The price action in the major U.S. indexes in the last couple of weeks is a perfect illustration of how the stock market tends to constantly discount the future. Coronavirus headlines have hijacked almost all the nation’s news headlines, unemployment claims have seen the largest gains in history, and a large part of the U.S. has remained closed for weeks.

Glimmer of Hope

Equities have told a different story, however. Since the end of March, the S&P 500 ($SPX.X), the Nasdaq ($NDX.X), and the Russell 2000 (@RTY) have registered gains of 23 percent or more. The recoveries in the major indexes have been violent and V-Shaped in nature.

Nothing material has changed with the U.S economy: Cities are still in lock-down, little travel is taking place, and almost all retail storefronts are closed. The spectacular move in stocks is further proof that markets tend to be forward-looking. Often, a bottom will be put in when the news headlines are at their worst. The fact is that investors have put money to work with the hopes that America will soon be open for business again.

What were the clues?

There is something to be said for traders who can block out noise during turbulent market gyrations. While news headlines can be exaggerated or manipulated for clicks, equities prices are always based on supply and demand. Since the global financial crisis in 2008 $SPX.X and @NQ have held the monthly 50 Simple Moving Average (SMA).

Why is this significant? Moving averages on longer time frames are more impactful because there is much more data. Technicians also generally put more credence on a moving average when it has been touched multiple times and far apart. After regaining the 50-SMA post-financial crisis, the monthly average was able to hold during corrections in 2011, 2016, and 2018. It’s realistic to believe that while traders watching this moving average might not have caught the bottom, they could have potentially got out of any meaningful short positions in their portfolio.

The S&P 500 Volatility Index ($VIX.X) also stuck out. The measure of fear and greed blasted to levels near financial crisis in 2008! Look at any long-term chart of volatility and you’ll find that it contracts over time. Massive spikes in volatility don’t always mean that the bottom is in, but it can be a great clue that it is close. Volatility is usually not used as a signal. The behavior of the instrument should be looked at in conjunction with price, volume, and other indicators for the best results.

Reversion to the Mean

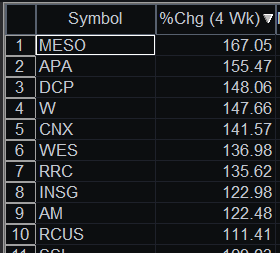

The stocks that have led the market higher are the same stocks that lead the market lower as more and more news of the pandemic broke. I created a simple scan in the TradeStation platform to show this. If you want to follow along the instructions are as follows:

- In the TradeStation platform click “File” -> “New Application”-> “Scanner”

- Navigate to “Create Scan” and enter the desired name.

- Under “Symbols to Include” select “All Stocks”.

- Under the “Scan Criteria Field” I chose “% Chg (4wk)”, “Top%” as Operator and a value of 5

- Lastly I added another field of “Market Capitalization (Mil), used “>” as the operator, and 1000 as the value

The goal of the scan was simple: identify which stocks with a market cap of more than a billion have gained the most over the rally in the last four weeks. The answer is clear: oil and gas-related names. Five of the top 10 names were oil and gas-related and all gained more than 120% over the period.

Individual Energy Names Decouple from Futures

The previous paragraph may come to a surprise to most. While May Crude Oil futures (CLK20) traded negative, individual oil stocks rallied. In fact, on April 21st, CLK20 dropped 40%, while the Energy Select SPDR ETF (XLE), an ETF tracking individual oil names, was down a mere 2 percent. The disconnect between the commodity price and individual oil equities is due to storage issues. Demand for oil has been low as the global economy has come to a standstill. Meanwhile, supply has hit near-capacity. The recent run in oil tanker stocks such as Nordic American Tanker (NAT) is evidence of the supply issues. Oil names, on the other hand, are looking ahead to a potential reopening of the economy.

I ran another scan similar to the previous scan but focused on the Restaurant and Hotels and Motels industry groups in TradeStation. Of the 33 stocks in the scan, 30 are positive over the last four weeks. Again, little has changed in the way of the economy aside from investors gaining confidence that the economy will open sooner rather than later.

Sell in May and Go Away?

So what now? The S&P 500 and Russell 2000 are now back above declining 50-day SMAs while the Nasdaq is above all key moving averages. Stocks are now in the middle of earnings season. This quarter will undoubtedly be a dud for most companies, but investors will be keying in on any forward guidance. Investors will also be watching seasonality to see if the old Wall Street saying of “Sell in May and Go Away” holds up.

If recent years are any indicator, bulls have something to look forward to. Over the past eight years, the S&P 500 has seen gains in the May to October period seven times. Though this is encouraging, the sample size is small, and 2020 is no ordinary year. As always watch how price acts around support and resistance levels and manage risk.