After a busy year, the Federal Reserve is set to begin a long vacation today.

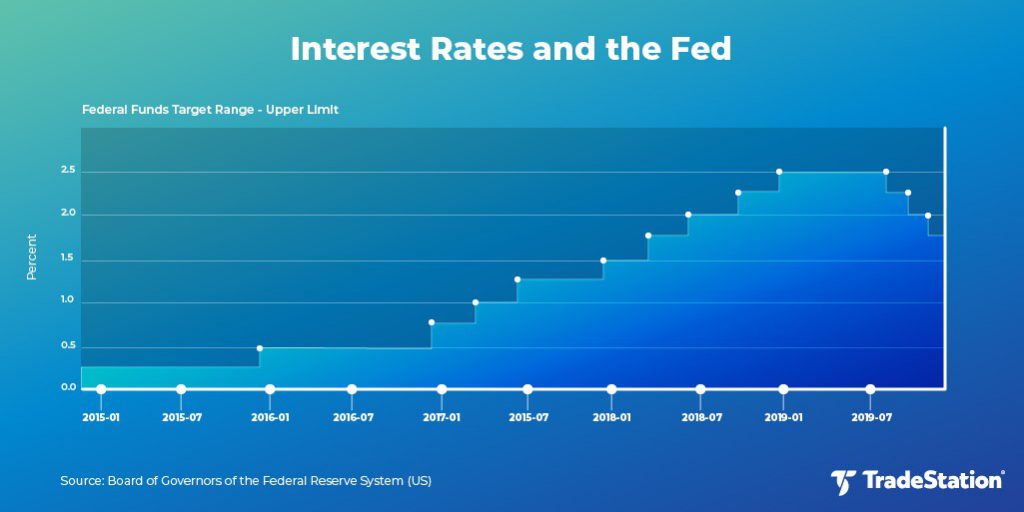

The central bank is expected to leave interest rates unchanged, following a trio of cuts since the summer. Going forward, markets see them going nowhere well into next year.

The official policy announcement is due at 2 p.m. ET and a press conference is 30 minutes later.

So what else should we expect from the meeting? Fed statisticians will also release long-term estimates for U.S. economic growth. We could see a small increases, based on recent strong numbers like Friday’s non-farm payrolls report.

But even with that good news lately, interest rates are unlikely to change anytime soon. Last month Fed Chairman Jerome Powell said there are no major bubbles in financial markets that need to be popped with tighter monetary policy. To use an old saying, there’s no reason to take the punch bowl away from the party yet.

He hammered that point home on November 25, hoping inflation will reach 2 percent. That’s also accomplished with low interest rates.

Balance Sheet Growth

Another story has been “balance sheet” expansion. In the dark days after the financial crisis, this was another way of keeping interest rates low. But this time it results from some technical anomalies between banks. It’s not likely to be very important for investors or the market.

However there are some interesting takeaways. First is that Americans continue to reenter the workforce. We can see that in the Labor Force Participation Rate and the Civilian Labor Force Level. Google either and you can see for yourself.

We got a similar clue from another report yesterday. Productivity fell 0.2 percent in the third quarter, even as hours worked increased. Meanwhile, average pay rose less than expected. Again, not a surprise when less experienced people come back to work. They work more, produce less and earn less than established employees.

This has a double positive effect on the economy. Obviously more Americans working is “good.” But it also means wage inflation isn’t spiking. That, in turn, argues against sharp Fed rate hikes.

Global Stocks

Global stocks and emerging markets could be the second big trend to watch because low rates in the U.S. can make investors favor international assets.

There have also been several positive stories overseas this week. Germany’s Zew confidence survey rose much more than expected to its highest level in almost two years. German exports and the Euro Zone Sentix index also beat expectations. On top of that, Japan revised its gross domestic product sharply higher.

Still, China may face more tariffs from the U.S. and Britain has parliamentary elections before a potential Brexit under Boris Johnson. We’ll know more on both stories within the next week.

In conclusion, the Fed’s meeting today is likely to be a non-event on the surface. However it shows some important progress about the U.S. economy and may nudge investors toward some neglected corners of the market.