A lot of catalysts are vying for attention after last week’s sharp drop, but two earlier trends seem to remain intact.

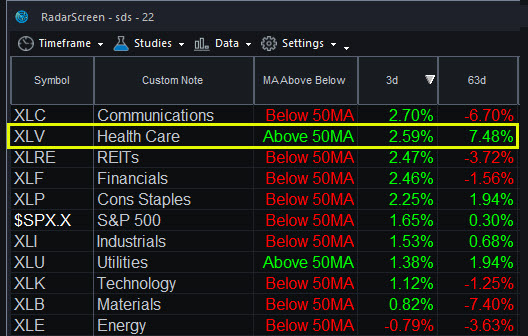

First, health-care stocks enjoyed surprising positive results last earnings season. That made the SPDR Health Care ETF (XLV) the best-performing major sector fund in the third quarter, and it’s near the top again so far this week. In fact, XLV is only one of two key SPDR funds already back above its 50-day moving average.

Of its three constituents that have reported so far this quarter, the two most important companies have beaten estimates: UnitedHealth (UNH) and Johnson & Johnson (JNJ). Both are also in the Dow Jones Industrial Average. The laggard was Abbott Laboratories (ABT), hurt by a strong dollar and higher taxes.

Interestingly, Walgreen Boots Alliance (WBA) has also ripped higher despite downright poor numbers last week. This giant is technically a consumer-staple company and not a member of the XLV. Still, investors’ willingness to buy its dip may be a sign of bullish sentiment toward the health-care industry.

Another area to watch are the biotechnology firms tracked by ETFs like SPDR S&P Biotech (XBI) and iShares Nasdaq BioTech (IBB). Both were among the biggest gainers in yesterday’s broad market rebound.

Moving on from health care, traders may want to remember Brazil with Jair Balsonaro poised to be its next president. That would mark an end to years of socialist rule and potentially usher in a new regime of pro-business policies in the giant South American country. The elections take place two Sundays from now on October 28.

The iShares MSCI Brazil ETF (EWZ) is pushing to its highest level since May and is the top-performing country fund in the last month. Click here for other stocks following the trend.