Market volatility is one the biggest headaches for investors. You can make very good choices on stocks or exchange-traded funds (ETFs), researching the fundamentals and knowing their opportunities. But then a tornado of movement hits and all that hard work turns into red ink!

This is the reason why so many investors use options to hedge. Today we’ll look at the most basic technique: Protective puts.

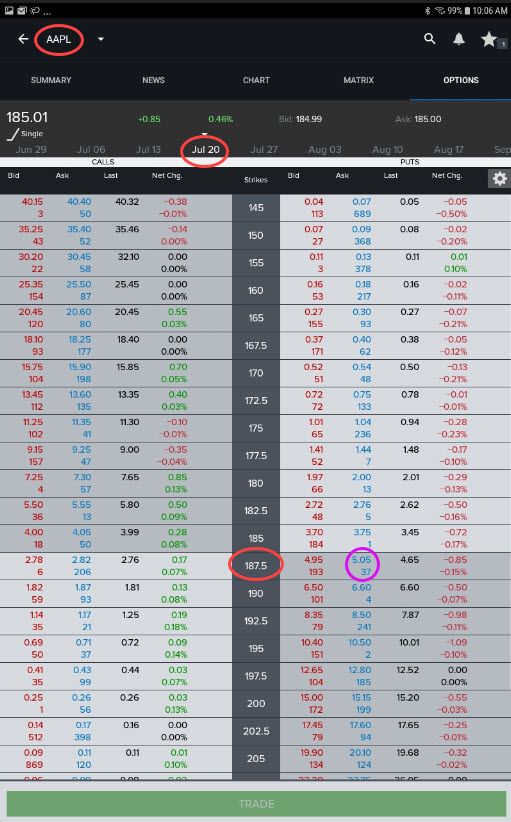

Puts are contracts that give you the right to sell a certain security at a certain price over a certain time frame. The price is called “the strike” and the time frame ends with “expiration.” Puts are identified by these key elements (outlined in red on screenshot below):

- The underlying security: This could be Apple (AAPL), the SPDR S&P 500 Trust (SPY) or countless other products.

- The strike: At what price in dollars can you dump the security?

- Expiration: The last day the puts are effective. They’ll go worthless if they’re “out of the money.”

Protective puts are often compared with insurance policies on a house. You want to live in your home and enjoy it. No one wants a fire or tornado to come along, but if one does at least you won’t get bankrupted rebuilding. It’s still bad, but not a “total loss.”

That’s the way to think about protective puts. You might believe in a stock over the long run. Knowing that a twister of volatility might spring up any day, you can buy puts as insurance. The contracts will go up in value if a selloff drives the shares below the strike. Losses will effectively be limited at that price, plus the premium on the option — almost like a deductible on a homeowners policy. You don’t want to use it, but are protected in case volatility starts blazing.

Two last things. First, remember that an option contract controls a block of 100 shares. Second, their price is expressed on a single per-share basis. In the options chain below for AAPL, the 187.50 puts expiring on July 20 are offered for $5.05. (See the magenta circle below.) But that’s the price of protecting each individual AAPL share. Buying a single contract will cost $505 and protect a block of 100 shares.

Next time, we’ll discuss covered calls.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See Characteristics and Risks of Standardized Options. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.