Uber’s initial public offering (IPO), one of the most anticipated deals in history, is drawing near.

“Uber hires more IPO underwriters as it prepares to go public,” read the Reuters headline last night. The timing is reportedly flexible, with the possibility of pricing before the end of June.

Sources told the news wire that firms including Bank of America (BAC), Barclays (BCS) and Citigroup (C) were added to the Uber IPO. They’d join lead underwriters Morgan Stanley (MS) and Goldman Sachs (GS).

Uber’s deal will follow smaller ride-sharing rival Lyft. It also comes amid a busy year for IPOs as major technology companies come to market following years of growth under private ownership. Pinterest, Airbnb and Slack are also in the works.

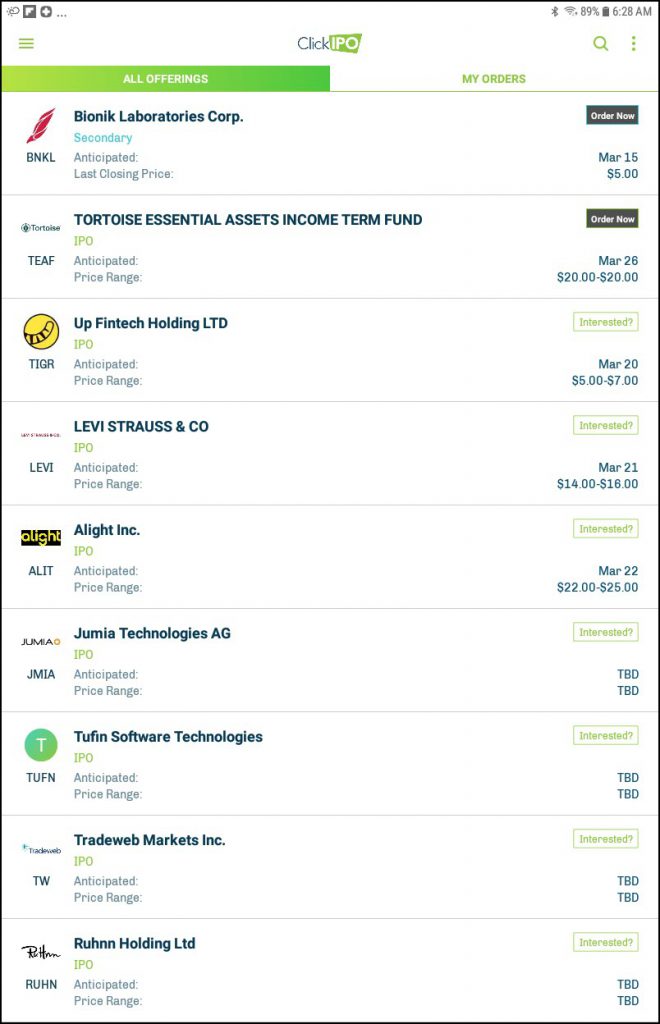

In the nearer term, a handful of deals are scheduled to price. Here are a few from ClickIPO, which helps individual investors gain access:

- Up Fintech (TIGR): a Chinese online brokerage. Did you know the Asian country’s tech stocks are outperforming again this year — despite trade uncertainty with Washington?

- Levi Strauss (LEVI): The 165-year-old denim company shows that San Francisco isn’t only a technology town.

- Alight (ALIT): Yet another cloud-based provider of business services, this one focused on human resources. It looks similar to Ceridian (CDAY), which went public 11 months ago and closed at a new all-time high yesterday.

ClickIPO preview of upcoming offerings.