This post is a translation of the weekly cryptocurrency analysis by Block Insight, a wholly owned subsidiary of Monex Group (Tokyo, Japan). Monex is the parent of TradeStation Group.

Summary

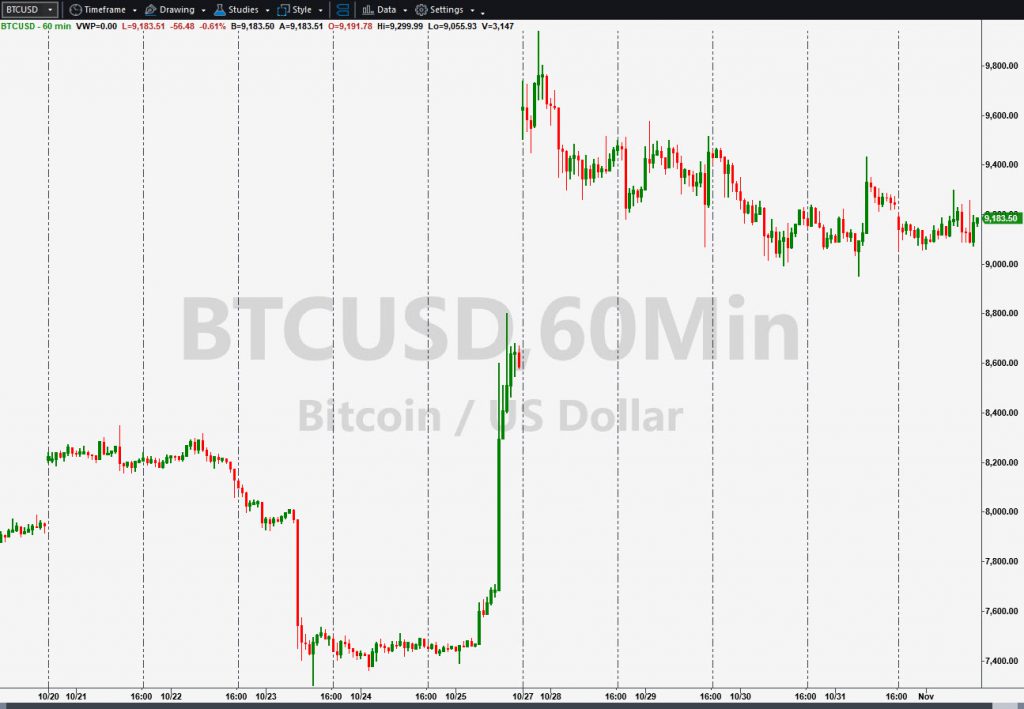

- Bitcoin (BTC) surged after Chinese Premier Xi Jinping publicly expressed national support for blockchain technology.

- BTC is now settling into a range between about $9,000 and $10,000.

- Ripple (XRP) may see activity before its Swell conference in Singapore November 7-9.

Market Trends this Week

BTC neared $10,000 for the first time in over a month after Premier Xi spoke favorably of blockchain technology. State media prominently reported the news, increasing public interest in the country.

Facebook (FB)’s Project Libra encountered more criticism but the bearishness faded. Then buyers followed Xi’s remarks and BTC ended the week with a gain of more than 20 percent.

This Week’s Topics

- Regulators have approved a digital-currency index fund by Grayscale Investments, which said it was the first of its type. (10/25)

- U.S. financial regulators participate in UK FCA’s Global Sandbox. (10/25)

- BTC rallies sharply after hitting a five-month low, advancing more than 30 percent from its trough before pulling back. (10/25)

- Xi says China should “seize the opportunity” to use Blockchain technology. (10/25)

- Twitter (TWTR) CEO Jack Dorsey says “hell no” when asked if the social-media company would join FB’s Project Libra. (10/25)

- China’s National People’s Congress passes a law to support the development of crypto assets. (10/27)

- A Chinese central banker urges the country’s commercial banks to increase blockchain development. (10/27)

- Heath Tobart, Chairman of the U.S. Commodities Trading Futures Commission (CTFC) has said he expects to see Ethereum (EHT) futures in 2020. (10/28)

- CTFC has upgraded its financial-technology research operations into a full-fledged office. (10/28)

- China’s foreign-exchange officials look to adopt the use of blockchain for trade finance. (10/28)

- Zamna has raised $5 million in a funding round. The start-up will use blockchain technology for managing airline-passenger data. (10/26)

- Kenneth Bianco of the Financial Crimes Enforcement Network (FinCEN) has said crypto companies will be punished for violations of the Bank Secrecy Act and anti-money laundering rules. (10/28)

- Japan’s Lifull will begin a proof-of-concept this month for using blockchain in association with real-estate records. (10/28)

- Nihon Unisys demonstrates an experimental electronic voucher service using blockchain. (10/28)

- Seven major resource companies, including Glencore and Tata Steel, sign an agreement with the World Economic Forum to use blockchain-based sustainability tools. (10/29)

- The Association of National Numbering Agencies has created a task force to consider asset labels in financial markets, including cryptocurrencies. (10/29)

- Intercontinental Exchange (ICE) and Starbucks (SBUX) plan to start testing a Bitcoin-based payment system in early 2020. (10/29)

- Chinese state media warn against rapid price gains in cryptocurrency markets. (10/29)

- Chinese Bitcoin mining giant Bitmain dismisses one of its co-founders. (10/29)

- Crypto miner Canaan Creative files for a $400 million initial public offering in the U.S. It would use the symbol “CAN”. It previously tried to go public in China and Hong Kong. (10/28)

- Paxos Trust wants to improve the settlement of stock trades using blockchain technology. (10/28)

- The Inter-American Development Bank plans a two-year test of using blockchain for land registrations in Bolivia, Peru and Paraguay. (10/28)

- Japan’s MoneyTap forms an alliance with PayPal (PYPL) using distributed ledger technology. (10/30)

Next Week’s Market Forecast

Premier Xi’s mention of blockchain spurred interest in the market across China. This was visible not only in prices but also in search usage on major Web sites like Baidu (BIDU).

This may now have the potential to offset negativity surrounding FB’s Project Libra. The result could be steady buying in BTC, especially after its near-term overbought condition fades.

Traders may want to watch $8,800 as support and roughly $10,000 as resistance for now on BTC.

Also don’t forget that XRP may get more active next week because of the Swell conference.

Next Week’s Topics

- 11/4-5: Stellar Meridian Conference in Mexico

- 11/6-10: SteemFest in Bangkok

- 11/7-8: Swell Conference in Singapore, hosted by Ripple (XRP)

- 11/7-8: AI & Blockchain Conference in Malta