The world’s biggest company keeps getting more valuable as investors look for a mix of positive forces to keep it moving upward.

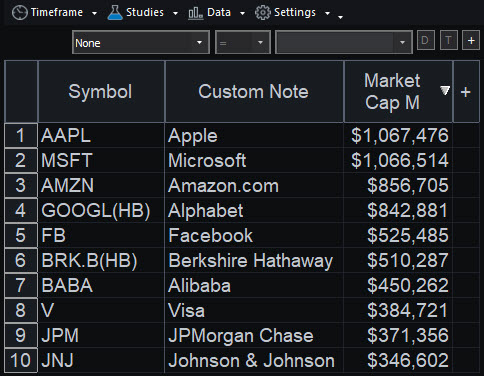

Apple (AAPL) hit new all-time highs the last two sessions and has risen for seven of the last eight weeks. That’s established it firmly over $1 trillion of market capitalization, slightly ahead of software giant Microsoft (MSFT).

While AAPL is known for flashy and high-end handsets, strong demand for the cheaper iPhone 11 is fueling the breakout. It all started on October 4, with Japan’s Nikkei reported the company boosted supplier orders by about 10 percent.

That followed AAPL’s ho-hum new product release on September 10. Everyone focused on the new Apple TV+ service, but the real story was CEO Tim Cook’s decision to roll out a cheaper version of the iPhone 11. Wall Street barely noticed at the time, but the price cut stoked demand.

Analysts are now starting to appreciate the move as iPhone buyers come out of the woodwork. Recent weeks have seen a flurry of positive notes from firms including Wedbush, Longbow Research, Bank of America, J.P. Morgan, Canaccord Genuity, UBS and TF Securities.

More Users for Services?

The growing user base comes at a big time for AAPL because it’s focusing more on services like streaming content, video games and its App Store. That means more customers for the company’s key growth area.

The market may react even more positively because service revenue is usually considered more durable than products. If AAPL keeps growing in that area, analysts will likely argue that it deserves higher valuations.

That could mean investors are willing to pay richer price-to-earnings and price-to-sales ratios. For comparison sake, AAPL now trades at about 20 times earnings and 4 times revenue. Service providers like MSFT and Facebook (FB), trade at 27-31 times earnings and 8 times revenue.

Earnings on October 30

Attention could also increase with AAPL scheduled to report earnings after the closing bell on Wednesday, October 30. Traders following the stock may want to explore options strategies because it’s one of the most liquid underliers in the entire market.

Finally, another potential catalyst is lurking in the shadows for AAPL in 2020: 5G networking and a new line of super-fast iPhones. Details won’t be clear, but investors see it as a longer-term catalyst.

In conclusion, AAPL successfully evolved from computers to MP3 players in 2001 and then to smart phones in 2007. It’s now widening its user base at the same time management makes another transition into services. Following that, it has another potentially huge upgrade cycle to 5G handsets.

As Charles Dow said, investors are forward looking and price in the future before it happens. Right now they seem to anticipate a look of positive news for one of the most successful and popular stocks in all of history.