Energy markets heat up fast. Don’t let high margin rates freeze your strategy.

Refine your approach with attractive intraday rates on crude oil, gasoline, and heating oil futures.

Futures trading is not suitable for all investors. Margin trading carries risks.

Put your portfolio’s power to use with attractive intraday margin rates.

In volatile energy markets, positioning for price swings before they surge can fuel or fracture a strategy. To help you maximize your trading power, we’re slashing intraday margin rates on some of the most actively traded energy futures contracts.

- 25% of initial margin on select crude oil, gasoline, and heating oil futures

- Applies to day-trading session, between 9:00am and 4:00pm ET

- See full list of margin rates here

Full-size energy futures

| Contract | Symbol | New intraday rate |

|---|---|---|

| Crude oil futures | CL | 25% |

| RBOB gasoline futures | RB | 25% |

| Heating oil futures | HO | 25% |

E-mini energy futures

| Contract | Symbol | New intraday rate |

|---|---|---|

| E-mini crude oil futures | QM | 25% |

| E-mini RBOB gasoline futures | QU | 25% |

| E-mini heating oil futures | QH | 25% |

Applies to day trading sessions between 9:00am and 4:00pm ET

Drill down into market data. Rev up your execution. Trade energy futures for less on an award-winning† platform.

Advanced futures traders need a feature-rich ecosystem to get the job done. That includes market data that doesn’t lag, advanced analytics tools, fine-tuned risk management, and fast, efficient execution. You’ve come to the right place. See why TradeStation has been named Readers Choice for Futures Trading Systems by Technical Analysis of STOCKS & COMMODITIES readers for more than 20 years in a row!

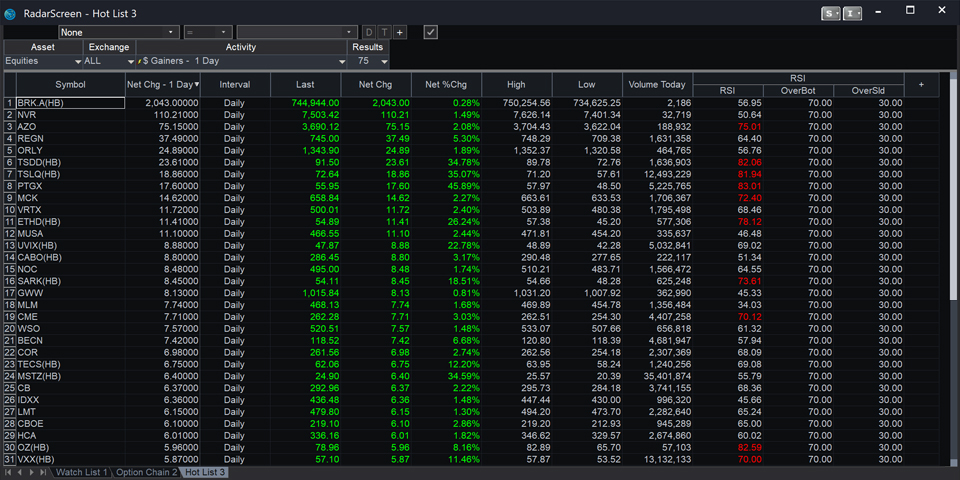

Real-time market analysis: Use RadarScreen® to cut through market noise. Unlike static screeners, RadarScreen continuously updates as market conditions change, giving you a dynamic view of price action. Take advantage of the Market Explorer tool to quickly filter through contract months, exchanges, and product types.

Deep market database: Access decades of historical data across all energy futures contracts. Analyze long-term trends to identify seasonal patterns and multi-year cycles.

Backtest your trading ideas: Stress-test your energy strategies against historical market conditions using tick-by-tick data. Validate approaches before deploying capital in leveraged futures positions.

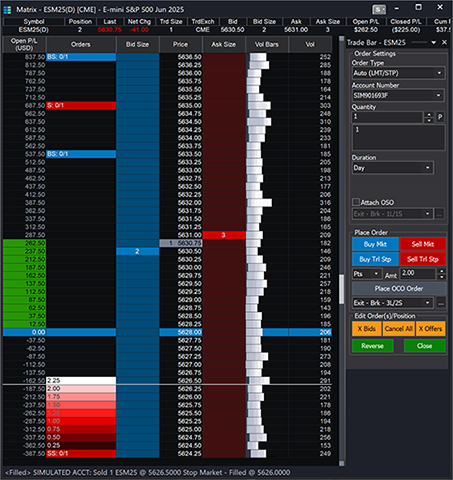

Matrix trading interface: TradeStation’s Matrix Matrix tool combines depth-of-market visualization with one-click trading. See volume at each price level, place trades directly from the price ladder, and track position and P&L in real time – all in a single interface.

Advanced charting: Complete flexibility with tick charts, daily views, and multiple timeframes for crude oil, gasoline, and heating oil futures. Place precisely targeted entries and exits from your charts without switching screens. See pending orders alongside price action and drag-and-drop to modify orders.

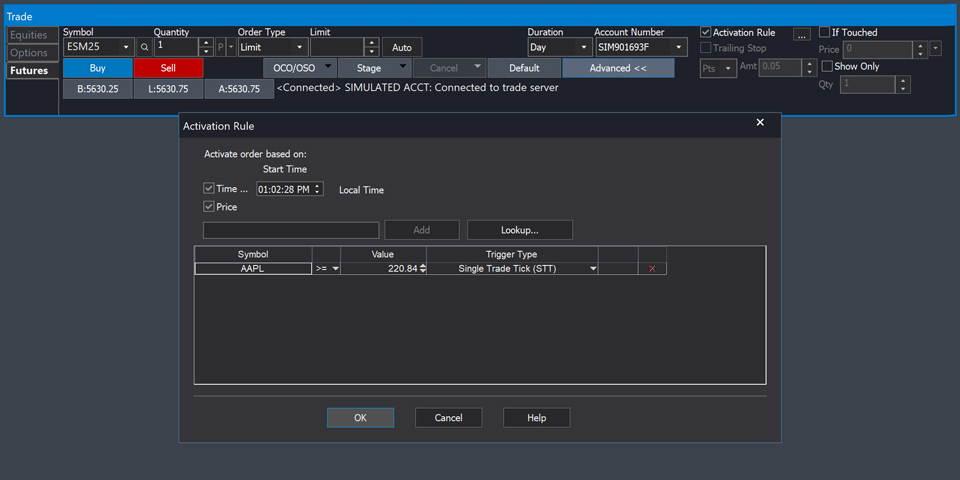

Faster order entry: Fully customizable hotkeys for almost all trading actions mean you can execute complex order types like bracket orders and OCOs in a single keystroke.

Postion management: TradeManager brings real-time P&L monitoring across all energy futures contracts, so you can track critical margin requirements and available buying power as markets shift. The Position Graph Bar on our desktop platform lets you visualize profit/loss thresholds and view account-wide exposure at a glance.

All-in-one trading environment: Trade energy futures alongside equities, options, and other futures contracts on one integrated platform.

New to futures?

For experienced traders

†Visit TradeStation.com/Awards for details.

1Any potential tax advantages or benefits will depend on your circumstances. The information provided here is for information purposes only. It is not intended to constitute tax advice that may be relied upon to avoid penalties under any federal, state, local, or other tax statutes or regulations and does not resolve any tax issues in your favor. Consult your tax professional about your individual tax situation.

Futures trading is not suitable for all investors. To obtain a copy of the futures risk disclosure statement visit www.TradeStation.com/DisclosureFutures.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com/DisclosureMargin.

ID4728972 D0825 P9243137089