Stocks keep climbing amid bullish news as we enter a super-busy week of events.

The S&P 500 rose 1.2 percent between Friday, April 19, and Friday, April 26. The index also closed at a new all-time high of 2940, with technology and the Nasdaq-100 still leading the charge.

Good corporate earnings, solid economic numbers and an apparent glut of money on the sidelines were some of the positive catalysts. Will sentiment remain bullish this week, which is packed with big events? (See below for a full breakdown.)

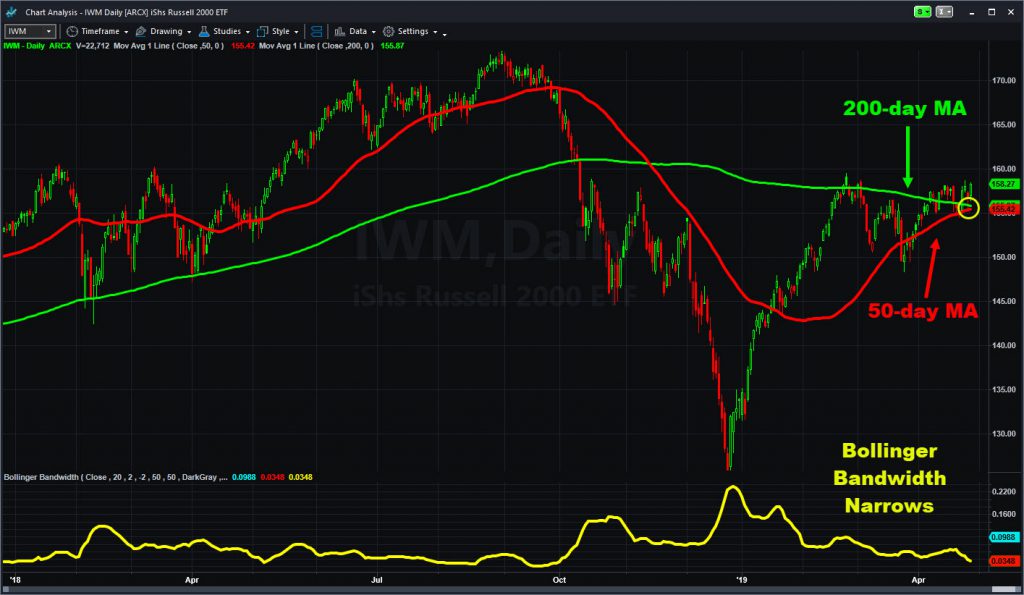

Buyers were active across several sectors last week. They chased the strength in social media stocks as Facebook (FB) and Twitter (TWTR) recovered from last year’s crisis of confidence. They value-hunted health-care stocks after a mid-April liquidation. They also pushed banks and small caps against the top of their tightening ranges.

Roughly three-quarter of companies have beat profit estimates so far this earnings season, relieving some fears about a sharp slowdown in profits. Aside from FB and TWTR, Microsoft (MSFT), Amazon.com (AMZN), Coca-Cola (KO) and Ford Motor (F) were some of the other happy surprises recently.

Winners & Losers

Toy maker Hasbro (HAS) was the single biggest gainer in the S&P 500 last week, ripping 15 percent after the Bumblebee film kick-started demand.

Anadarko Petroleum (APC) was second on the list with a 13 percent increase. It bucked weakness in the broader energy space thanks to being the target of a bidding war between Occidental Petroleum (OXY) and Chevron (CVX). Align Technology (ALGN) and TWTR vied for the No. 3 spot, both on strong quarterly numbers.

But then you have 3M (MMM). The industrial conglomerate missed across the board and suffered its worst one-day selloff in a generation. Its 12 percent drop was the worst in the S&P 500 last week.

Chip maker Xilinx (XLNX) followed with a similar decline after analysts predicted weaker results going forward.

Energy was worst-performing sector overall as President Trump jawboned crude oil (@CL) lower. Black gold also had an unexpected inventory build on Wednesday, followed two sessions later by its biggest price drop of the year.

Economy & Technicals Remain Strong

The U.S. economy grew 3.2 percent in the first quarter, blowing past estimates. It also marked a big improvement from earlier in the year, when forecasters worried about the government shutdown and less fiscal stimulus.

So, what did they miss? First, a sharp improvement in foreign trade as exports rose and imports fell. Second, increased state and local government spending. Third, strong corporate investment on inventories and software.

Private consumption was relatively tepid, but last week also saw better-than-expected new-home sales. How long can housing remain in the doldrums with interest rates this low and employment this strong? That could be an increasingly important question as we move into summer.

Things also seem to remain bullish from a technical point of view after the S&P 500 inched above its September highs. The index has advanced steadily since entering the month with a “golden cross” chart pattern.

An ‘Uber’ Busy Week Ahead

As mentioned, this is set to be one of the busier weeks of the year. It has the most companies reporting for any week this earnings season. There’s a Federal Reserve meeting and press conference on Wednesday, followed by the Labor Department’s non-farm payrolls report on Friday.

To top it all off, Uber (UBER) will market its shares ahead of an initial public offering (IPO) that’s certain to draw heavy attention. Several other companies are also issuing shares for the first time. Log on to our partner, ClickIPO, for more.

Here’s a rundown of the biggest events this week:

- Monday: Personal income and spending are due, along with Alphabet (GOOGL) earnings after the closing bell.

- Tuesday: The Euro Zone announces gross domestic product and the Conference Board reports consumer confidence. MasterCard (MA) and General Motors (GM) are two of the big names in the morning. Apple (AAPL) and Advanced Micro Devices (AMD) are two of the big names after the closing bell.

- Wednesday: ADP’s private-sector payrolls report, the Institute for Supply Management’s manufacturing index and crude-oil inventories are due. The Fed’s interest-rate decision and press conference follow in the afternoon. Qualcomm (QCOM) is the biggest earnings name.

- Thursday: Initial jobless claims and Activision Blizzard (ATVI) earnings come out.

- Friday: Non-farm payrolls from the Labor Department and ISM’s service-sector index will be reported.