Something bullish has taken place in cryptocurrency markets as stocks crashed on trade worries.

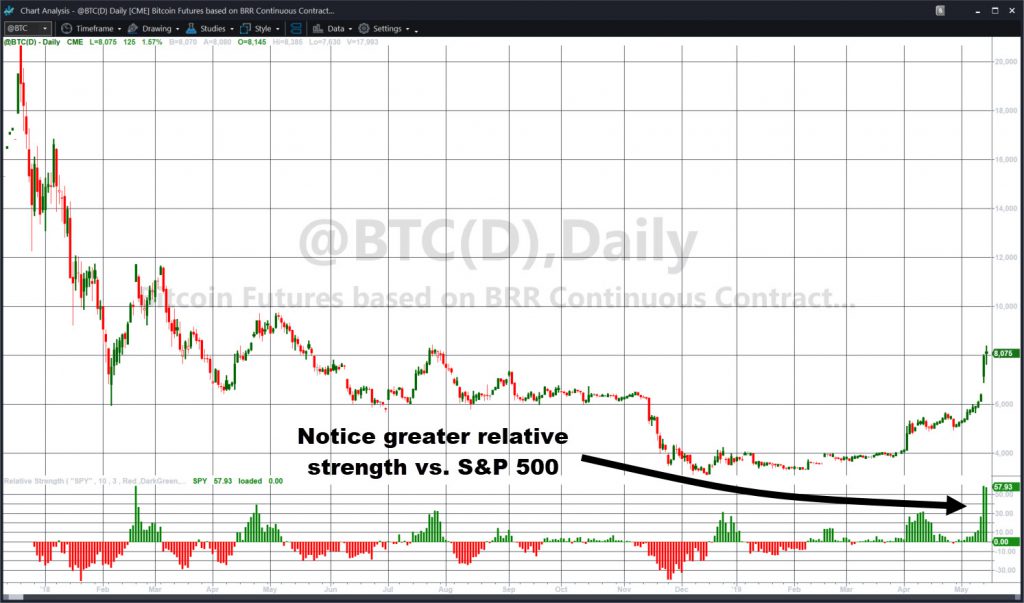

Bitcoin (BTCUSD) climbed 11 percent last week and is up almost triple that amount so far this week. The leading crypto is not only in the midst of its best month since November 2017. It’s also outperforming the S&P 500 by the widest margin since TradeStation began hosting the price data. (See chart below.)

The current rally began in early April and appears to result from an influx of institutional money. Several high-level changes have taken place around the same time as regulators and major companies grow in the blockchain space:

- On March 8, investment giant Fidelity launches virtual-currency custody services to some institutions.

- On April 3, the U.S. Securities and Exchange Commission suggests not all tokens would be considered securities. That could mean less regulatory obstacles for growth.

- On May 3, Facebook (FB) announces blockchain-based payments.

- On May 6, Fidelity reportedly plans to offer crypto-trading services to institutions in a few weeks.

- On May 8, FB removes a ban on crypto-related advertising.

Crypto ETF on the Horizon?

Some other catalysts are also potentially in play. The prospect of an exchange-traded fund (ETF) might be back on the table after Crescent Crypto Asset Management filed a prospectus on May 9. The fund has the proposed symbol XBET and would track multiple tokens — mostly BTC and Ethereum (ETH) — rather than just BTC.

Some news reports have also suggested Chinese investors have amassed BTC given Beijing’s trade war against the U.S. One final catalyst is Coindesk’s Consensus industry conference in New York, which runs from yesterday through tomorrow.

In conclusion, BTC has more than doubled from its low and is back over $8,000. It’s also pushing against an old peak from last July. Traders may have forgotten about it during its period of correction in 2018 and early 2019. But now sentiment may be turning positive again.