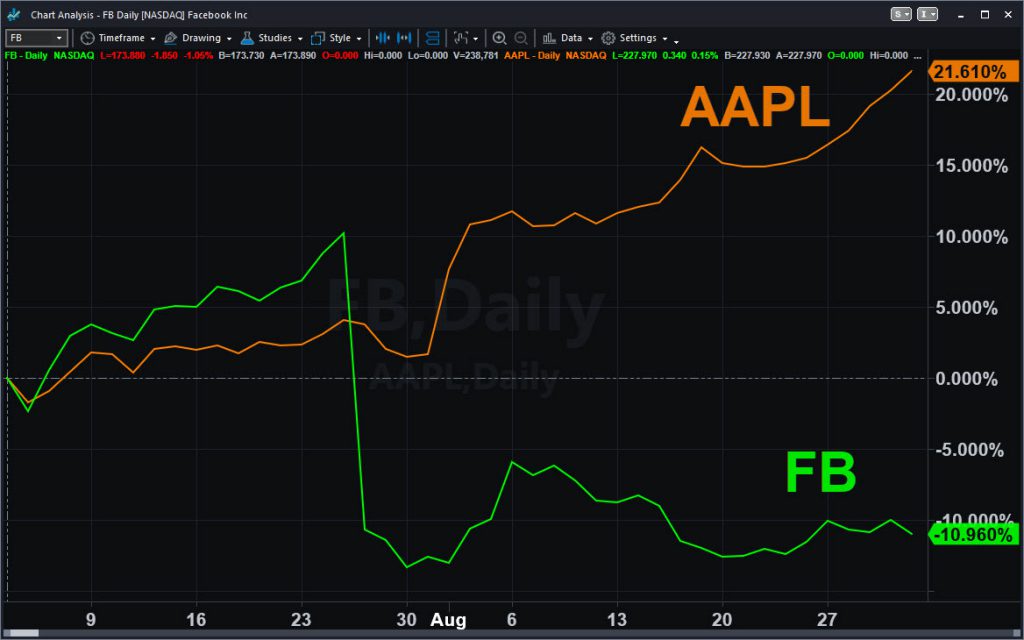

Two tech giants are moving in two very different directions as we enter the home stretch for the third quarter.

Apple (AAPL) has appreciated 22 percent since the end of June. That makes it the second-best performer in the SPDR Technology Fund (XLK), with only Advanced Micro Devices (AMD) faring better.

However, Facebook (FB) is the fourth-worst over the same period with an 11 percent drop.

Most readers probably know some of the story. AAPL’s latest results on July 31 revealed gains in stickier service revenue and highlighted the company’s ability to hurl cash back at investors in the form of buybacks. Tim Cook is also charging more for the company’s iconic smart-phones, which is pretty clever.

FB is going in virtually the opposite direction. Where AAPL’s quarter could be described as transformative in a good way, the social-media giant’s numbers devolved into something much less bullish.

Instead of widening, margins are squeezed by new costs. Instead of growing at a rampant pace like in the old days, FB’s traffic is slowing. Where AAPL seems to have a clear path to growing its proven services business, some of FB’s key initiatives haven’t gotten far off the ground yet.

Meanwhile, things might get even harder for Mark Zuckerberg’s company because a new and dangerous predator is loose in the ecosystem: Amazon.com (AMZN). Yep, in case you forgot, Jeff Bezos’ steamroller is moving into the online advertising market.

Suddenly FB has to deal with multiple problems: higher costs, slowing traffic and dangerous killer with a history of devouring its prey. That’s right, America’s No. 4 website is going after No. 3.

The prospects for AAPL, on the other hand, seem to be brightening as the market eagerly awaits the rollout of new iPhones on September 12. Analysts expect three new devices, including some with bigger and better displays. Tech lovers who follow the company closely predict they’ll be called iPhone XS and offer the option of gold cases. A new watch also seems to be in the works.

In conclusion, technology is always about innovation and growth. And right now, the winds seem to be clearly blowing in different directions for two of the sector’s biggest companies.