Value Takes Off as Large Growth Sputters

Dramatic rotation continues in the stock market as old leaders crumble and value stocks break out.

Call toll-free 800.328.1267

The hard part is done. You identified the macro trends. You picked the sectors with real opportunity. You built a portfolio of high-quality equities that are grinding higher.

You’re sitting on thousands of shares of blue-chip capital. And yet, every single day, you are losing potential money. You’re not losing it to price action, but administrative friction.

You know you should be writing covered calls against these positions. The math of extracting theta is clear. You know that reducing your cost basis is the only way to outperform the index in a sideways market. But you don’t do it.

Covered call options are a strategy that allows you to generate income from your stock ownership by selling call options on stocks you already own. To execute a covered call, you must own at least 100 shares of the underlying stock, and this strategy is generally used when you intend to hold the shares for the long term but do not expect them to increase in value sharply before the option expires.

Why? Because on a standard retail platform, managing a covered call strategy across 20, 40, or 50 positions is a logistical nightmare.

You have to open 50 separate option chains and manually calculate the annualized return for the 30-delta call on every single ticker. You have to hunt for Implied Volatility (IV) Rank one by one to see if the premium is even worth selling.

It’s tedious, slow, and even mind-numbing. It’s not the excitement you feel when you’re concocting your strategy. So you don’t do it. You sell calls on your two biggest positions, and you let the rest of your portfolio sit there like dead weight.

This is the “retail tax” applied to portfolio management. It can amount to thousands of dollars of annualized yield left on the table simply because your interface cannot process the data fast enough to show you the opportunity.

Yield is not a gift. It is extracted. And you cannot extract it with a spoon. You need an industrial excavator.

Stop viewing your long stock positions as trophies on a shelf. They are working capital. Every day that a stock sits in your account without generating income is a day of wasted efficiency.

But you cannot treat a 40-stock portfolio like a day trade. You cannot scalp gamma on forty tickers at once.

You need a workflow that inverts the problem. Instead of hunting for premiums one by one, you need a system that brings the outliers to you. Scan your existing holdings for volatility anomalies, model the yield instantly, and execute the write without legging out of your underlying.

The TradeStation Desktop can help you o turn a passive portfolio into an active income engine using a specific triad of tools: the Scanner, OptionStation® Pro, and the Matrix.

Here is how you stop holding the bag and start managing the asset.

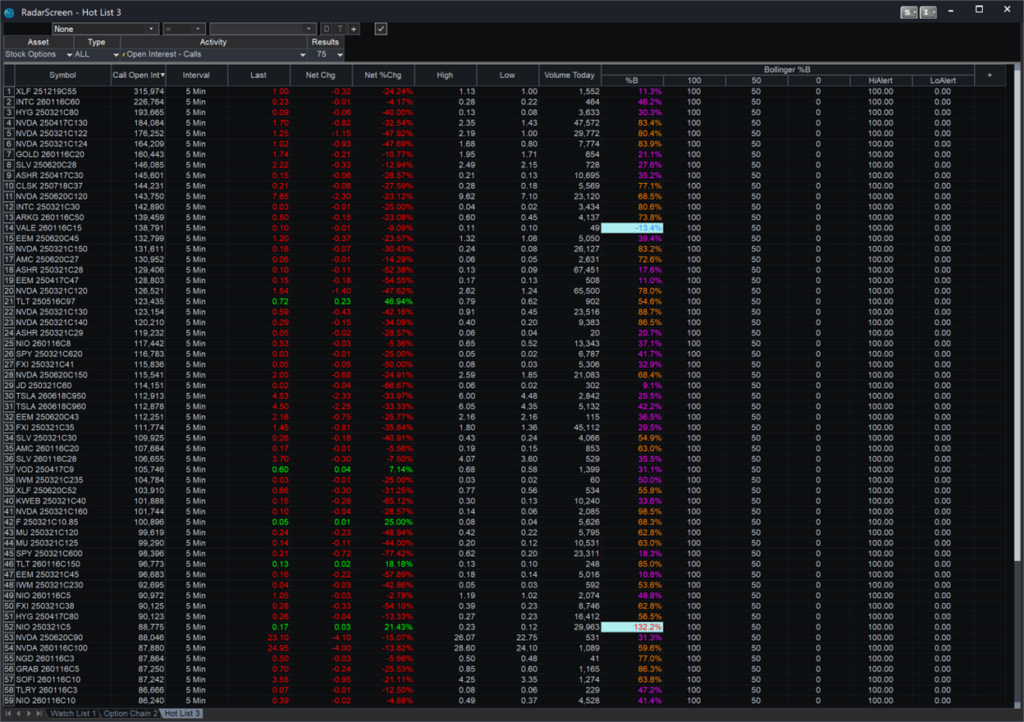

Most traders use watchlists to see price. This is a waste of pixel space. You already know the price. You need to know the edge.

You can’t sell premium blindly and hope for consistent success. You need to sell when it is expensive. To do that, you need to see IV Rank and IV Percentile; metrics that tell you if the current volatility is statistically high relative to the past.

You don’t have to click through charts to find Implied Volatility. You use the TradeStation Scanner or the dedicated Search within OptionStation Pro.

These are high-powered filtering engines that sift through the noise. You configure a scan specifically for your holdings. You set the criteria: Show me all symbols in my portfolio where Implied Volatility is abnormally high. Instantly, the list of forty stocks becomes a customized list of opportunities targeted to you.

Once you have isolated the targets, you drop them into RadarScreen for real-time monitoring. While RadarScreen tracks the tick-by-tick price action and volume flow, your scan has already done the heavy lifting of identifying the volatility edge.

You’ve gone from blindly guessing to surgically identifying the top income opportunities in your portfolio in less than five seconds.

Once you’ve identified the target via the scan, you must then design the extraction. Don’t make the amateur mistake of simply selling the 30-delta call blindly. You need to understand how that short call interacts with your long .

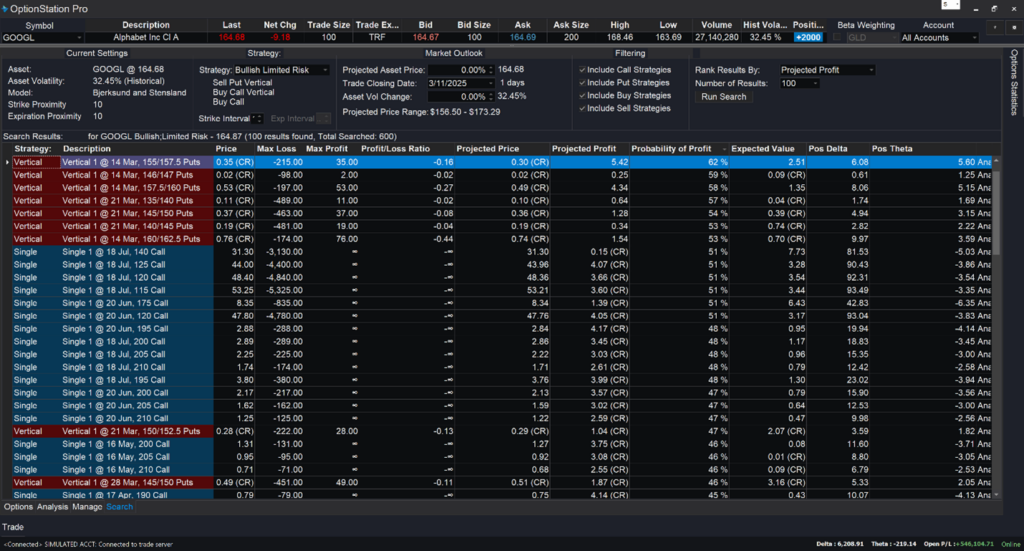

You load the symbol into OptionStation Pro. This is not a basic chain. Instead, you are looking at a 3D risk model.

You click on Covered Call in the strategy selector. TradeStation instantly recognizes you hold the long stock (or simulates it if you are modeling) and pairs it with the short option.

Now you look at the Risk Graph. You see the expiration breakeven point visually projected on the chart. You see the max profit cap. But more importantly, you can stress-test the position. What happens if the stock rallies 5% next week? What happens to the option delta if IV crushes by 20 points after earnings?

OptionStation Pro allows you to manipulate these variables in real time. You can slide the Date cursor forward to see how theta will decay the premium day by day. You might find that the monthly call offers good premium, but the weekly call offers a higher annualized return with less exposure to an earnings event.

OptionStation Pro calculates these metrics for you. You are not guessing. You are modeling the future value of your position under different market regimes. When the math creates an edge, you can pull the trigger.

The target has been identified. The trade has been modeled. Now, it’s time to execute.

In a covered call, you are effectively entering a limit order for a net credit. But markets move fast. If you are trying to leg into this (or if you are rolling an existing position), friction kills your fill price.

You use the Trade Bar within OptionStation Pro or the Matrix to work the order. If you are establishing a new Buy-Write (buying stock and selling the call simultaneously), you do not leg in. You route the order as a single complex spread. TradeStation’s intelligent routing seeks the best price for the package, ensuring you don’t get stuck with the stock but no call, or a naked call with no stock.

If you are selling calls against existing inventory, you use the Matrix to see the depth of liquidity on that specific option contract.

You don’t just hit the bid. You see where the volume is resting. You place a limit order inside the spread, forcing the market makers to come to you. Because TradeStation routes direct to the exchange, your order is visible. You are providing liquidity, not just taking it. You are fighting for every cent of that premium.

The trade is on. But the job is not done. Passive traders let options expire. Professional traders manage the gamma risk.

If the stock rips higher and challenges your strike, you need to defend your shares. You do not want them called away for a tax hit. You want to roll.

TradeStation turns the complex roll mechanics into a seamless workflow. In OptionStation Pro, you view your positions. You see the short call is testing your strike. You highlight the position. You select Roll directly from the platform.

OptionStation Pro instantly builds a diagonal or calendar spread order for you: buying to close the near-term call and selling to open the further-out (and perhaps higher strike) call.

You see the net credit or debit for the roll immediately. You check the new risk profile. You transmit.

In a matter of seconds, you have kicked the can down the road, collected more premium, and raised your effective exit price.

Covered calls offer income potential, but they also cap your upside. If the underlying stock rallies sharply, you may be forced to sell shares at the strike price, missing out on gains above that level. Additionally, the premium collected does not fully offset a significant decline in the stock’s value. While this strategy is generally considered lower risk than selling naked options, it still involves market exposure. The tools described in this article help streamline execution, but they cannot eliminate the inherent risks of options trading. Every position requires careful monitoring and a clear understanding of the potential outcomes.

Your portfolio is either growing or it is dying. There is no stasis in the market. Inflation is eating your cash. Theta should be feeding your account.

If you are sitting on long equity positions and not actively managing the yield because it is “too much work,” you are volunteering for lower returns.

Stop accepting the friction of retail platforms. Stop letting your blue chips collect dust.

Scan for the volatility edge. Model the risk in OptionStation Pro. Extract the premium with precision.

Turn your portfolio into a business.

Trade like you were born to do this.

Disclosure:

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com/DisclosureOptions. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.