It’s a busy time for investors, with earnings and the S&P 500 trying to reclaim 3,000. There’s something else in the background: The IPO market is buzzing as companies push deals before the summer holidays.

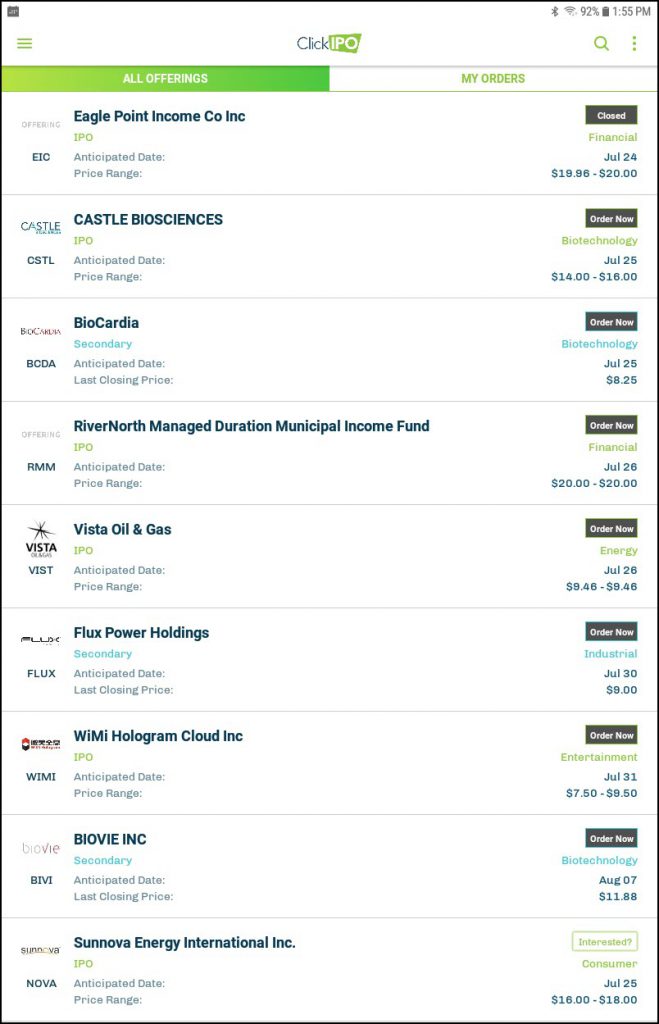

A record seven offerings are available on ClickIPO, a partner giving TradeStation clients access to new companies before they go public. That’s right, gone are the days when only super-rich individual investors could access initial public offerings (IPOs).

The roster includes a hologram company, a biotechnology firm and an oil-and-gas driller. There are also two secondary offerings by companies already in the public market. (See below.)

WiMi Hologram Cloud (WIMI) could be the most intriguing in the near term. The Chinese company’s augmented-reality (AR) tools let advertisers insert objects into videos and images as if they were real. Want to add your product to a movie or TV show? Sixty-five customers have signed up so far, according to the prospectus on ClickIPO’s app.

The company plans to sell 4 million shares for $7.50 to $9.50 — or about $30 million to $38 million of proceeds.

Mini Rush Before Vacation?

IPOs have gotten more active as the broader equity market stays bullish. Last month was the busiest June of the decade, and the second quarter was the most active period in almost four years. The pipeline indicates a mini-rush in the next few weeks before the vacation period in late-August.

A combination of solid economic growth and low interest rates have supported sentiment. Just today the S&P 500 pushed back over 3,000 amid reports that President Trump may be near a trade deal with China.

In conclusion, the IPO market is back in business as Wall Street takes advantage of favorable conditions. This time around, new technology is making more deals available to ordinary investors than ever before. Will you be one of them?