Initial public offerings (IPO) are taking a pause before Uber’s (UBER) huge deal next month. That makes it good time to review some of last year’s deals.

Several companies that went public in early 2018 or late 2017 have pulled back after pushing to new highs in recent weeks. Are they now interesting to momentum investors in search of upward-trending stocks?

Here are a few:

- Zscaler (ZS): This company focuses on the up-and-coming cybersecurity niche. It priced its IPO at $16 in March 2018 but never traded below $24 in public markets. ZS surpassed estimates on both top and bottom lines each of the four times it issued results. That includes the most recent report on February 28.

- MongoDB (MDB): The provider of databases for cloud computing went public for $24 in October 2017. It started rampaging higher in the second half of last year amid a steady flow of consensus-beating results. MDB gapped higher in mid-March and is now back near its 50-day moving average.

- Pluralsight (PS): This company hosts education and training materials for enterprises. It went public for $12 last May but has almost never traded below $20 in public markets. PS also beaten estimates several times but hurt sentiment last month by diluting shareholders with a convertible-debt offering.

- Smartsheet (SMAR): Online collaboration and data sharing have driven this company’s growth story. Its IPO priced at $15 in April 2018 but the stock has remained above $20 almost its entire time as a public company. The last earnings report on March 19 crushed estimates, and now SMAR has pulled back to its 50-day moving average.

Here Comes Uber IPO

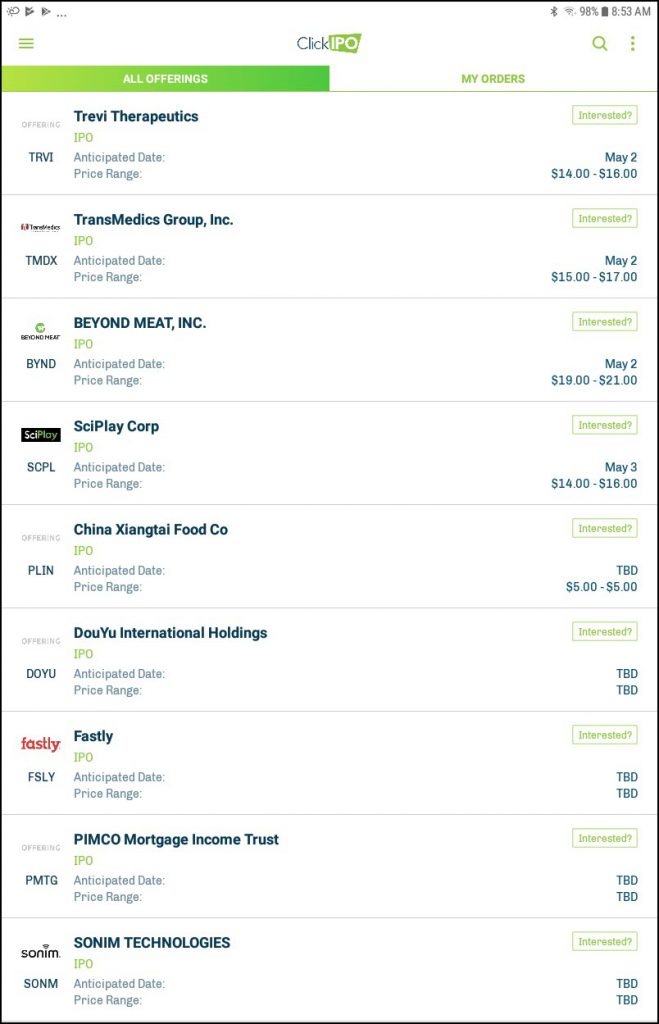

IPOs have been on an upswing since March as volatility abates in the broader market. Still, ClickIPO shows no deals expected to price until May 2 as investors focus their attention on first-quarter earnings.

The other elephant in the room, of course, is UBER. The ride-sharing giant is expected to begin its marketing “road show” next week. Timing of the actual deal has yet to be determined.

You’ll notice that all the IPOs listed above are technology companies. But last year also saw a couple of energy firms go public. These might also interest investors as crude oil pushes higher and forecasters raise their outlooks for economic growth:

- Cactus (WHD): Its ticker symbol is short for “wellhead.” This company manufacturers components for the fast-growing domestic oil and gas industry. WHD went public for $19 in February 2018 and has remained above $24 for the last year

- Apergy (APY): This provider of oil-field services, including lifting crude from deep in the earth, was spun off from Dover (DOV) in May 2018. Unlike others in this post it’s drifted aimlessly since, but recently had a so-called “golden cross” chart pattern.

In conclusion, IPOs are currently on a mini-vacation. But plenty of other companies have gone public in recent years. Hopefully this article will help you rediscover some names you might have missed earlier or forgotten about.

ClickIPO preview of upcoming offerings.