Options Alert: Why Puts Surged in Warner Bros.

After a long bidding war for Warner Bros. Discovery, one big options trader is looking for the current deal to go through.

Call toll-free 800.328.1267

The closing bell rings. The ticker halts. The options market holds its breath.

The setup is universal. You’ve spent the last hour modeling the trade and know the implied volatility is historically high. You calculated the expected move. This is a textbook strategy designed to harvest the IV crush the moment trading resumes.

Your math is nearly perfect. Your thesis is sound. You try to execute and it’s chaos.

On a standard retail platform, you fight with a clunky order ticket. You try to leg into the spread because your broker cannot handle complex routing efficiently. You get filled on the call spread. But the market moves. The put spread runs away from you. Suddenly, you are not hedged. You are exposed. You are chasing the bid while the premium evaporates.

You were right on the direction. You were right on the volatility. But you still lost money. This is the retail tax. It is the cost of bringing a knife to a gunfight.

Volatility does not wait for you to navigate three different drop-down menus. When you trade high-beta events, infrastructure is not a luxury. It’s a risk-management necessity.

You may need to separate your analysis from your execution. You deserve a platform that offers a spectrum of entry mechanics. TradeStation provides diverse tools for every scenario: the Matrix for high-speed scalping, the Quick Trade Bar for equity blocks, and RadarScreen for scanning. But for a complex volatility construct like this, you do not use a hammer when you need a scalpel. You need OptionStation® Pro and staged orders.

This is where placing a trade changes from a scramble into a sniper shot. TradeStation allows you to customize the “when” and “how” of your execution using a specific set of professional tools designed for this exact moment.

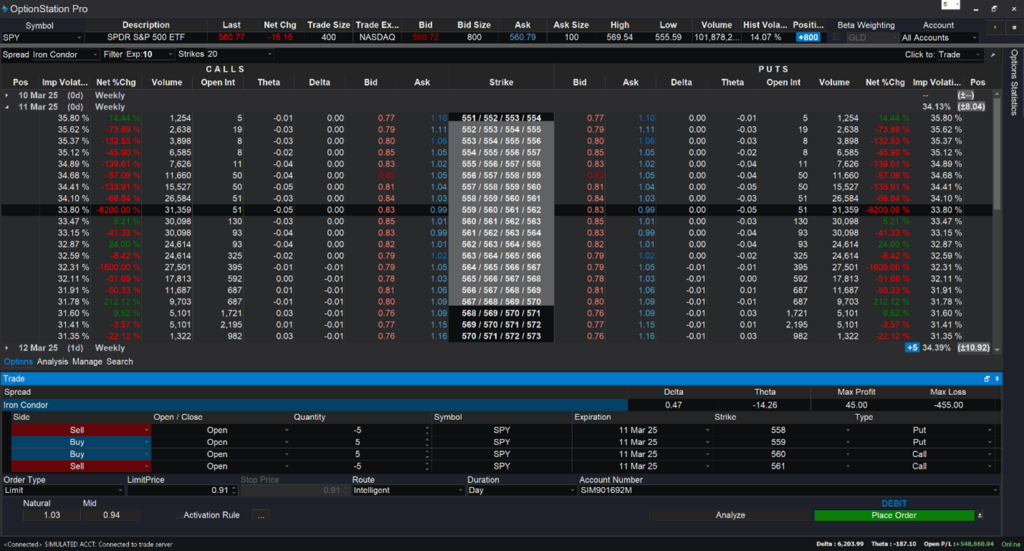

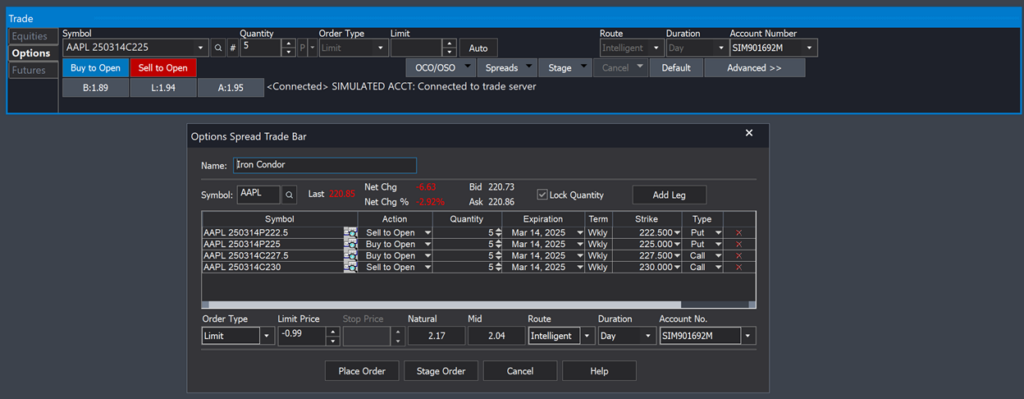

You shouldn’t have to toggle between charts and order tickets to check your strikes. Seeing your risk overlaid on the data can be a game-changer. OptionStation Pro does this as your dedicated interface for building, analyzing, and trading complex spreads.

This powerhouse of a tool allows you to build the entire position, whether it is a butterfly, iron condor, or a custom multi-leg volatility play, in a single visual interface. You are not guessing. You are engineering.

Precision requires confirmation. In OptionStation Pro, you can customize the chain view to project the expected move and breakeven points directly onto the strike column.

As you build the order, vertical green and red lines appear next to the strike prices in the chain. The green line indicates your potential profit zone. The red line indicates your loss zone. These indicators update dynamically. If implied volatility shifts, or if the underlying price moves, you see the impact on your probability instantly. You confirm the edge visually before you commit the capital.

You do not build this trade at the open or the close. You build it at 2:00 PM when the market is calm. You operate in a “cold state” of logical analysis rather than a “hot state” of reactive panic.

TradeStation allows you to stage your orders. In OptionStation Pro, you customize every leg of your iron condor. You adjust strikes, quantities, and expiration dates to match your exact thesis. You verify the risk graph. But you do not send it. You hit the Stage button.

The order is now frozen. It is saved directly to your machine, pre-formatted and validated. It sits in your Staged Orders tab, waiting for your command. When the earnings print hits and the market reopens, you do not type a single number. You simply right-click your staged order and select Send Now.

You have effectively customized time. You performed the labor of order construction hours ago so you could bypass the friction of live entry. This is how professionals trade events. They do not react to the bell. They prepare for it.

Speed is your protection. When you release that staged order, you are relying on TradeStation’s execution engine to handle the complexity.

In the retail world, traders often fear legging risk. This occurs when a broker splits a complex spread into individual orders. You might get filled on your short strikes while your long protection remains unfilled. If the market rips against you in that split second, you face undefined risk on a defined-risk trade.

TradeStation routes options orders utilizing intelligent order routing technology to seek the best execution available. This allows you to route the entire complex spread as a single package. You are not legging in. You are not risking a partial fill on the call side while the put side runs away.

Furthermore, the engine is built for speed. When the market is moving fast post-earnings, you are not just getting filled. You are getting filled at a price that helps preserve your edge.

Iron condors are defined-risk strategies, but they are not risk-free. Earnings events can produce moves that exceed historical norms, blowing through your short strikes and resulting in maximum loss. The IV crush you’re counting on may not materialize if the market remains uncertain. Staged orders and professional execution tools reduce operational friction, but they cannot eliminate market risk. Every earnings play carries the possibility of total loss on the position. Approach each trade with discipline and never risk more than you can afford to lose.

The market is hard enough without fighting your interface. When you trade a high-stakes earnings print, you need to know that your platform is prepared for the volatility.

Stop building complex orders in the middle of a panic. Stop accepting the risk of legging into spreads. Stop guessing where your breakeven points are.

Start staging your orders when you have clarity. Start trusting an execution engine that prioritizes speed and precision. Upgrade your cockpit.

Trade like you were born to do this