Initial public offerings have faced a double-whammy of challenges, but now experts expect a pickup.

First, the stock market ended 2019 with its worst quarterly drop in over seven years. Volatility like that is a challenge for any company going public, but it was especially difficult because the selloff hit technology stocks the hardest. As a result, IPO volume in November and December fell about half from its pace earlier in the year.

Next, the government shutdown prevented the Securities and Exchange Commission from reviewing the companies’ applications. Fortunately for the market, it on January 25.

And now the pipeline is filling. Last week saw the first deal since mid-December, power-generation firm called New Fortress Energy (NFE). This week brings two names, including a biotechnology company focused on oncology, which has been a hot corner of the drug market.

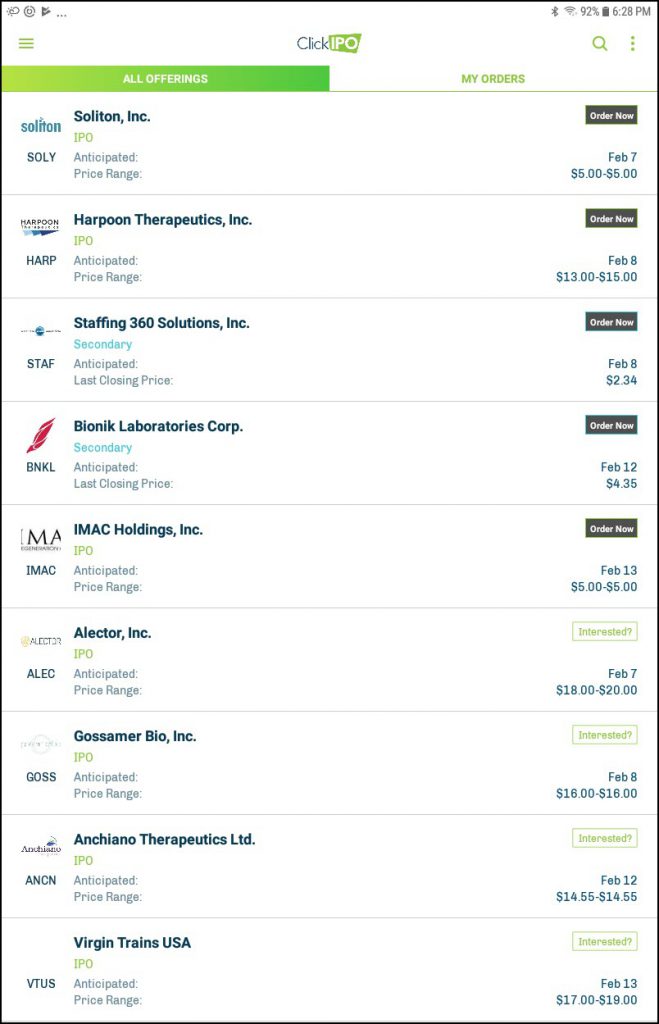

Harpoon Therapeutics (HARP), is expected to sell shares for $13 to $15 on Friday, according to TradeStation’s partner ClickIPO. Its technology modifies patients’ own immune systems to kill tumors. Its pipeline includes possible treatments for prostate, ovarian, small-cell lung cancer, along with multiple myeloma. Most are in early stages of development.

And don’t forget that later this year investors are looking for some very big, high-profile transactions like Uber, Lyft and Pinterest. Slack, a provider of workplace-collaboration programs, just filed for its IPO yesterday.