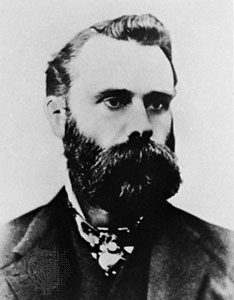

Charles Dow Founded The Wall Street Journal

Charles Dow was a late-19th century newspaper reporter in New York with a passion for the stock market. He and his partner, Edward Jones, delivered a concise and straightforward coverage of the market.

At a time when most mainstream publications were biased or even dishonest, Dow and Jones embraced credibility and objectivity. This won readers and their following steadily grew.

They formed Dow Jones & Co. in 1882, initially publishing small bulletins throughout the day. Seven years later these were consolidated into a single newspaper, and The Wall Street Journal was born.

Charles Dow Created Stock Indexes

It’s hard to imagine the stock market without indexes like the S&P 500 or Nasdaq-100. But they didn’t always exist. Charles Dow introduced the concept in a modern form in 1885 with the predecessor of the Dow Jones Industrial Average. He soon created a second benchmark for railroads and shipping firms, the Dow Jones Transportation Average.

These two indexes — industrials and transports — are key to another of Dow’s great insights: the concept of confirmation in the market.

Dow Theory

Charles Dow recognized that market moves follow trends over time. But how can you recognize moves that a part of a longer-term flow of money and not a random fluctuation?

His answer was by comparing industrials with transport stocks. If the economy truly is doing well, manufacturers don’t simply make higher profits. Companies also ship more products. Therefore strength in railroads and could confirm strength in industrials. Or weakness in the transports would be a classic case of non-confirmation.

Dow also observed that market moves have three phases: the accumulation phase, the public phase and the excessive phase.

Moves Begin With Accumulation

The accumulation phase occurs when savvy investors such as institutions begin to purchase shares against the crowd. At this point in the market cycle the crowd is either too distraught to invest due to a previous drop or are uninterested. This can be the best time to invest, but may not be immediately obvious.

Accumulation periods often begin with stocks basing out over a period of months. They may rise for no apparent reason or fail to drop on bad news.

Public Participation Comes Next

As well-informed institutions are accumulating a stock, less informed members of the general public start to notice. These are classic trend followers who recognize a constituency of larger buyers are active. They looking to ride the move as money keeps flowing into the market.

The public phase is usually the longest for a stock in a major uptrend. It can also offer the most opportunities of technically-minded traders looking to exploit price swings.

It’s also important to realize that many, if not most, traditional analysts follow this public phase. Remember they’re on the sell-side and don’t work for the big institutional money managers that drive accumulation.

Moves End in Excess

Lastly, the excessive phase occurs when the cat is out of the bag. Everyone knows about a stock and is talking about it. Sentiment is too giddy and people who missed the move come late to the party.

Meanwhile, the original buyers from the accumulation phase start to distribute their holdings.

The Internet bubble of 1999 and 2000 was a huge example of this, with the public buying virtually anything associated with technology. Investors were blind to profitability or sustainable growth prospects.

During the excessive phase everyone loves stocks and owns them. That means there are few marginal buyers to push it higher. Things can then get bearish when the selling begins and the complacent people who bought at the top become panicked sellers.

Charles Dow’s Six Tenets

Here are six basic concepts technical analysts credit to Charles Dow:

- The market trends have short-term, intermediate and long-term components. Different kinds of traders can exploit each of these over different time frames.

- Market moves consist of accumulation, public participation and excess.

- The stock market discounts all news. Dow believed that once news came out, the stock price adjusted to mirror these changes.

- Confirmation. Dow’s most famous concept, confirmation looks for transports to confirm, or not confirm, strength or weakness in the broader market.

- Trends are confirmed by volume. When price moves on low volume, investors should be wary. Conversely higher volumes can confirms a trend.

- Trends exist until a clear-cut signal indicates it’s ending.