Last week, low interest rates freaked out investors. Now they’re helping boost an important part of the U.S. economy: housing.

The iShares U.S. Home Construction ETF (ITB) has climbed 4 percent so far this week — more than triple the gain of the broader S&P 500. It’s also hitting a new 14-month high and has potentially broken the top of bullish ascending triangle chart pattern.

Related companies like Home Depot (HD) and Lowe’s (LOW) have surged as well despite mediocre quarterly results. That can indicate deeper optimism by investors taking a glass half-full approach.

The sentiment shift follows mortgage rates dropping to their lowest since November 2016. That typically makes houses more affordable and encourages spending on improvements.

Global vs. Local

As readers of Market Insights know, borrowing costs declined mostly because of global forces. Namely, the slowdowns in China and near-recession in Germany. (Its Bundesbank actually warned of a recession on Monday.)

Meanwhile, U.S. consumers have shown few signs of weakness. Last week’s retail-sales report crushed estimates for a second straight month, and most employment indicators like jobless claims, income and payrolls remain strong. Will those two forces — strength at home and low rates from overseas — combine to boost housing? The market seems to think so.

Other numbers have helped, too. July’s existing home sales today, for instance, beat estimates. And strong building permits last week reflected a potential acceleration in construction activity.

Big Gainers in the Housing Space

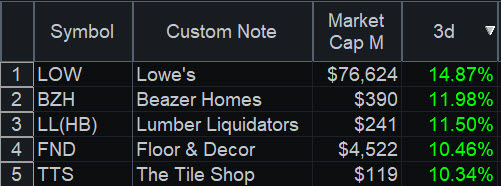

Wanting to know more about the housing sector, we downloaded the holdings of ITB from iShares website. They were added to RadarScreen® with a custom indicator allowing a week-to-date performance ranking. Here are some big movers:

- Lowe’s (LOW), up 15 percent. While its quarterly numbers weren’t amazing, better-than-expected same-store sales spurred hopes that the home-improvement chain is finally gaining traction with customers. That can lead to better pricing power and better margins — a big deal for a retailer. It would also be the polar opposite of what’s happening with traditional merchants like Macy’s (M).

- Beazer Homes USA (BZH), up 12 percent. It’s pretty much the smallest of the major homebuilders by market cap. BZH also has a heavy debt load but managed to beat earnings and revenue expectations last quarter.

- Lumber Liquidators (LL), up 12 percent. Bears have loved to hate this flooring retailer, resulting in a hefty short interest. This month, however, it had a positive write-up in The Wall Street Journal’s “Heard on the Street” column.

- Floor & Decor (FND), up 10 percent. The seller of hardwood and tile began the month by rallying on better-than-expected earnings.

In conclusion, global recession fears weighed on stocks recently. This was especially true for financials because of the yield curve. But the domestic consumer has shown few signs of weakness. That, along with lower mortgage rates, seems to be drawing money to housing stocks.