While coronavirus hammered most stocks in the first quarter, a few began the second quarter on a strong footing.

Tesla (TSLA) is one of them. The electric-car maker just reported deliveries of 88,4000 vehicles, more than 10 percent above forecasts. The total included its new Model Y sport-utility vehicle, which is ramping production sooner than expected. It was another dose of good news for TSLA following a dramatic turnaround late last year.

Profits increased sharply last autumn after CEO Elon Musk fixed production difficulties. That eliminated the need for raising additional capital and punished short sellers with bets against the stock.

TSLA quadrupled in value by early February before crashing along with the rest of the market. It found support at its 200-day moving average on March 18, a potential sign its bullish uptrend is still intact.

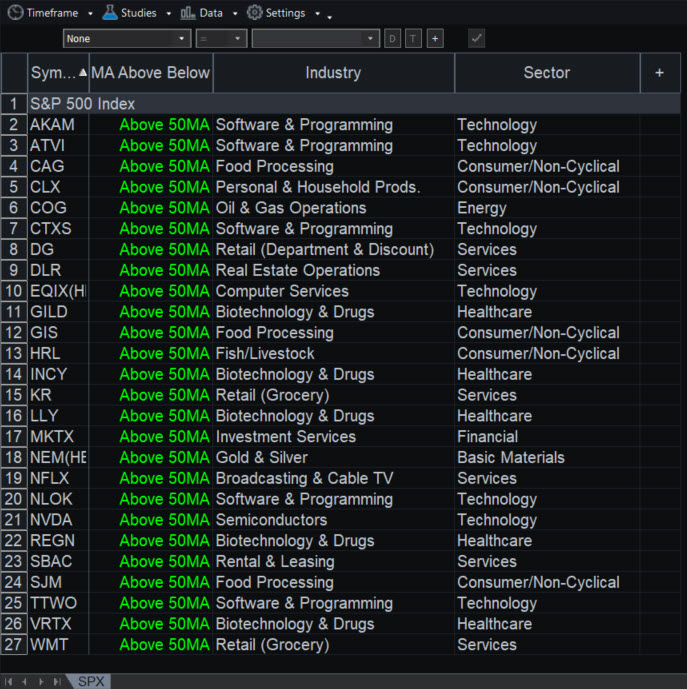

Speaking of moving averages, TradeStation data shows 95 percent of the S&P 500’s members closed below their 50-day moving averages yesterday. Which companies are in select club above that level?

Biotech, Video Games and Food

Moving averages like the 50-day MA can show which companies have held up better during the recent correction. Stocks that are truly out of favor, like energy, hotels and financials, are well below their respective levels. This isn’t a surprise because coronavirus is especially bad for their businesses.

The handful above their 50-day MAs are either immune to the outbreak or benefit from it. Biotechnology, video-game makers and food companies appear most on the list. Some big examples include:

- Netflix (NFLX): Millions of people around the world are confined to their homes. That’s helping drive new account growth for the streaming-video giant. Earnings are due April 21.

- Walmart Stores (WMT): Not a surprise as Americans stock up on canned foods and toilet paper.

- Nvidia (NVDA): A key chip stock that with exposure to cloud computing, artificial intelligence and video gaming. Those segments are either immune to coronavirus, or may even benefit from it.

Others are Eli Lilly (LLY), Gilead Sciences (GILD), Activision Blizzard (ATVI) and Take Two Interactive (TTWO).

Do you want the custom code to find stocks like these? Be sure to watch our special webinar on April 15.

In conclusion, coronavirus is crippling most stocks and the global economy. But investors seem to be focusing on a small group of companies they think can weather the crisis — or even benefit from it. TSLA, NFLX, biotechs, video-game makers and food companies are the names to watch for now.