This post is a translation of the weekly cryptocurrency analysis by Crypto Lab, a wholly owned subsidiary of Monex Group (Tokyo, Japan). Monex is the parent of TradeStation Group.

Bitcoin rose temporarily along with stocks, but leveled off due to a series of adverse factors

As if to dispel the concerns seen at the beginning of the year, stock market prices have continued to rise, the risk-off mood has eased and BTC buying dominance has developed since the beginning of the week.

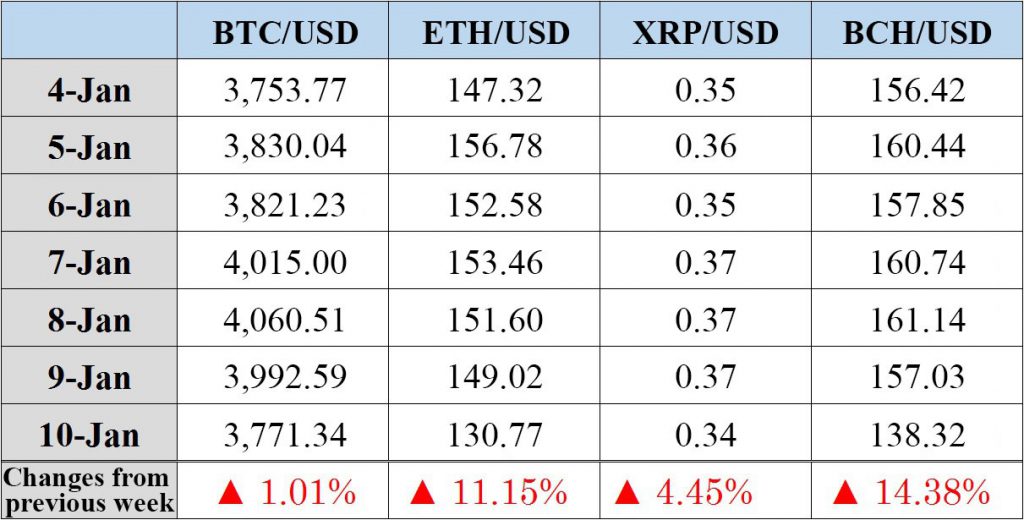

Although the report was false, BTC prices rose sharply to around $4,064 as a result of the FSA’s cryptocurrency ETF review report on January 7. Thereafter, due to the FSA’s denial of the report and considerations regarding the introduction of EU unification regulations etc., price increases were suppressed. Coupled with the announcement introducing a new regulation by China on January 10, the long position that had been accumulating since the end of the year was terminated and BTC plummeted to around $3,787. Prices for the week have leveled off.

ETH prices fell due to a heavy increase in prices as a result of the illegal mining of EthereumClassic (ETC) and the rise of profit-taking the previous week.

BCH sales intensified on the January 10 and subsequently fell likely due to news of the resignation of Jihan Wu of Bitmain, who is known for his support of BCH.

Next Week’s Market Forecast

Will there be weak BTC activity? With some negative factors this week and BTC price slipping below $3,695, investor sentiment is worsening and the short position is building again.

However, although expectations for a price rise have diminished, long positions remain dominant. Moreover, based on the positive factor that some U.S. asset management companies have been seen newly applying for the creation of cryptocurrency ETFs, no massive price collapses are to be expected. BTC may range between $3,510 and $3,695. Prices are expected to dip once again depending on which factors emerge next.

With the upcoming Constantinople hard fork next week, it is crucial to watch the movements of ETH around January 16.

Next Week’s Topics

- Steem planning SMT test net release. (January 15)

- ETH is planning to carry out Constantinople hard fork. (Around January 16)

- CBOE futures XBTF19 finalize trading date. (January 16)

- Crypto Finance Conference will be held in Switzerland. (January 16-18)

- The North American Bitcoin Conference will be held in Miami, U.S.A. (January 16-18)

- The NITRON Summit will be held in San Francisco, U.S.A. (January 17-18)

- The U.S. India Blockchain Summit will be held in India. (January 18-19)

- The Queen’s Global Energy Conference will be held in Canada. (January 18-20)

Industry-Related Trends

Colorado Moves to Oppose SEC Policies

On January 4, Colorado state legislators submitted a bill to exclude some cryptocurrencies from the Securities Act in the state.

The bill, known as the Colorado Digital Token Act, aims to reduce regulation on the use of cryptocurrency for consumption (rather than investment purposes). Under those circumstances, some companies will be exempted from the Securities Act, eliminating the need to be licensed and registered as brokers and sales agents.

As control over cryptocurrencies by the U.S. Securities and Exchange Commission (SEC) becomes increasing unclear, Colorado’s proposal could expand cryptocurrency-related business in the state by clarifying the scope of regulation. Governor Polis is a known cryptocurrency advocate expected to promote blockchain policies.

In the U.S., movements to oppose the regulatory policies established by the SEC for cryptocurrencies are spreading among some politicians. According to the course of events thus far, the impression to reinforce regulations comes across as strong in the country as a whole. Still, industry trends across the country vary at the state levels.

ProgPoW Implementations Discussed During the ETH Developers Meeting

On January 4, discussions were carried out regarding a consensus building algorithm during the regular meeting of ETH core developers.

ETH is currently adopting the PoW algorithm Ethash prior to migrating to PoS. One of the improvements proposed for this is ProgPoW, an algorithm with ASIC resistance. This proposal emerged due to increasing concerns over the monopoly of mining inside communities due to the progress of Ethash ASIC by mining companies such as Bitmain last year.

It is difficult to judge the pros and cons of ASIC given that opinions are split within the industry with regard to the profitability and dispersion of mining. However, in this meeting, many developers voiced their support for the implementation of ProgPoW. Presently, it is being test-operated, and developers report that the hash rate is stable.

With the upcoming ETH Constantinople hard fork next week, various technical movements should appear again this year.

Launch of DX Exchange Drawing Interests in the Industry

On January 7, Estonia-based cryptocurrency exchange DX Exchange started providing trading services officially.

In addition to the usual cryptocurrencies like BTC, XRP, and LTC, it is drawing interest by allowing sales of the upper 10 stocks on the NASDAQ market such as Amazon.com (AMZN), Facebook (FB) and Alphabet (GOOGL) as tokens. These stock tokens are issued as ERC20 tokens based on actual stocks owned by partner MarketPlaceSecurities.

Services are currently limited to the European Union region, but the company is planning to start expand into the U.S. in the second or third quarters of 2019. This will let users trade U.S. equities from anywhere, 24 hours a day and 365 days a year, at small amounts. That’s expected to enhance the liquidity of assets. The exchange’s uses the NASDAQ matching system and monitoring software. Given that NASDAQ is also reinvigorating activities in the area of cryptocurrencies, the two companies may collaborate moving forward.

Some may view the use of stock tokens with suspicion in terms of regulations and safety. However, along with the dissemination of the security token offering (STO) expected in the industry, the tokens are expected to become commonly used.

The day Satoshi Nakamoto reveals his true self

“Shock” is stronger the longer something stays hidden. There was an incident at the very start of the new year that taught me this once again.

Every year on January 2, members of my high school activity club would gather for a New Year party. It has been about a decade since our graduation, but strangely the attendance hasn’t dropped. Once again this year, more than 80 percent of my classmates came for the party. Given that we are all in our late 20’s, marriage is a common topic of conversation. Over the past few years at each gathering, there would always be someone saying that they had gotten married. Once again this year, a few reported their happy news.

Among us, one person stole the spotlight of the gathering all at once. He used to be a shy fellow who knew little about girls during our high school years. Of course, everyone was shocked when we found out he was one of the first ones to get married. What drew more excitement was the fact that he had been with his future wife for seven years before they got married. “No way!” was what everyone at the venue said out loud looking at him.

He was there every gathering, so why did no one know that he had a girlfriend? Why did we never ask, “Do you have a girlfriend?” in our conversations? Perhaps we had missed the timing from shyness. If he had made it a point to keep quiet about it, that is certainly admirable. “One cannot beat someone who is able to keep such a secret for seven years,” said the person who had been the center of the conversation until then.

No one really knows the true self of Satoshi Nakamoto to date. There are people in the industry that proclaim that they are like him. But I would never say such a thing. The real Satoshi Nakamoto keeps looking for the timing to reveal his true self, one that would leave his name behind in history. This year marks 10 years from the birth of Bitcoin. “It’s still too early.” I can image him calmly watching the fate of the industry with a fearless smile, as if he were God.