Trading options? This spring brings new trading tools for constructing your trades in these volatile times.

Today we’ll show how to choose an options strategy in TradeStation Web Trading based on your market outlook.

You can find option trades not only in up and down markets, but also in quiet markets when the stock price stays flat, or active markets, when the price moves a lot (like during the coronavirus pandemic).

Trading your strategy — bullish, bearish, neutral, or volatile — has never been easier. Here’s a way to find spreads that match your strategy if you think the S&P 500 is moving a lot.

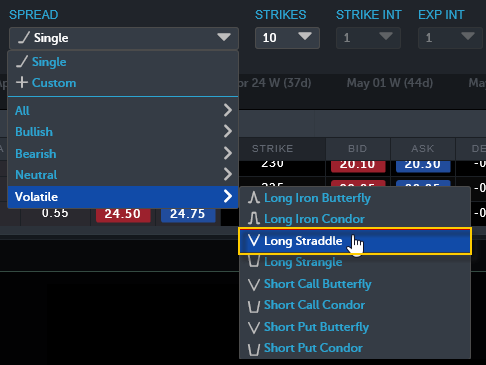

First, from the Option Chain tab in TradeStation Web Trading, enter SPY in the symbol box. Then, select Volatile from the Spread drop-down menu. A list of popular volatile option strategies appears. Let’s choose Long Straddle as an example.

Smarter Option Chains

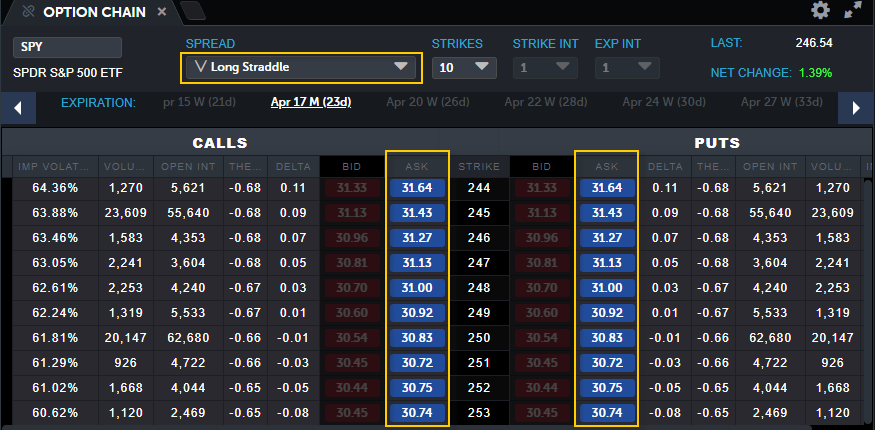

Then, snap! Your customized Option Chain is built. The spread type you select automatically adjusts the strike price column and related Calls and Puts values to reflect the prices for that spread over a range of expiration dates. The Option Chain is dynamic, with streaming data.

But that’s not all.

The best part — and the focus of the new technology — is that the applicable columns light up, showing us which options trades match your strategy. This makes it easy to keep an eye on the stats that are most important to us.

In this case, the Calls and Puts columns both light up because the long straddle strategy is made up of a long call and a long put purchased at the same expiration and same strike price. A long straddle works best when you’re expecting a big move in the market, one way or the other.

From the list that’s illuminated, you can home in on only the trades that apply to your strategy. You can choose from the expiration dates above the Option Chain.

The Ask price buttons are highlighted in blue so you can swiftly spot where to click to buy. For bearish strategies, the Bid price buttons light up in red.

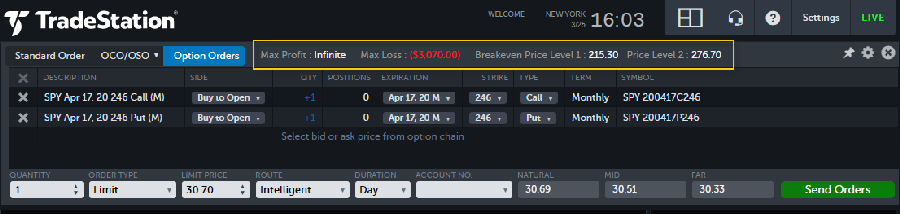

Click an Ask price button to initiate a trade. After you’ve entered a Limit Price in the Option Trade Bar, you’ll see the trade’s maximum profit, maximum loss, and breakeven price(s).

If you’re ready to place the trade, click Send Order(s). When your confirmation dialog appears and the trade looks correct, click Send. You’ll see a message that the order has been sent and can check the status of your orders on the Orders tab.

And that’s a wrap! Now you know some time-saving strategy building techniques that can help you spring into action when the market is moving.

Disclosure: Options trading may not be suited for all investors.