‘Sell America?’ Stocks Struggle as Dollar Sinks

Stocks are struggling as money streams away from U.S. assets.

Call toll-free 800.328.1267

Stocks have entered a turbulent phase, making big moves but going nowhere.

The S&P 500 began last week with a bullish tone, jumping 1.5 percent on Monday. It continued higher the next two sessions, but reversed sharply on Thursday. The index ended the period between Friday, November 7, and Friday November 14, up less than 0.1 percent. It was the smallest weekly move since August 2024.

Worries about interest rates and AI investment were big issues.

“It will likely be appropriate to keep policy rates at the current level for some time,” Boston Federal Reserve President Susan Collins said on Wednesday. She noted “several reasons to have a relatively high bar for additional easing.”

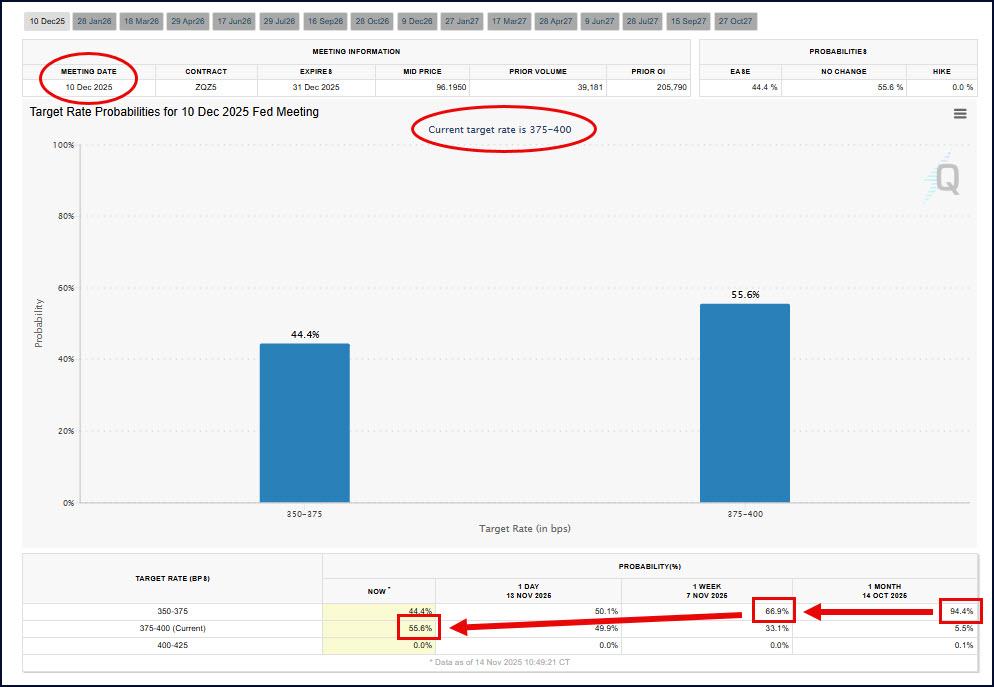

Investors responded by dialing back expectations for a 25-basis point cut on December 10. CME’s FedWatch tool showed odds dropping to 44 percent, down from 70 percent a week earlier and 94 percent in mid-October.

CME’s FedWatch tool showing reduced odds of a December 10 rate cut.

U.S. Treasury auctions also met with weak demand for 10- and 30-year debt. That pushed longer-term yields to their highest weekly closes since late September.

Attention may remain focused on borrowing costs with minutes from the last Fed meeting due at 2 p.m. ET on Wednesday.

| Albemarle (ALB) | +18% |

| Eli Lilly (LLY) | +11% |

| Cisco Systems (CSCO) | +9.8% |

| Becton Dickinson (BDX) | +8.6% |

| Biogen (BIIB) | +7.7% |

| Source: TradeStation data |

Last week also saw growing discussion about the sustainability of AI investment.

Michael Burry, who famously shorted subprime mortgages before the Global Financial Crisis, has said AI processors may lose value more quickly than expected. That could accelerate depreciation and shorten the time before companies need to purchase new chips. The result could be higher costs and lower profits.

Oracle (ORCL) and CoreWeave (CRWV) are both feeling the pain. ORCL is down 15 percent this month and is down 36 percent from its all-time high as investors react to aggressive investing plans. Its bonds have also lost value on worries that assets now being built will generate less cash flow than hoped.

CRWV, which buys and leases Nvidia (NVDA) processors to AI developers, fell 26 percent despite issuing strong results. It also borrows to finance assets.

Other companies associated with the hardware side of AI fell: Dell Technologies (DELL), Super Micro Computer (SMCI) and Seagate Technology (STX). Japanese investment company SoftBank, known for its involvement in technology, is also in the midst of its sharpest monthly decline since 2008.

Despite the worries, the AI boom lifted Advanced Micro Devices (AMD) and Cisco Systems (CSCO). Chipmaker AMD jumped after CEO Lisa Su doubled her estimates for AI data center demand from $500 billion to $1 trillion.

CSCO had its best week in five years after reporting strong profit, revenue and guidance.

Albemarle (ALB) had the biggest gain overall in the S&P 500, riding momentum from its quarterly report on November 5.

Some of the economic data painted a relatively weak picture. ADP estimated that the U.S. lost 11,250 jobs per week in October. Separately Goldman Sachs economists said that AI could be starting to fuel layoffs.

A CNBC report also highlighted various metrics of slower consumer spending as the holidays approach. Deloitte said Americans are planning fewer trips and cutting travel budgets. The data included high-income households.

Healthcare was the strongest sector last week, apparently reflecting that recessionary sentiment. Biotechs, gold and silver miners also jumped. They’re also less economically sensitive.

| Iron Mountain (IRM) | -12% |

| AppLovin (APP) | -10% |

| Qnity Electronics (Q) | -9.6% |

| Molina Healthcare (MOH) | -9.6% |

| Dell Technologies (DELL) | -8.8% |

| Source: TradeStation data |

Economically sensitive consumer discretionary stocks fared the worst. Utilities, which have benefited from AI enthusiasm, also struggled. Homebuilders, airlines and solar energy also struggled.

Iron Mountain (IRM), which has recently touted data centers as a growth area, had its biggest weekly drop in more than three years. That came despite beating profit and revenue estimates.

Walt Disney (DIS) fell to its lowest price since early May, partially because weak advertising demand hurt revenue.

While the S&P 500 has steadily trended higher since the spring, some patterns may suggest its advance is slowing.

First, the index stalled at 6,852. That was the intraday low on October 29 when the index hit a new record high and failed to hold. Has that level become resistance?

Second, prices are pushing against a rising trendline that began on May 23. They’re also testing the 50-day moving average for the second straight week.

Third, Wilder’s Relative Strength Index (RSI) has made lower highs since late September. That kind of “bearish divergence” may reflect weakening momentum.

If weakness occurs, traders may eye the October 10 low of 6,551 as potential support.

S&P 500, daily chart, with select patterns and indicators.

This week brings some noteworthy events and earnings. However, the calendar may change as the government resumes economic reports following the shutdown.

Today features speeches from at least two voting members of the Fed: Vice Chair Philip Jefferson and Governor Christopher Waller. Given shifting views about monetary policy, their comments could impact sentiment.

Home Depot (HD), Medtronic (MDT) and Baidu (BIDU) report earnings tomorrow morning. ADP releases its weekly private-sector employment report and NAHB issues its homebuilder sentiment index.

Wednesday is perhaps the most important day:

Thursday features the non-farm payroll report for September (delayed by the shutdown).

Nothing important is scheduled for Friday.