Transportation stocks just had their best week in a year.

The Dow Jones Transportation Average ($DJT) advanced 4.35 percent since the close on Friday, November 23. Big names like Union Pacific (UNP), Delta Air Lines (DAL) and United Parcel Service (UPS) were among the top gainers.

Most of the rally came after Federal Reserve Chair Jerome Powell indicated the central bank will stop raising interest rates sooner than expected. That removed a drag on economic growth. There’s also been hope of a cease-fire in the trade war between the U.S. and China.

Investors responded by piling into transports because they’re sensitive to ebbs and flows in the business cycle. Pioneering financial journalist Charles Dow, founder of The Wall Street Journal, noticed this link over a century ago. His approach (“Dow Theory”) could be used to argue that the strength in rails, airlines and shipping stocks is a positive for the broader market.

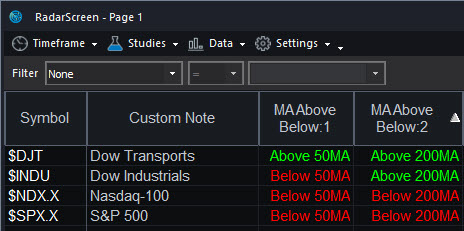

It’s also noteworthy that $DJT is the only major index to finish this week above both its 50- and 200-day moving averages. (See RadarScreen® below.) Meanwhile the technology-heavy Nasdaq-100 is below both of those lines.

In conclusion, sentiment has improved dramatically this week thanks to the Fed and hopes of better relations with China. Given the bigger headwinds in tech, investors looking to own equities may be shifting to other parts of the market like transports.