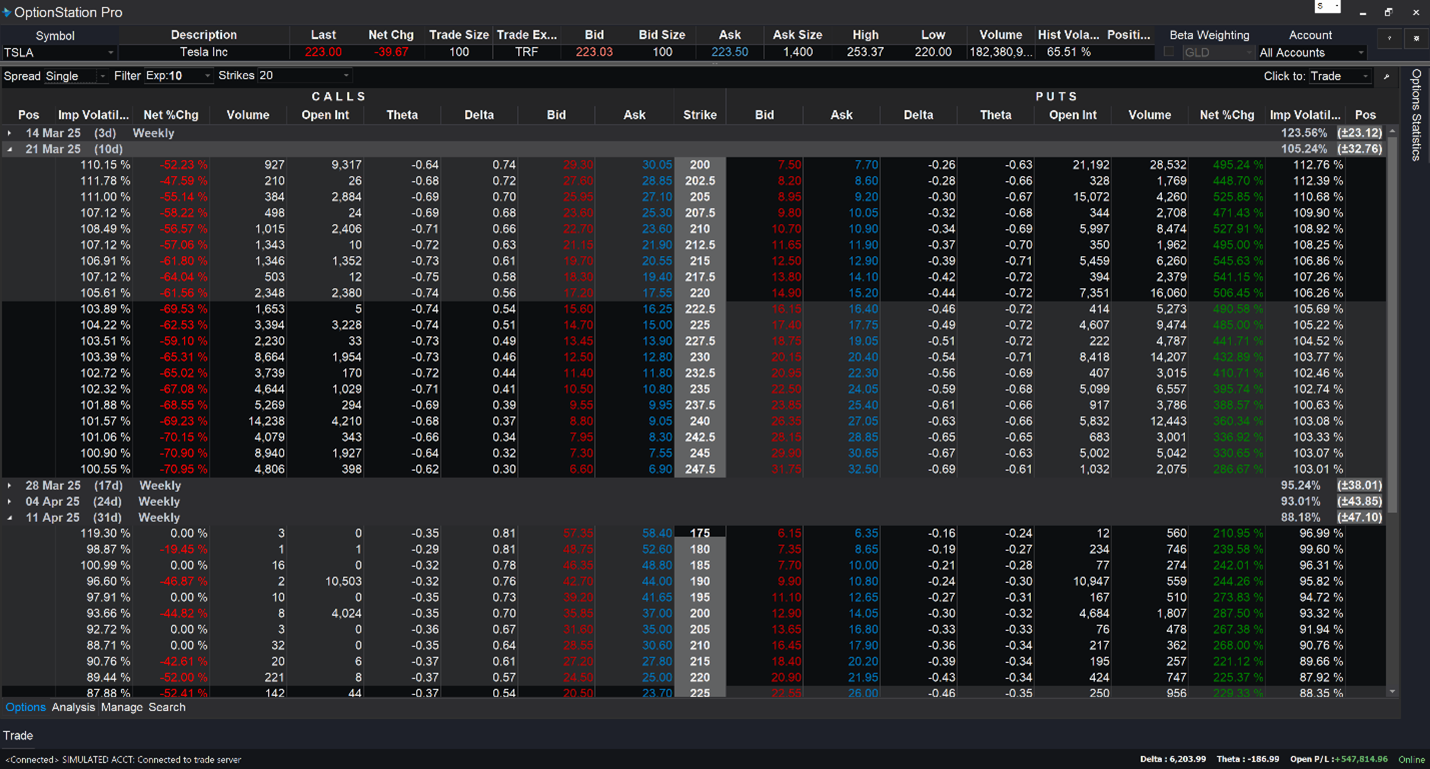

Load your specific ATM Call contract directly into TradeStation’s Matrix. Now, you are not looking at a list of numbers; you are looking at the liquidity ladder. You see the bid and ask sizes fighting in real-time.

When the underlying stock ticks through resistance, you do not fumble with an order ticket. You single-click the Ask column on the price ladder.

Bang. You are long.

There is no confirmation pop-up asking if you are “sure.” There is only the fill. You can visually drag your stop-loss and profit target directly onto the ladder the second you are filled. This is how you scalp with precision.

2. Keyboard Trading: Zero-Click Entry

For the ultra-aggressive scalper, even a mouse click is too slow.

TradeStation allows you to map specific order commands to your keyboard. You can configure a “Buy Ask” or “Buy Market” command to a single hotkey, like F9 or a custom macro.

You watch the chart. You see the volume spike. You hit the key.

Your order execution is routed instantly. You are in the trade before most retail traders have even opened their broker’s app.

3. The Tether: Server-Side Safety

You are in the trade, but life happens. You need to step away from the desk. On other platforms, you would be forced to close the position early or risk a disconnect.

With TradeStation, you simply walk away.

Your desktop environment syncs seamlessly with the mobile trading app. You open your phone, and your position is there, updating in real-time.

But here is the critical part: When you place a bracket order on the Matrix, it resides on TradeStation’s Execution Servers, not your phone.

If your signal dies or your phone battery quits, your stop-loss is still live and active at the exchange or server level. You are untethered from the desk, but you are never unprotected.

The Reality of Scalping Risk

Scalping ATM options demands precision, but it also carries real risk. The same speed that creates opportunity can quickly amplify losses when the market turns. Even with advanced tools that help reduce slippage, no technology can erase the uncertainty of fast-moving prices. Every order, every fill, every exit carries exposure. The strategies in this article are meant to illustrate concepts. They do not guarantee results. Turning speed into precision takes practice, discipline, and respect for risk.

The Close: Stop Clicking, Start Striking

The market often rewards those who can execute their ideas instantly. If you are still navigating three windows to place a single call option, you are fighting with one hand tied behind your back.

Stop chasing the price. Stop paying the Retail Tax.

Load the Matrix. Map your hotkeys.

Trade like you were born to do this.

Learn more

ID5187260 P10616076494 D0226