Editor’s note: This article was originally published on March 2, 2020.

Last week’s selloff is making people think the Federal Reserve will cut interest rates again soon.

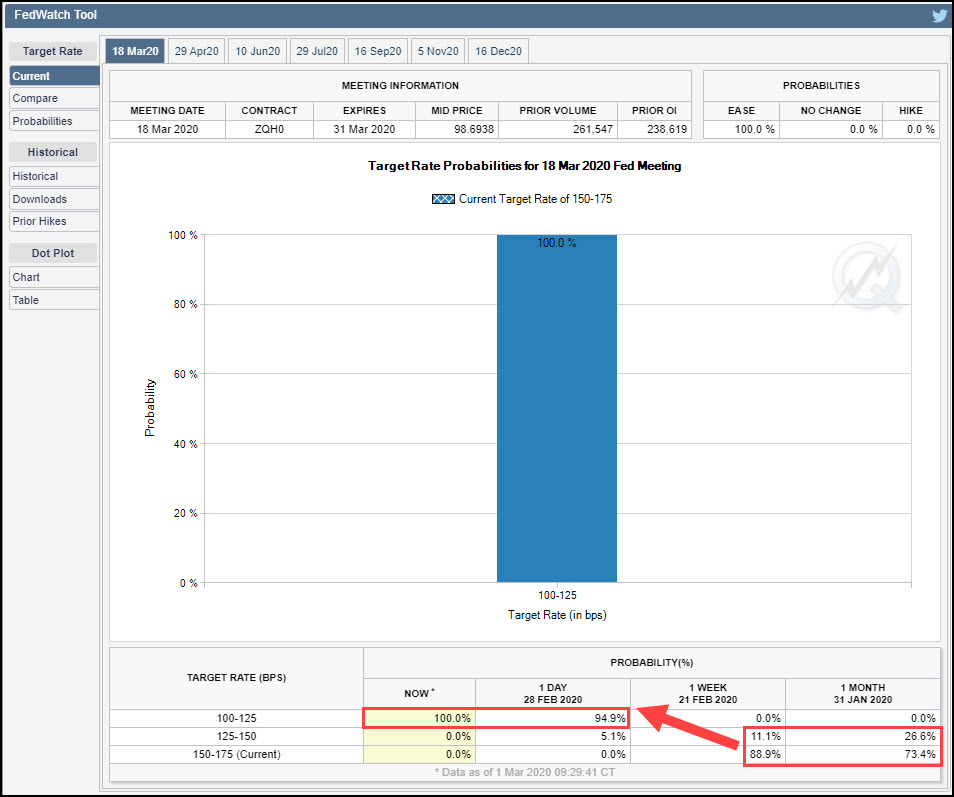

The market is pricing in a near-unanimous opinion that the Fed will lower its target rate by 50 basis points at or before its next meeting on March 18. Back on February 21 (before the selloff) few thought that was remotely possible, according to CME’s FedWatch Tool.

“The coronavirus poses evolving risks to economic activity,” Fed Chairman Jerome Powell said in an unscheduled statement on Friday afternoon. “We will use our tools and act as appropriate to support the economy.”

The outbreak has made investors swing from confident about economy to fearing a recession in a matter of days. The result? The S&P 500 plunged 11.5 percent last week, the biggest drop in over a decade and the fastest correction in history.

It’s also pushed the yields on 10-year Treasury notes and 30-year bonds to record lows.

Double Trouble From Covid-19

The disease, officially known as Covid-19, has two major negative effects on business. First, it discourages travel and consumption. Second, it disrupts factory production — especially in China. Both forces are a direct hit to the gross domestic product of countries around the world.

“We expect a 50 basis point cut at the upcoming March 18th meeting,” Bank of America economist Michelle Meyer wrote on Friday. She added a pre-meeting cut is possible depending “on the extent of market dysfunction.”

Jan Hatzius of Goldman Sachs made similar comments on Friday.

An even more detailed prediction came on Sunday from former Fed official Bill Nelson, now chief economist at the lobbying group Bank Policy Institute. He sees Powell coordinating a rate cut with other central banks — potentially on Wednesday morning.

Lower rates could soften the blow of coronavirus and make investors more willing to own stocks. It could also fuel demand for housing at the start of the key home-buying season.

In conclusion, several experts think last week’s huge crash will spur spur central bankers into action. If this perception spreads, sentiment could move back in a more positive direction — at least for now.