Earnings season is just getting started. This post will consider what it means for options, and how traders may want to position for the reports.

Implied volatility (“IV”) is the key term because it often declines after big events like quarterly results. Traders often respond by selling options, which lose value when IV drops. Still, there are always plenty of risks.

IV indicates how much the market thinks a stock will move over the next year. Historic volatility shows how much it moved in the past, while IV projects into the future. Because events like earnings have uncertain outcomes, they often increase IV.

That, in turn, boosts options prices. However, both typically fall after the news passes. Here are some ways traders look to profit from this ordinary process.

Covered Calls Are Short Vol

Covered calls are one of the most basic option strategies. This consists of owning shares and selling calls against them.

Because it involves selling options, covered calls by definition are “short volatility.” They make money from premiums declining.

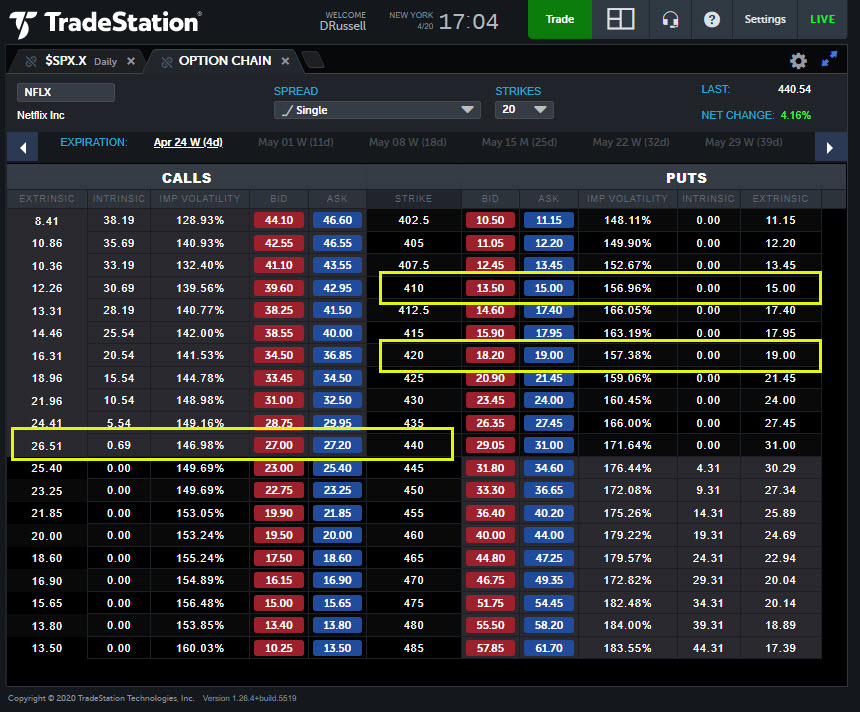

Let’s consider Netflix (NFLX), which reports this afternoon. It closed at $437.49 on Monday. A trader could have sold the 24-April 440 calls (expiring this Friday) for $27. These contracts are slightly out of the money, so extrinsic value accounts for all their premium.

They’ll expire worthless if NFLX remains below $440 through the end of the week. Above that level, a trader would be obligated to sell their stock for $440. When you include the $27 collected up front, their real exit price will be $467. ($440 + $27)

There are two risks:

- NFLX jumps above $467. Their profit will never get any bigger, no matter what.

- NFLX has a violent crash. They’ll make some money from the calls going worthless. But they’ll also lose money on their shares.

The covered call lowers their cost basis by $27, which provides limited protection against a drop. In this case, they’ll break even as long as NFLX remains above $417. (That’s the current price of $410.49, minus the $27 premium collected.)

Overall, the covered call profits from the stock going sideways and the options losing value.

Credit Spreads and Volatility

A more advanced technique involves selling options without underlying stock. This can have big risks when done in isolation. But combined with other options, it can be an effective strategy.

Say a trader thinks NFLX will stay above $420 through the end of the week. He or she could execute a “credit spread” like this:

- Sell the 24-April 420 puts for $18.20.

- Buy the 24-April 410 puts for $15.

They’d collect $3.20. ($18.20 – $15) If NFLX remains above $420, the entire position will expire worthless and they’ll keep the $3.20 as profit. (Remember to multiply this by $100 for each contract because options control 100 shares.)

Their risk is to the downside because a drop below $420 would force them to buy stock at that level. Owning the 410 puts limits the spread’s value at $10, preventing a huge loss from the stock falling below that level. This way, their maximum pain is $6.80. (That’s the $10 spread, minus the $3.20 collected.

Tech Earnings and the VIX

These strategies may be useful now because coronavirus triggered a historic spike in volatility. Traders expecting a return to normal in coming weeks may also look for options premiums to decline if social distancing ends.

Aside from NFLX, several key technology companies report earnings in the next few weeks. Some of them trade more than 100,000 options contracts a day, which can result in better pricing. Here are some big names to watch:

| Date | Stock | Avg Options Volume |

| 4/21 | Netflix (NFLX) | 148,000 |

| 4/28 | Advanced Micro Devices (AMD) | 349,000 |

| 4/28 | Alphabet (GOOGL + GOOG) | 51,000 |

| 4/29 | Facebook (FB) | 199,000 |

| 4/29 | Microsoft (MSFT) | 384,000 |

| 4/29 | Tesla (TSLA) | 471,000 |

| 4/30 | Apple (AAPL) | 689,000 |

| 4/30 | Amazon.com (AMZN) | 198,000 |

| 5/7 | Roku (ROKU) | 130,000 |

In conclusion, selling volatility before big events like quarterly results is a common options strategy. This earnings season may have even more opportunity because of all the uncertainty resulting from coronavirus.

Disclaimer: This article is for educational purposes only and shouldn’t be considered a trade recommendation. Trading options may not be suitable for all investors.